Personal

Budgeting

Game

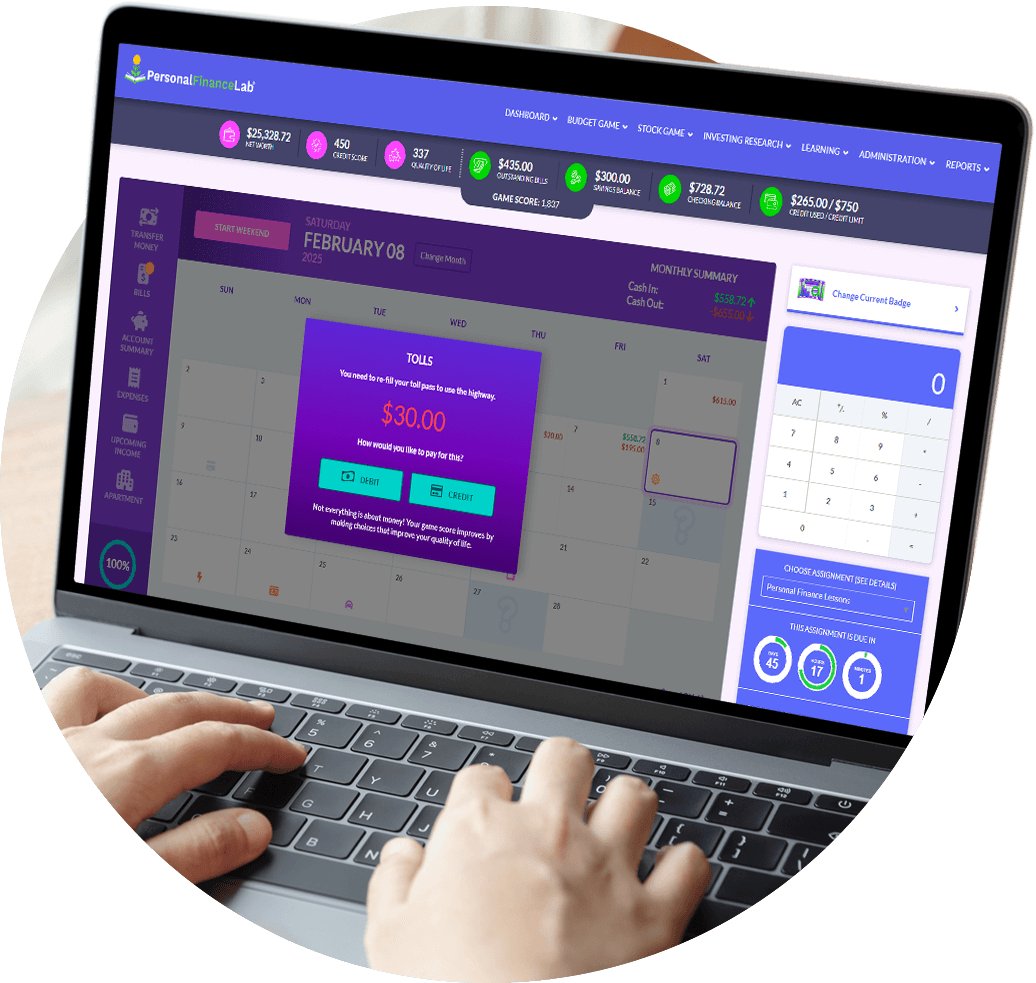

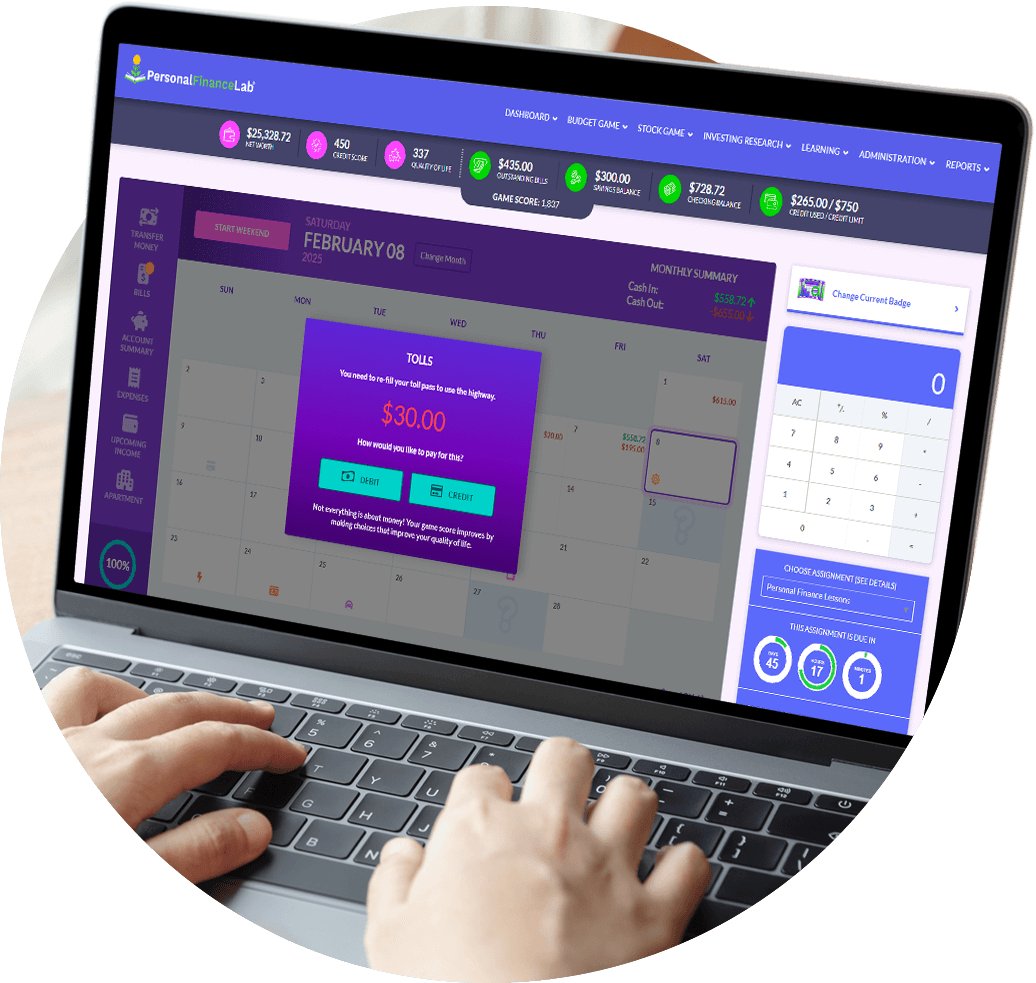

An engaging learning experience

that teaches financial literacy skills with real-life scenarios and consequences. Students play twelve virtual months to sharpen their skills.

An engaging learning experience

that teaches financial literacy skills with real-life scenarios and consequences. Students play twelve virtual months to sharpen their skills.

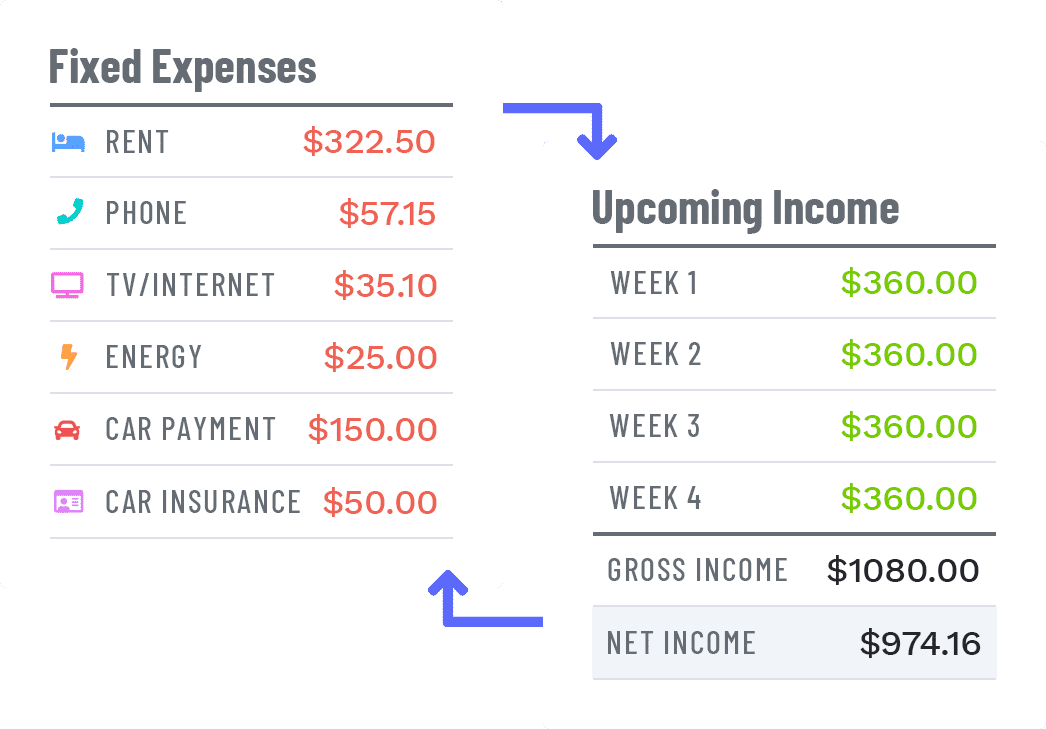

Students learn how to manage realistic monthly expenses and bills, and their choices have long-term impacts on the events they experience.

In an ideal world we would stick to our planned budgets. This is never the case in real life. Students learn through experience how each choice they make has consequences.

Reinforcing the saving habit so students realize the importance of setting and maintaining savings goals. When unexpected life events pop-up they’re ready for them.

Most budgeting games are focused on savings only, which is unrealistic. Students learn about balancing needs vs wants, and how to use credit responsibly to build their credit score.

Teachers start out by choosing the specific rules of their class. These can also be updated as the simulation progresses through the semester.

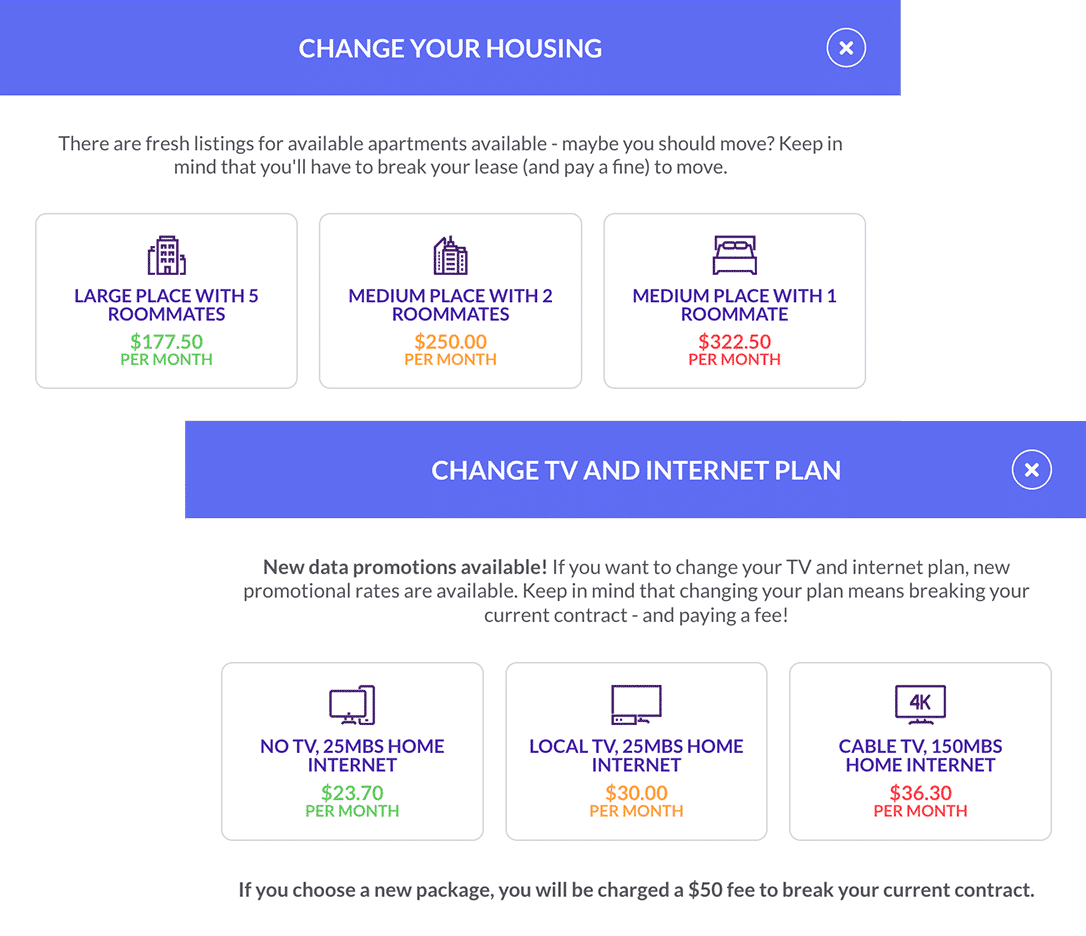

Teachers can also customize the types of “Life Events” that occur in the game. Emphasize risk and insurance while you cover it in class, then encourage more events focusing on reading and understanding contracts, and much more!

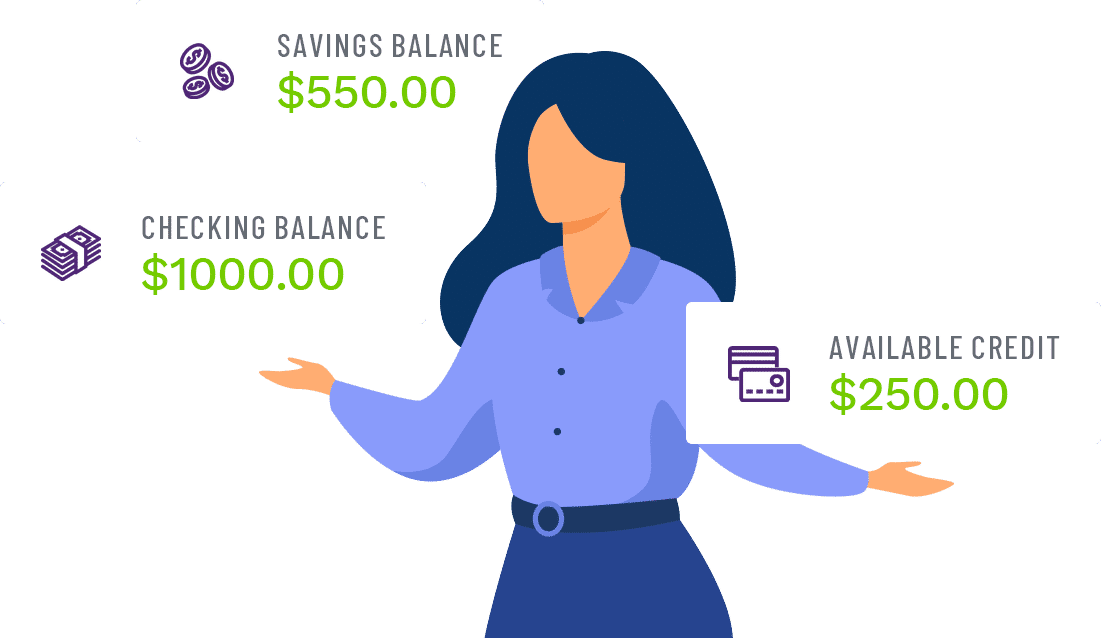

Your students’ goals are to build their net worth by transferring money from their checking account to savings, and build up their credit score by responsibly covering cash flow shortfalls (and paying off their balance on time).

Students progress through 12 “months” of the game, with each month taking about 20 minutes to complete. “Life Events” crop up every couple days, with unplanned expenses (and occasionally income) putting pressure on their budget – requiring careful planning!

Class rankings tie everything together, with students able to compare their net worth, credit score, and overall score with their classmates!

Students progress through the game, with similar (but not the same) events happening across the class. Students taking a risk will sometimes pay off, but sometimes it comes back to bite! This is an awesome starting point for class discussions – who did what, and how did it pay off?

While students work through the budgeting game, they also work through the lessons you set up from our customizable learning library (with built-in assessments) for a completely customized learning experience!

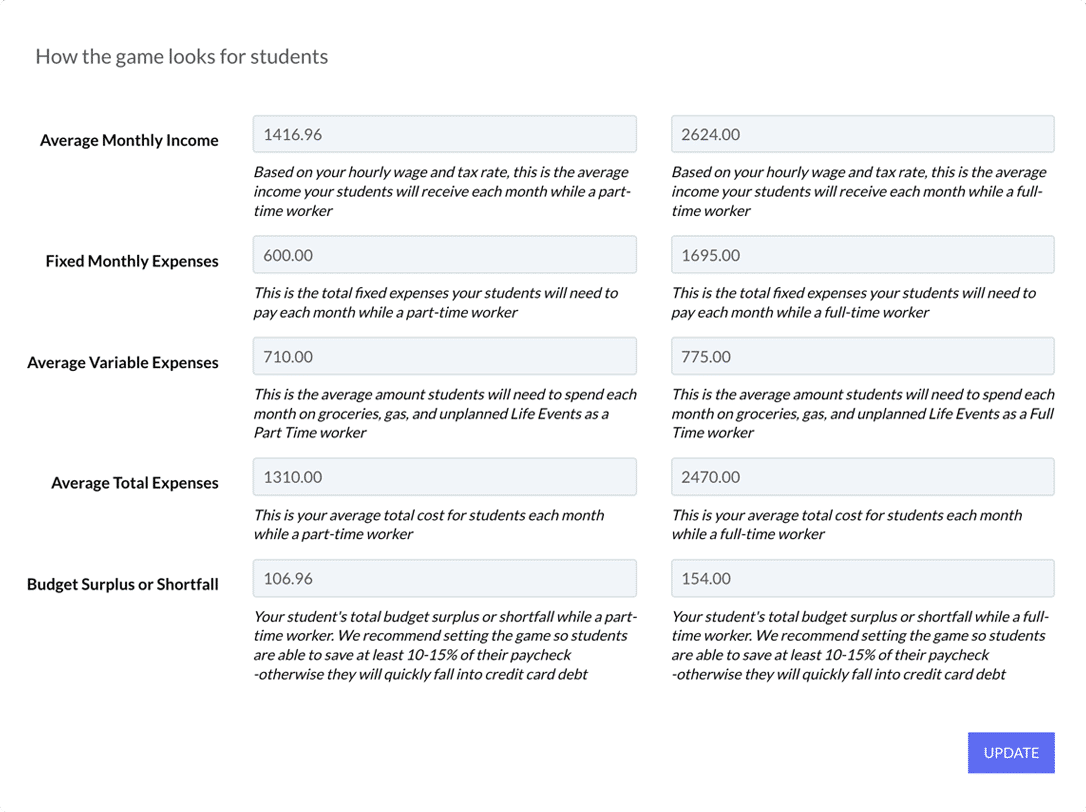

Choose the starting bank balance, fixed expenses, hourly wage, taxes and the types of pop-up cards to match your local standard of living. Select whether your students start as students with part-time jobs, or as full-time professionals. You can choose after how many months of gameplay they graduate.

Students get experience reviewing their monthly fixed and variable expenses, their projected income and set savings goals based on how much surplus or deficit they will have. They learn the important lesson of Pay Yourself First, by gaining the most points from hitting their monthly savings goals.

A seamless experience so students are introduced to key concepts like comparison shopping, mortgages, writing checks, opportunity cost and more while they play the game. Also, they can play mini-games within the game to make it even more fun to learn personal finance.

Make your classroom the coolest room in the school! Project class rankings, stock market watchlists, personal finance words of the day or even custom school-specific information to create an engaging personal finance lab.

Included with the Budget Game are additional class activities, group projects, lesson plans, and grading rubrics to integrate the game into your class. Click here to view all the teaching resources available.

Get more information, request a quote, or get your students started on PersonalFinanceLab.

Request More InformationAttention Title 1 Schools and/or Schools in Low-Income Areas: We have sponsors in most states that want to sponsor your access to PersonalFinanceLab so please fill out the Information Request Form and indicate you would like sponsored access!

Great for virtual or in-class learning. Bulk discounts are available for larger class sizes!

REMEMBER: Title 1 Schools and/or Schools in Low-Income Areas: We have sponsors in most states that want to sponsor your access to PersonalFinanceLab so please fill out the Information Request Form and indicate you would like sponsored access!