Learning how to file a federal income tax return is a cornerstone of every Personal Finance class. At PersonalFinanceLab, we’re excited to share our two activities specifically designed to help students learn how to file their own taxes once they start work.

Filing Taxes Mini-Lesson

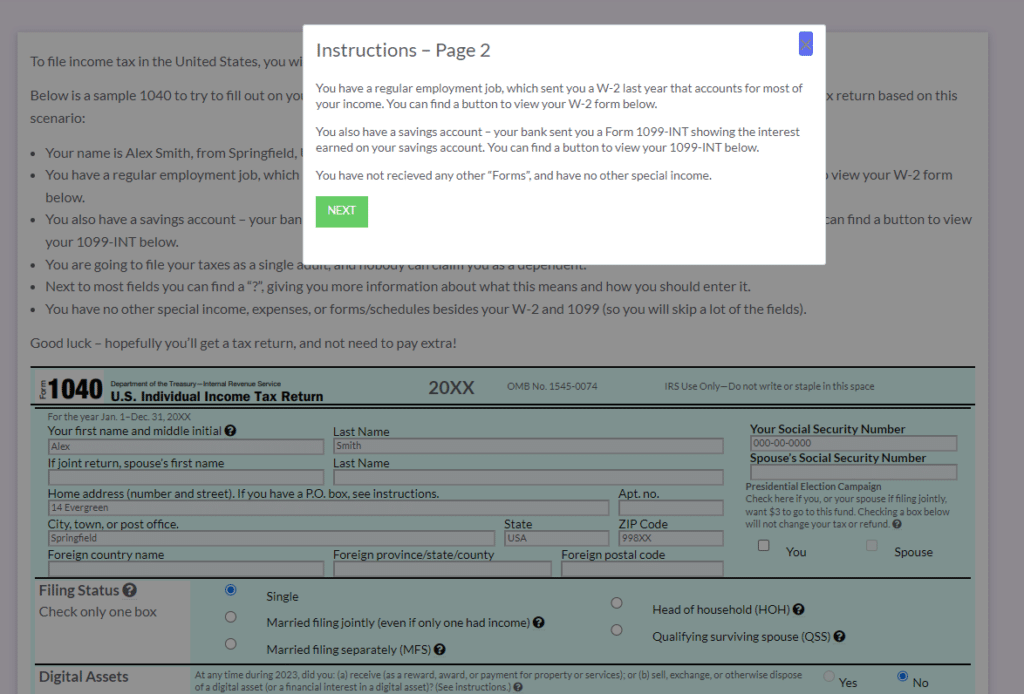

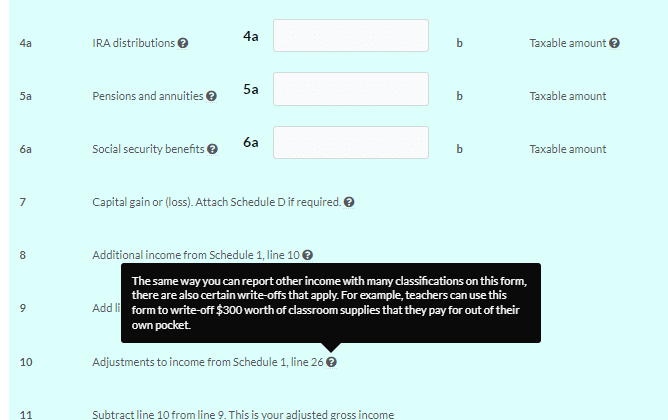

As part of the Budget Game, we have a built-in mini-lesson on the 1040 Income Tax Return. This includes a brief overview of what the form is, and “hotspots” where students can see more information on some common fields to try to remove some of the mystery around the tax return:

This mini-lesson occurs on April 15 of the budget game, with a one-question quiz afterwards to check for understanding.

Filing The 1040 Interactive Activity

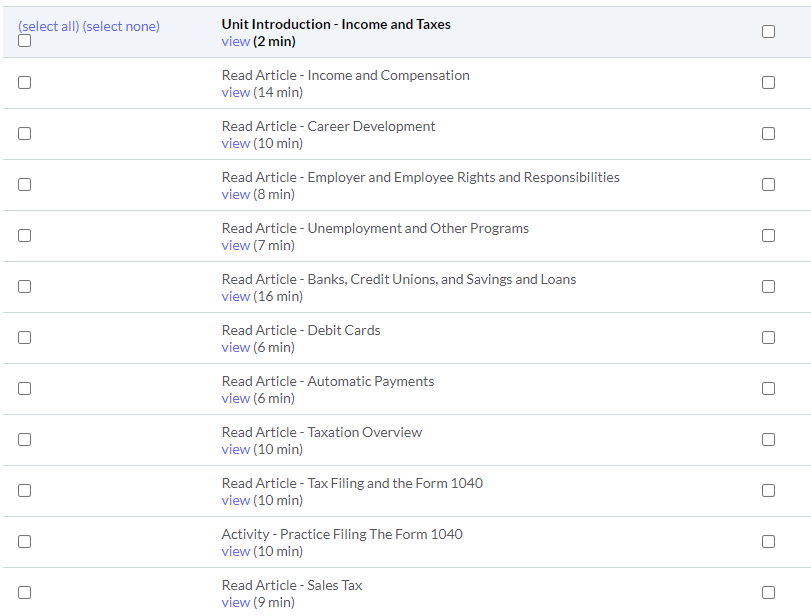

Our mini-lessons are designed for students to complete in less than 5 minutes, but we also have a more robust income tax activity as part of our “Taxation” lessons in our Assignments tool.

This activity has students work through the full Tax Return to correctly file an example federal income tax. In this exercise, students are given a sample W-2 and 1099-INT forms, and every field has a helpful tooltip explaining what this is for, when it might be used, and how it applies with a person filing their taxes for the first time.

With this exercise, students work through the form field-by-field, with the system giving them feedback on each entry if they make a mistake. The exercise ends with the student finding how much of an income tax return they will be getting (or how much tax they would need to pay if they owe anything).

New for 2025 – this activity is now available free to the public! Click here to access!

Teachers who have an existing site license, or a Teacher Test Drive account, can preview this exercise by clicking here, and can include this for their class by creating an Assignment, and including the “Activity – Practice Filing The Form 1040” activity.

Other Lessons on Income Taxes

Our learning library also includes two other lessons focusing on income taxes:

- Taxation Overview: This lesson gives a brief overview of the concepts of a “progressive income tax” (with current tax rates and brackets), and contrasts with Regressive Taxes (like sales tax), Capital Gains Taxes, and Property Taxes.

- Income Taxes and the Form 1040: This lesson is a more “reading and understanding” version of our “Filing Taxes” activity. This lesson goes more into the details of the different information found on a person’s W-2 form, differentiating between “Gross Income”, “Net Income”, and “Taxable Income”, and what happens if the IRS finds an error on your tax return.

Both lessons can be previewed by teachers with a site license or a Teacher Test Drive account.

These tools were designed to help students overcome the hurdle of filing a basic income tax return on their own, not running off to buy expensive tax-prep software or hire an accountant for relatively simple returns.

Happy Learning!

-The PFinLab Team