Financial math is more important than ever – and we are here to support teachers along the way! These new topics generally build on the more basic lessons in our personal finance curriculum library, with additional complexity and examples to make them at home in a class focusing on financial algebra.

About Each Lesson

This spring, we are dropping one of our most exciting content updates yet – with 6 new lessons focusing on topics in financial algebra. These topics include our lesson on Limits and Logs, Discretionary Expenses & Central Tendency, Planning a Vacation on a Budget, Future Value and Investment Returns, Mortgage Math and Ratios, and Rent vs Buy: Which Home is Right For You!

You can find more information on each lesson below. To view the lessons, you will need to be logged in with your PersonalFinanceLab teacher account, or sign up for our free Teacher Test Drive!

Limits and Logs – Personalized Spending and Saving

Our first lesson teaches students about creating a model featuring decreasing returns to scale by leveraging logarithms in a function, and jumping from logs to limits to show how even summing an infinite series can still have a maximum point.

This is done through the lens of understanding their own personal spending and saving preferences to answer the fundamental question: how much is a dollar tomorrow worth to you today?

Discretionary Expenses – Understanding Central Tendency

This lesson is all about understanding mean, median, mode, and what a “skew” means for each. The lesson also incorporates histogram charts to show how “mode” measures can be applied in a wide range of comparisons, and is anchored in examples of a student trying to understand how their current spending habits compare to their peers – and what it means for their long-term savings goals.

Vacation Vibes: Planning a Vacation on a Budget

This lesson is all about variables – independent, dependent, lurking. Then it jumps across into central tendency, all in the service of planning the perfect (and most affordable) vacation!

Students walk through comparing hotel and flight costs for 5 different cities, then jump into measuring “wish-list” food costs to establish a complete (and accurate) budget for the trip

Future Value Unlocked: How Today’s Investments Shape Tomorrow’s Wealth

This lesson is all about Future Value, and hammering home how the formula comes into play in a variety of lifetime financial decisions. The lesson starts with a basic reminder on compound interest, grows into examples with savings accounts, saving to buy a car, and finishes with showing how to use the Future Value formula to evaluate complex spending and saving decisions across multiple time horizons.

Mortgage Math and Ratios

Our lesson on mortgage math and ratios focuses on all the math that goes into buying a home. We start out by talking about key affordability ratios (both how they are calculated and why they are important), and transition into down payments, bank risk & PMI, the nuts and bolts of amortization, refinancing, total profit (or loss) on the sale of a property, and pack it all in together with our advanced Mortgage Calculator, with dynamic graphs for students to easily visualize everything happening behind the scenes!

Rent vs Buy: Which Is Right For You

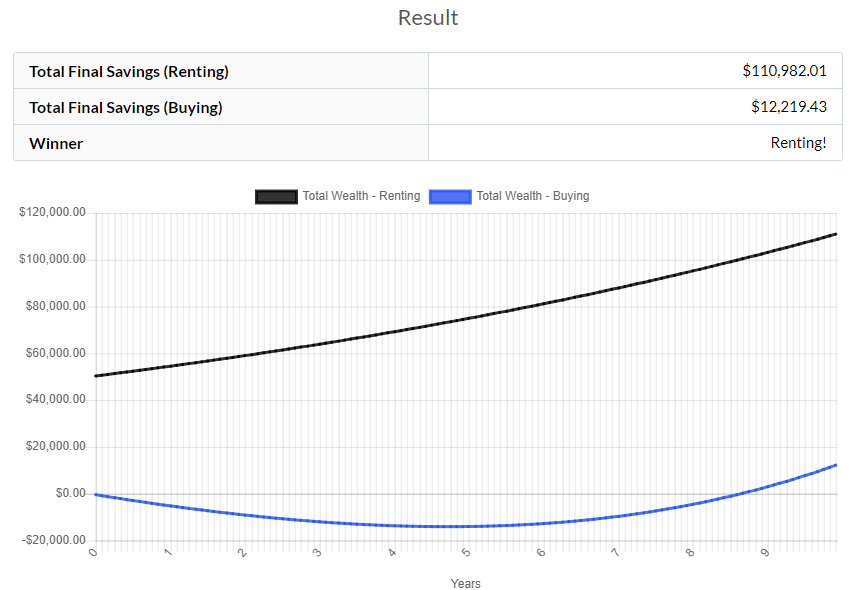

Our final new lesson talks about the complex decision of choosing to buy or rent. It walks through the Opportunity Cost of using a down payment towards another investment, factoring increases in rent and home ownership over time, walks through both future value and mortgage payment formulas (both long-form and spreadsheet formulas).

The lesson concludes with a one-of-a-kind calculator that takes a student’s inputs for two different properties (one rented and one buying), and shows the financial impact of both choices for as long as they intend to live in the home.

These new lessons are not just great for financial math – the inclusion of many integrated calculators makes them a great addition to every personal finance class! Stay tuned for our next update with even more resources for your class!

Happy Learning!

-The PersonalFinanceLab Team