So far in the Budget Game, you have been renting an apartment. In the real world, after a few years of working in the real world you may want to buy a house or condo – and to do that you will need a Mortgage.

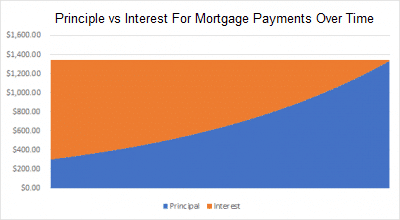

A Mortgage is a loan you would take from a bank to purchase property. They are long-term loans, typically issued for 15, 20, or 30 years. Every month, you will need to make a Mortgage Payment – part of the payment goes towards principal and part towards interest.

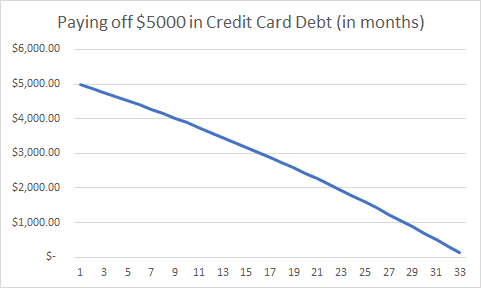

If you make a big purchase on your credit card, you will need to make monthly payments to pay it off. The interest that builds each month is added to the principal and compounds over time. This means if you only make the minimum payments, it will take a very long time to pay off the loan, and you will pay a LOT in interest.

Mortgages turn this around. Every mortgage is structured so you pay off the entire balance after exactly the term of the mortgage (15, 20, or 30 years). This means for the first year or two, most of your monthly payment is JUST interest and very little is applied against your principal (meaning the original amount borrowed). But with each payment you make, you are paying a little less in interest and a little more towards principal. At the end of the mortgage, you’re paying off mostly principal, with almost no interest left.

Because of this, many borrowers need to make a hard choice between a 15-year mortgage and a 30-year mortgage. The 30-year mortgage will have lower monthly payments, but you will end up paying more interest over the life of the loan. A 15-year mortgage will have much higher interest payments, but you will pay a lot less interest over the course of the loan.

For example, let’s say you wanted to take out a $250,000 mortgage to buy a house, and you can get a 5% interest rate. With a 30-year mortgage, you would end up paying $233,139 in total interest (almost as much as you originally borrowed!), but with a 15-year mortgage you would only pay $105,857 – saving a whopping $127,282!

Simple – your monthly payments are much lower. And having that extra money in your pocket today is worth a lot, especially in months when your budget is tight. In our example above, your mortgage was at 5%. With a 30-year mortgage, your monthly payment would be $1,342, and with a 15-year mortgage, it would be $1,977 per month – an extra $635 every month. If your investment portfolio earns a 10% annual interest rate, and you invest that $635 instead of putting it in your mortgage, you would have over $255,000 saved up after 15 years – about double the extra interest you’re paying for the longer mortgage (and if you keep it up for all 30 years, you’ll save up about $1,320,000)!

While you will pay far less interest with a 15-year mortgage, you need to make much bigger payments – which is money you could be putting towards other investments.

Now that you know a bit more about mortgages, close this lesson to continue the game!

[close]