Financial

Literacy

Games for

Students

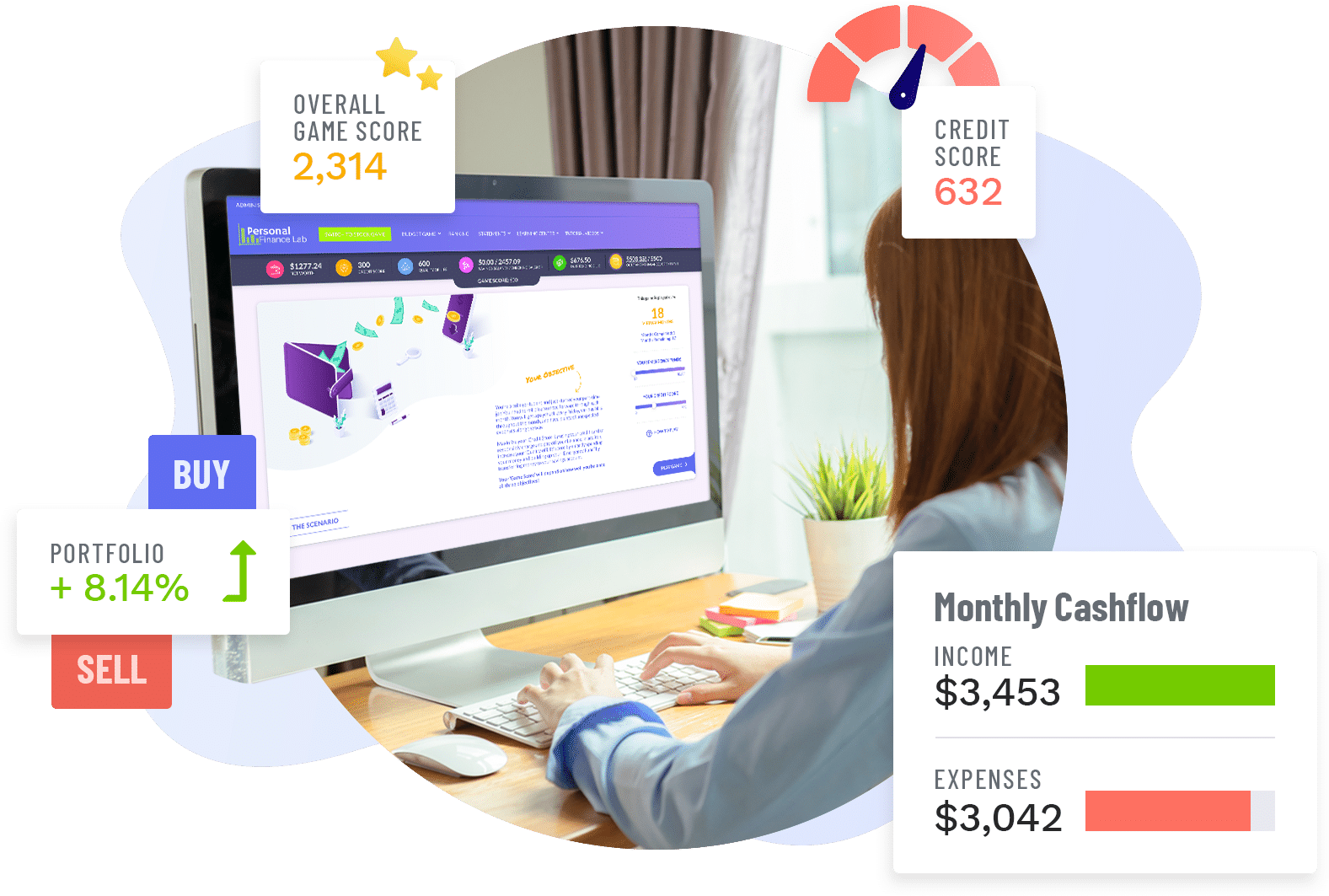

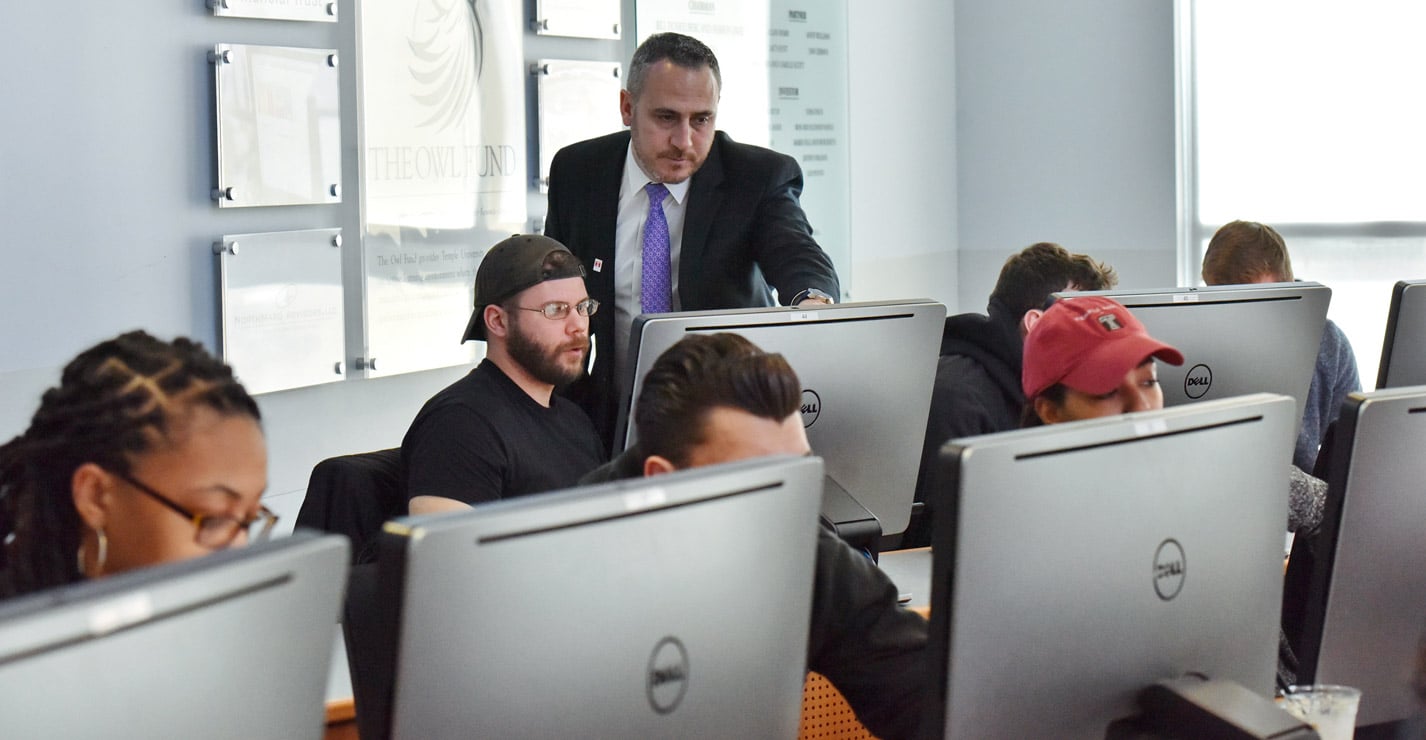

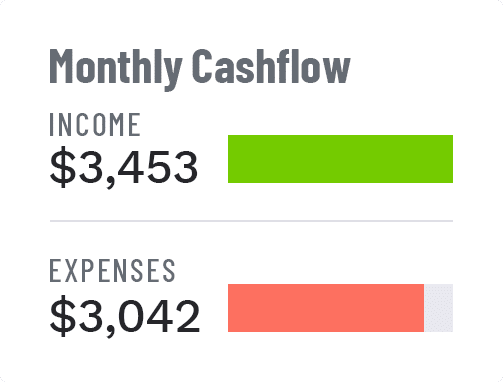

Budget Game. Stock Game. Supplemental Learning Resources. Banking, credit, debt, savings, taxes and more. All in one customizable platform.

Teacher Test DriveIf you’re a college professor,

please visit our college site.