PersonalFinanceLab’s Budget Game is an awesome tool to help students master the core skills needed to build a healthy financial future. But while students are progressing from month to month, it can be hard to tell how well they are doing – apart from their Class Ranking.

With this in mind, we’re excited to announce our new Monthly Feedback system!

Monthly Feedback

When students finish each month of the Budget Game, they will get a prompt outlining how much progress they made towards each of the core game objectives:

- Setting (and hitting) realistic savings goals

- Building an Emergency Fund of at least $1,000

- Building their Credit Score through responsible credit habits, and

- Once they are on the right track for their other goals, spending responsibly to maintain a high Quality of Life.

We outline this in each step of our new Feedback System!

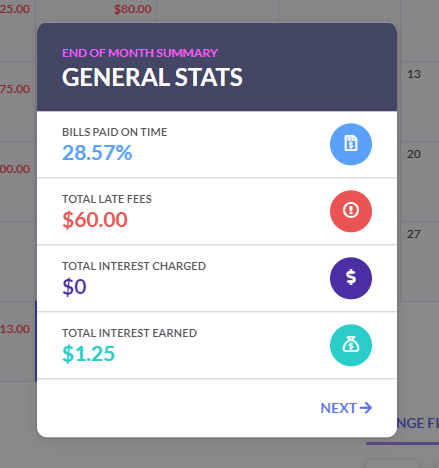

General Stats

First, students get a snapshot of the big items for the game:

- Bills Paid On Time: what percentage of their bills did they pay before the due date? In the example above, I was late on most of my bills. Later in the feedback I will see exactly what this means for my financial future!

- Total Late Fees: I was late on several bills – but not every bill has the same penalties for being late. This is the total amount of late fees I accumulated this month (hopefully $0!).

- Total Interest Charged: If I am carrying a balance on my Credit Card, this will show the total interest charges I accumulated this month (again, hopefully $0!)

- And Total Interest Earned: At the end of each month, students earn interest on their savings account. This shows how much I earned this month.

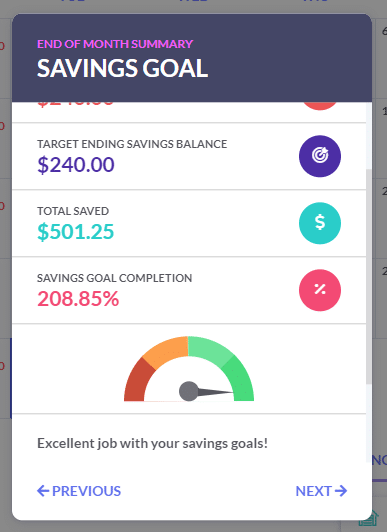

Savings Goal Feedback

Next, students get a summary of how well they worked towards their savings goal. Their feedback is based on two factors:

- Did they hit their savings goal for this month, and

- Was their savings goal above 10% or 5% of their expected income for the month

The feedback they get will congratulate them on hitting goals, with additional feedback on making sure to try to hit 10% of their expected income.

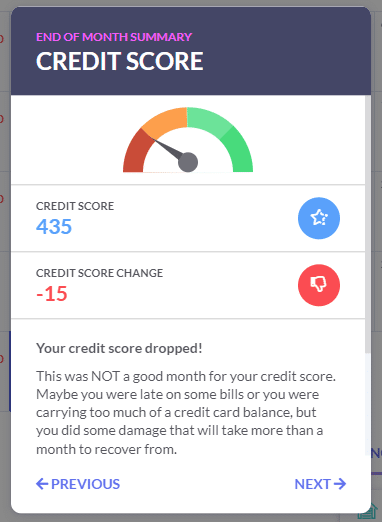

Credit Score

Next, students get feedback on how their credit score changed this month. Credit score improves as students pay bills on time and use their credit card responsibly (with the most points earned by using their credit card a bit, but paying off the full amount on time), with points lost by over-using their credit card or being late on bill payments.

The feedback students get will depend on how their credit score changed this month, with specific hints on what to do next month to earn the maximum points.

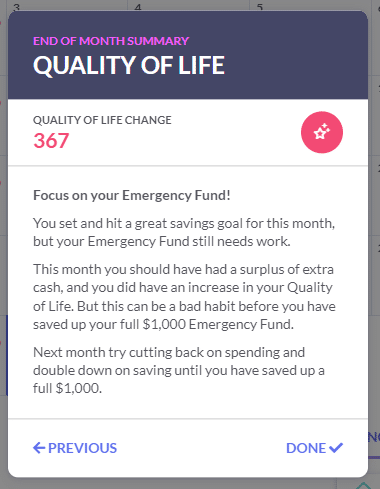

Quality of Life

The last feedback they get is on their Quality of Life – showing their total current score. Their specific feedback items are actually based mostly on their Emergency Fund – if students have not yet saved up a full $1,000 in their Savings Account, their feedback will remind them to work on saving up before spending extra cash. If they have built up their $1,000 fund, it will then confirm they are still setting (and hitting) that 10% savings goal.

If their savings are in good shape, then the game will congratulate them, and suggest they continue to invest in their Quality of Life as well – including buying new items for their Apartment.

We hope the End Of Month Feedback will bring the learning experience of the Budget Game to a whole new level, and help students really keep focus on the goals that matter.

Happy Learning!

-The PFinLab Team