We are excited as ever to announce the latest addition to our Personal Finance Curriculum Library – our interactive lesson on Debt Snowball and Debt Avalanche!

What is a Debt Snowball and Avalanche?

Debt Snowball and Debt Avalanche refers to two accelerated debt repayment techniques, which can save a person trying to get out of debt tens of thousands of dollars, and pay off their debts years faster than when making minimum payments. The concept works by taking a little extra cash each month, and paying off each debt one at a time. When each debt is paid off, that debt’s payment is “rolled” into the next debt as additional payments towards principle. So while your total monthly payments stay constant through the payment plan, debts get paid off faster and faster as time goes on.

The primary difference between “Debt Snowball” and “Debt Avalanche” is the order that you would pay off each debt – and you can read the full lesson to learn more!

Note: you will require a PersonalFinanceLab login to access this lesson. If you do not already have a teacher account, you can sign up for our Teacher Test Drive to access!

Calculator Included!

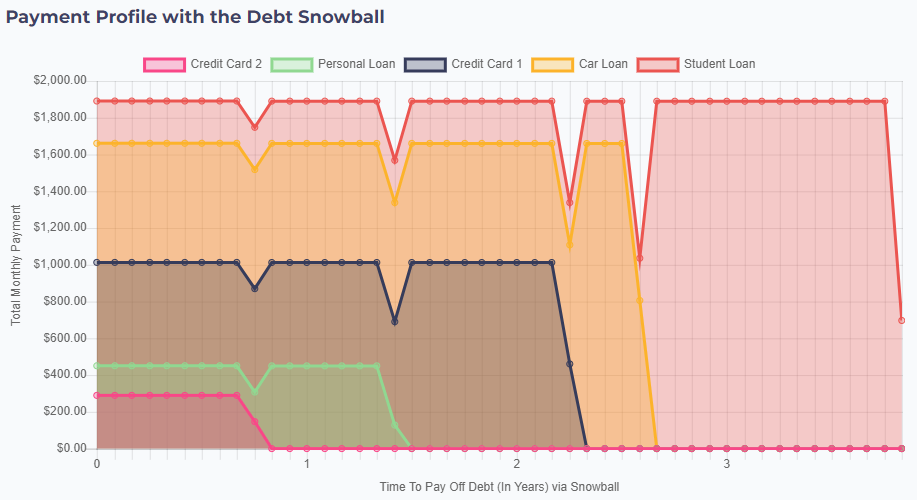

The best part of our latest lesson is that it includes an interactive calculator to visualize exactly how each debt is paid off, with each method – making it easy for students to see these payment plans in action!

The Debt Snowball and Avalanche lesson is just the latest addition to our Financial Literacy Resource Library, included with our stock and budgeting games for all classrooms! We hope your students take away the fact that powerful techniques exist to help them stay on top of their finances!

Happy Learning!

-The PersonalFinanceLab Team