Teachers sometimes ask us why we anchor the curriculum and other activities on PersonalFinanceLab.com to our stock market simulation – so we want to tell you why!

Research Tested, Student Approved

There are numerous studies showing how stock market games improve classroom outcomes in Personal Finance, Economics, and Business classes, with a body of literature going back nearly 30 years (coincidentally, not long after StockTrak, the makers of Personal Finance Lab, launched the world’s first web-based stock market simulation).

There are numerous studies showing how stock market games improve classroom outcomes in Personal Finance, Economics, and Business classes, with a body of literature going back nearly 30 years (coincidentally, not long after StockTrak, the makers of Personal Finance Lab, launched the world’s first web-based stock market simulation).

To get to the heart of the matter, there are two reasons why stock market games “work” in the classroom:

- It gives your students a chance to “get their feet wet” and see how concepts you cover in class are applied in the real world

- The class rankings of your game adds an element of competition that keeps kids paying attention day after day

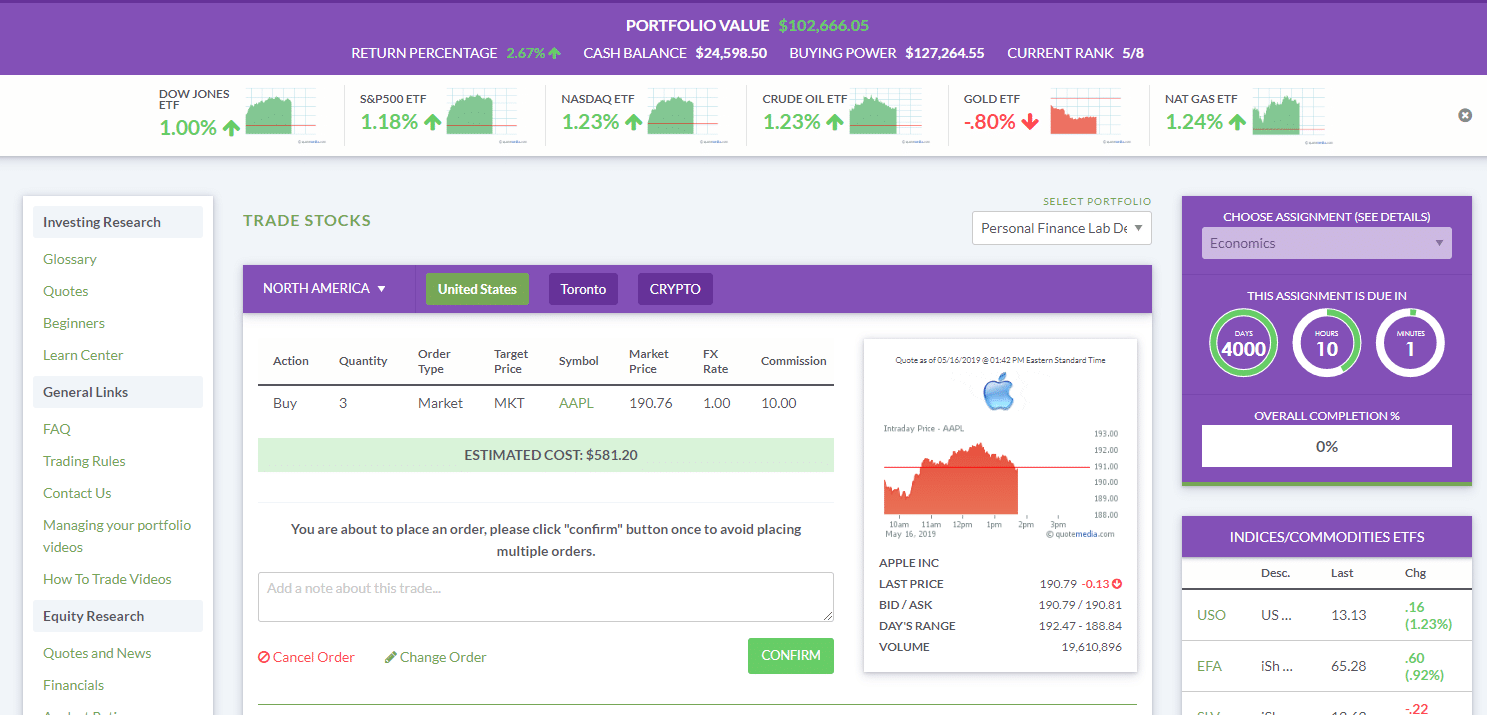

We took this one step further with our “Trade Notes” feature, which directly encourages students to connect concepts you cover in class with the trades they make in their virtual portfolio.

Longer Games = Better Learning

When we talk to teachers, we sometimes see teachers who are very comfortable investing on their own that still avoid stock games in class. Their reasoning is that the length of a class is not long enough for students to tell the difference between a “good” investor or “bad” investor. This criticism comes up most often when teachers are considering using a stock game just during their 2 week unit on Investments. And they are right!

When we talk to teachers, we sometimes see teachers who are very comfortable investing on their own that still avoid stock games in class. Their reasoning is that the length of a class is not long enough for students to tell the difference between a “good” investor or “bad” investor. This criticism comes up most often when teachers are considering using a stock game just during their 2 week unit on Investments. And they are right!

This is why it is important to run your class stock game for as long as possible – giving your students the most possible exposure to the real ups and downs of the financial markets. We designed our platform to even let your class game go on long after your class ends – letting students continue to log in and manage their portfolio even over summer vacation (if you choose). This is why we tie everything together on PersonalFinanceLab.com with the stock simulation – to encourage teachers to hold longer sessions. This can mean having students dive in to the game before you cover every part of investing in class, but we make sure to build in plenty of tutorial videos and educational resources to help them hit the ground running.

A New Way To See The World

Using stock games in class gives your students a whole new perspective on the world around them. By the end of your class simulation, your student’s thought process gets transformed from “I’m going to the store to buy some food” to “I’m going outside in my Nike (NKE) shoes, Wrangler (VFC) Jeans, and Abercrombie & Fitch (ANF) t-shirt, to the Bank of America (BAC) ATM to get cash, then drive my Ford (F) car rolling on Goodyear (GT) tires with BP (BP) gas to Walmart (WMT) to buy Charmin (PG) toilet paper, Crest (PG) toothpaste, Coca-Cola (KO), and Ben and Jerry’s (UL) Ice Cream.

Using stock games in class gives your students a whole new perspective on the world around them. By the end of your class simulation, your student’s thought process gets transformed from “I’m going to the store to buy some food” to “I’m going outside in my Nike (NKE) shoes, Wrangler (VFC) Jeans, and Abercrombie & Fitch (ANF) t-shirt, to the Bank of America (BAC) ATM to get cash, then drive my Ford (F) car rolling on Goodyear (GT) tires with BP (BP) gas to Walmart (WMT) to buy Charmin (PG) toilet paper, Crest (PG) toothpaste, Coca-Cola (KO), and Ben and Jerry’s (UL) Ice Cream.

This helps students take stock of how they spend their own money, and how businesses operate in the real world – fostering a new level of critical thinking and understanding of finance and economics. Why does Charmin toilet paper and Crest toothpaste have the same stock symbol?

Group Projects With Accountability

Stock games are also a perfect opportunity for group work in class. We take group projects seriously, and know it can be a challenge to properly credit each team member with their own work. That is why unlike other stock games, even if students work in teams, each participant will have their own separate login. You can see each student’s trading activities, assignment progress, quiz grades, and individual rankings separately.

If you choose to run your class game as a group project, you can move students into “Teams”, which aggregates their trades and portfolios into one big group – and also gives class Team Rankings. This lets students build group strategy and work together, while still maintaining the accountability of seeing exactly what each participant contributes.

Because They Need It

At the end of the day, very few of your students will become day traders, or even very active investors (but you definitely will see during the course of your game which have the aptitude!). The benefit of using stock market games for the average student is opening the window on a world that they absolutely need to understand in the 21st century. Not every student needs to understand how to read patterns in a stock chart, but EVERY student needs to be able to have an intelligent conversation with their financial adviser about their long-term goals, and what they want their investments to look like.

Giving your students exposure to the stock markets also makes the financial world far more accessible. This helps students understand that they can, and should, get started saving and investing as early as possible, rather than waiting until they feel “adult” enough to start putting money away. The trigger of “buying stock” in any person’s mind also fires the same triggers as spending on consumption. This means young adults tend to find “investing” a much easier pill to swallow than just the abstract concept of “saving”, since they have an actual asset they can see changing value in real-time. Showing how portfolio returns are moving every second of every day solidifies compound interest, encourages healthy saving habits, and helps make sure young people do not get left in the dust when it comes to building wealth early.

So if you haven’t already, start using stock market games in your classes!