Time To Read:

Many students are excited to earn their first paycheck, but it often comes as a surprise when that paycheck is smaller than expected. This is a great opportunity to introduce the topic of taxes in a way that feels relevant to their lives.

Why It’s Important for Students to Learn About Taxes

For many students, taxes can seem confusing and full of unfamiliar terms like “W-4” and “withholdings.” But learning about taxes early can help them feel more confident and better prepared when they start working.

By understanding the basics of taxes, students can:

- Know what to expect on their paychecks

- Avoid mistakes like underpaying or overpaying taxes

- Learn how to file their own tax returns

- Start building smart money habits

How PersonalFinanceLab Helps You Teach Taxes

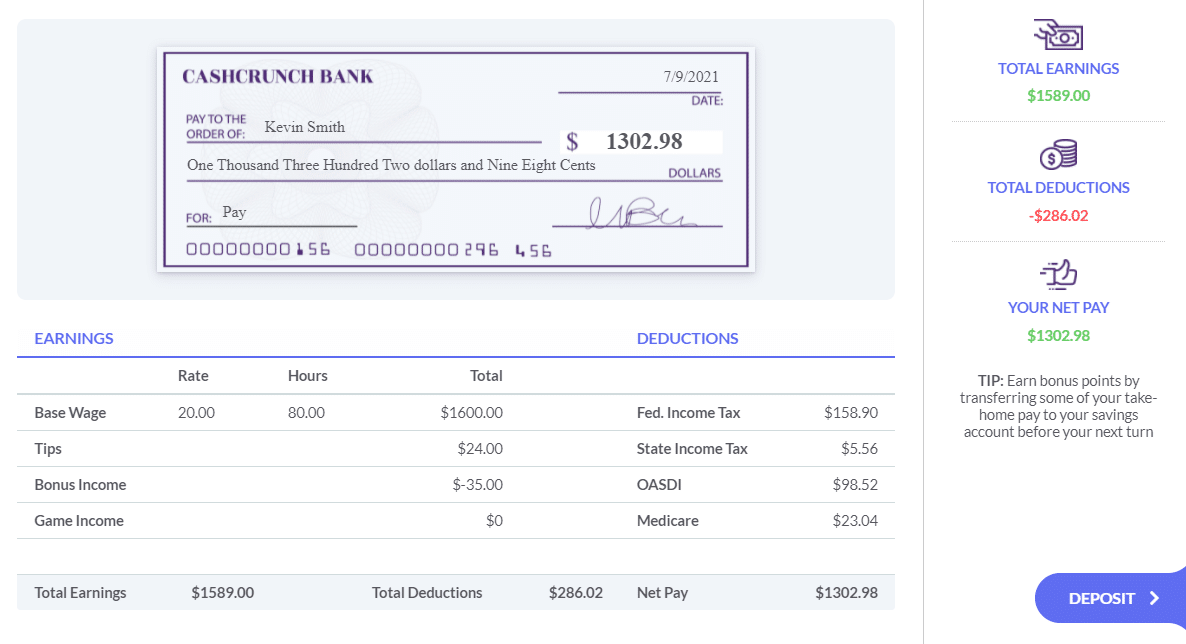

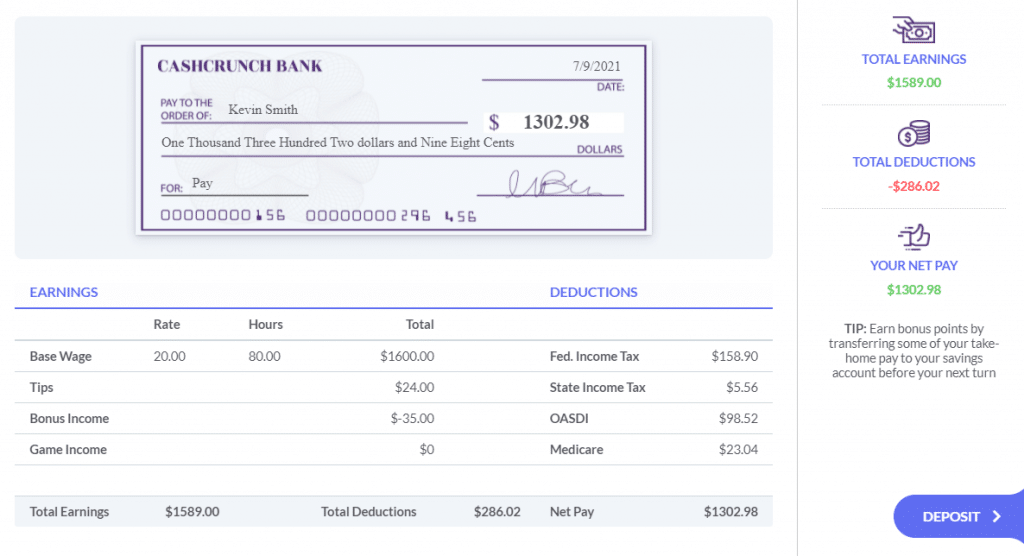

First up, as students play through our Budgeting Game, they will see their tax withholdings on every paycheck.

Beyond the games themselves, we also provide interactive lessons and tools that make taxes easier for students to understand. You don’t need to be a tax expert to teach this topic. Our platform is designed to support teachers and guide students through real-world examples.

Try Our Interactive 1040 Simulation

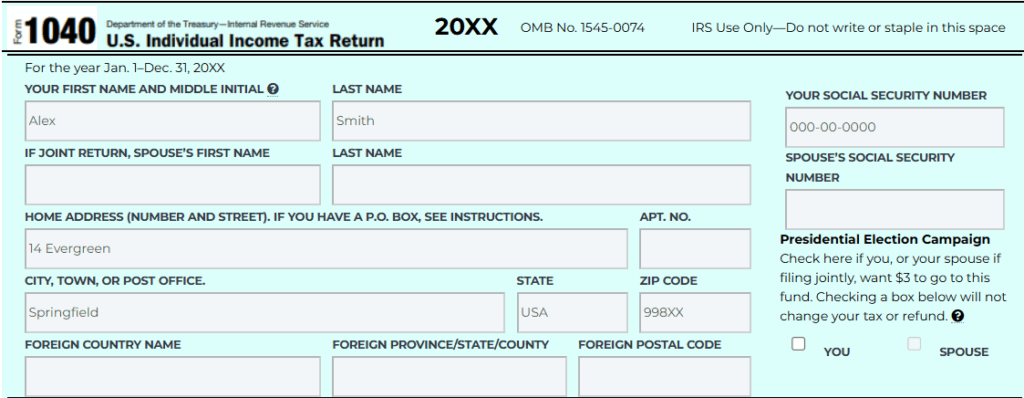

One of our most helpful tools is the 1040 Tax Form Simulation. This lets students practice filling out a federal tax return in a simple, step-by-step format. It shows them how income, deductions, and refunds all connect.

For shorter activities, we also have interactive “Hotspot” images you can share, for both a pay stub and the 1040 form. It gives students a clear breakdown of what each section means, using language they can understand.

Tips for Filing Your Taxes (Without the Stress)

Tips You Can Share With Your Students

Here are a few simple tips you can pass along to students filing taxes for the first time:

- Use free filing tools. The IRS and tax software companies offer free or discounted versions for young adults and students.

- Gather documents ahead of time. Encourage students to have their W-2s and other forms ready before they begin.

- File online. E-filing is faster and more secure, and using direct deposit means students get their refunds quicker.

- Ask for help. Remind students that parents, teachers, or VITA volunteers can offer support if needed.

- Don’t wait until the last minute. Filing early helps avoid stress and delays.

Make Taxes Part of Real-World Learning

Understanding taxes is an important part of financial literacy. With the right tools, students can learn how taxes work and feel more confident when they start earning and managing their own money.

Explore More at PersonalFinanceLab

Visit PersonalFinanceLab.com to access our tax lessons and simulations. These resources are ready to use in your classroom and designed to help students build essential money skills.