How Personal Finance and Career Readiness are Connected

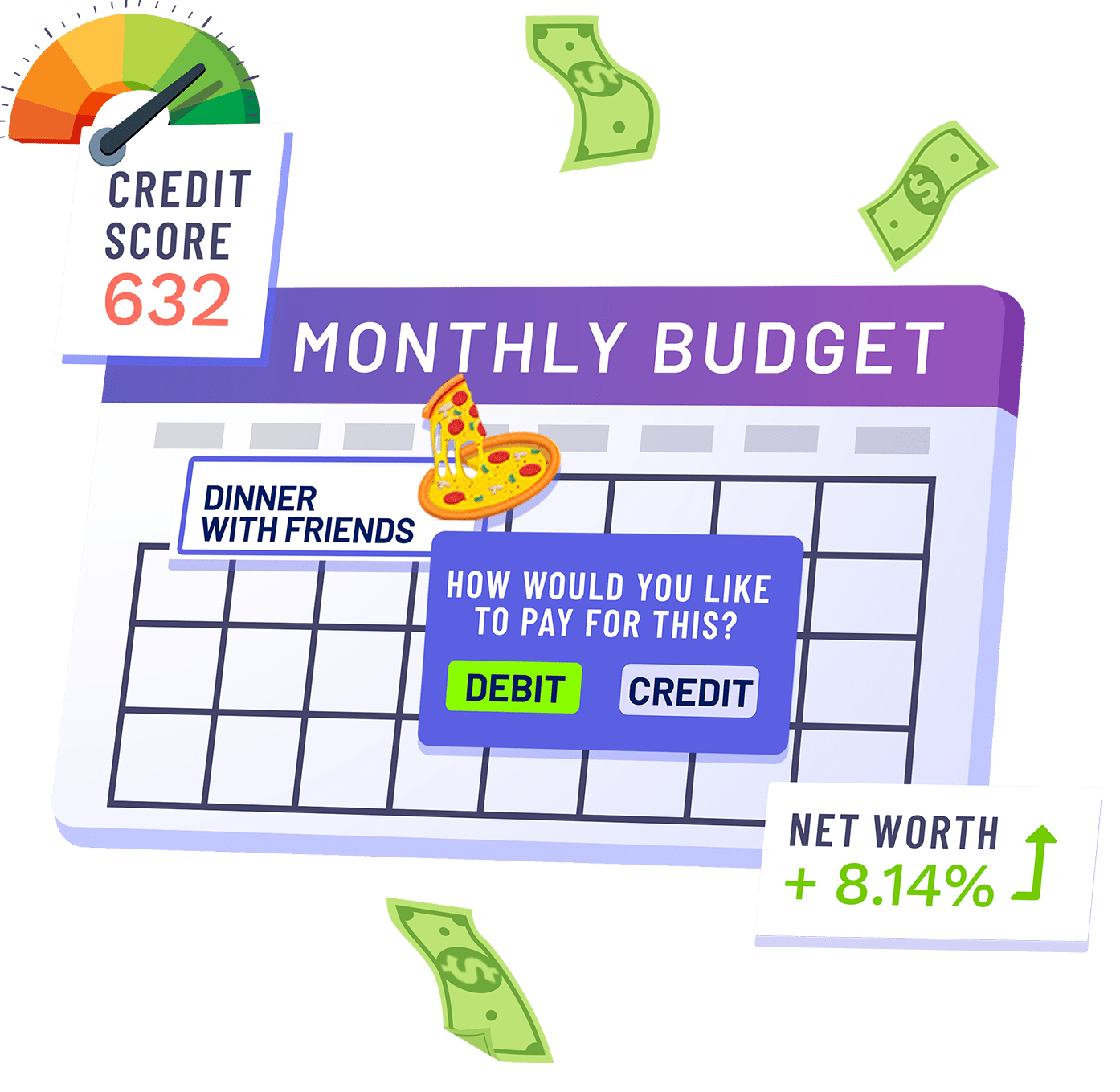

When students start researching career clusters, their first question is usually, “How much money will I make?”

While focusing on their potential salary and cash inflows, they often overlook other important factors such as location, cost of living, commuting, student and car loans, and other cash outflows.

These factors are equally important for making informed career decisions.

What if we could help students understand their financial responsibilities upfront?

By preventing them from having to constantly “chase their dollars,” they could focus on finding a career that truly aligns with their passions and interests, rather than solely basing their decisions on salary and benefits.

Unfortunately, many students go through school without considering their future career.

They study subjects they enjoy without considering the associated careers. After graduating, they find themselves hopping from job to job, burdened with student debt. The cycle continues as they prioritize high-paying but disliked jobs to repay their student loans.

By starting with Personal Finance education along with Career Readiness, students can learn the value of money and how to effectively manage it.

This knowledge will empower them to make smarter financial decisions and be aware of their spending habits, enabling them to live within their means and achieve financial independence.

By prioritizing career planning and financial education, we can guide students away from this harmful path.

Empowering them to make informed choices about their future.

Together, we can break this cycle and guide students towards fulfilling careers that offer not only financial stability but personal fulfillment.