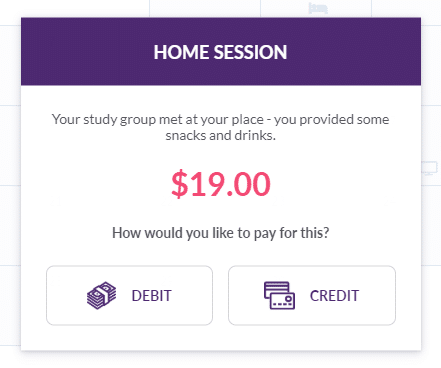

Once you get started on progressing through your first month, you’ll notice that you have two different ways to pay for almost every expense – your Debit Card or Credit Card.

Understanding the two, and how to use them, will be essential to effectively managing your budget.

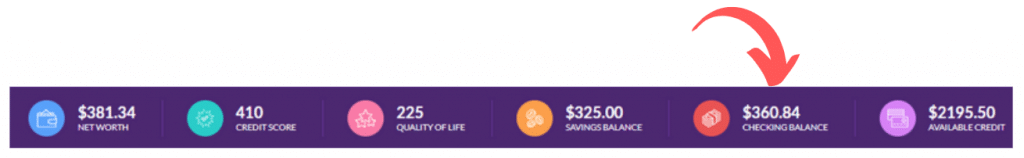

Making a purchase with your Debit Card withdraws the purchase amount directly from your Checking Account – it is the same as writing a check, or taking cash out at an ATM. You can monitor how much money you have in your checking account at any time at the top of the screen.

Since this uses money you already have available, paying with your Debit Card is usually a safe option. However, there are a couple things to keep in mind:

If you use your Credit Card, you are paying with Debt. Buying something with a credit card means you are borrowing money from your credit card issuer, which you promise to pay back later.

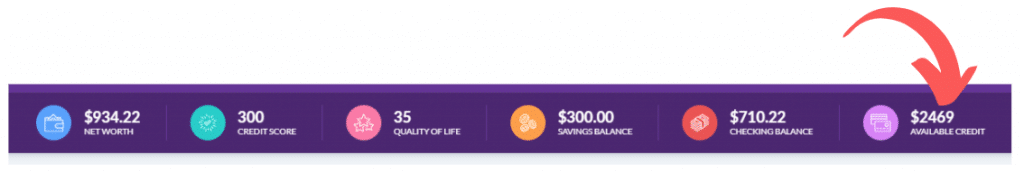

You have a Credit Limit at the top of the page – this is the maximum that you can borrow.

Buying things on your Credit Card means that you take out a loan, but there are some really good reasons to use your Credit Card regularly:

If you use your credit card, you will get a credit card bill every month. This will show your balance outstanding, and you will have one week to pay it off. This is called the Grace Period.

If you don’t fully pay off your credit card bill during the Grace Period, you will start to pay interest. Your credit card has a 20% annual interest rate. If you carry over a balance past your Due Date, you will start to see the daily interest get added to your card.

Since you have a 20% annual rate, this translates to 20% / 365 = 0.05% Daily Interest. This might not sound like a lot, but it can add up fast!

Your credit card statement is issued on the 19th of every month, and you have until the 26th to pay it off before you start getting charged interest.

Now that you know a bit more about your Debit and Credit cards, close this lesson to continue the game!

[close]