Time To Read:

Financial literacy is more than a checklist of topics, it’s a lifelong skill that students must internalize through active engagement, decision-making, and reflection. At PersonalFinanceLab, we believe that the best way to teach financial concepts is by letting students live them — virtually, of course — in safe but realistic simulations that mirror the financial world they’ll enter after graduation.

We often get asked how PersonalFinanceLab compares to other platforms like Everfi®. While Everfi offers useful digital lessons across a wide range of topics, many of which are free for schools, the real question isn’t just what topics are covered, but how deeply students practice and retain what they’ve learned. And that’s where PersonalFinanceLab excels.

Core Philosophies: Passive Learning vs. Active Mastery

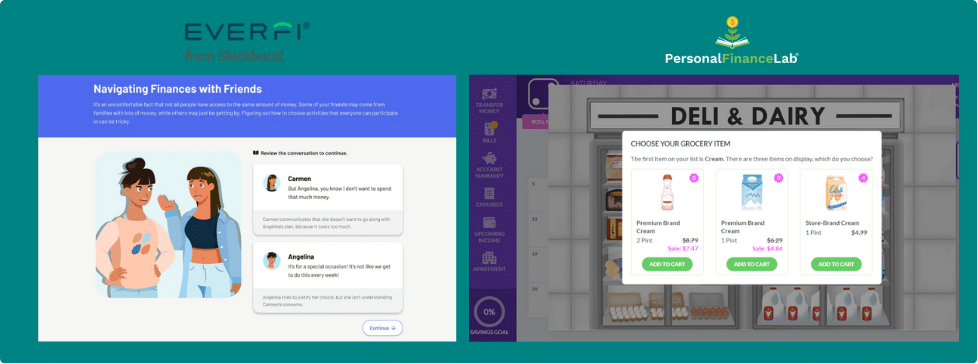

Everfi is built around bite-sized, self-contained modules that serve as great introductions to topics like budgeting, investing, and paying for college. These are designed to be completed quickly, often in a single sitting, with pre- and post-quizzes to gauge understanding. There is no doubt, it’s efficient and accessible.

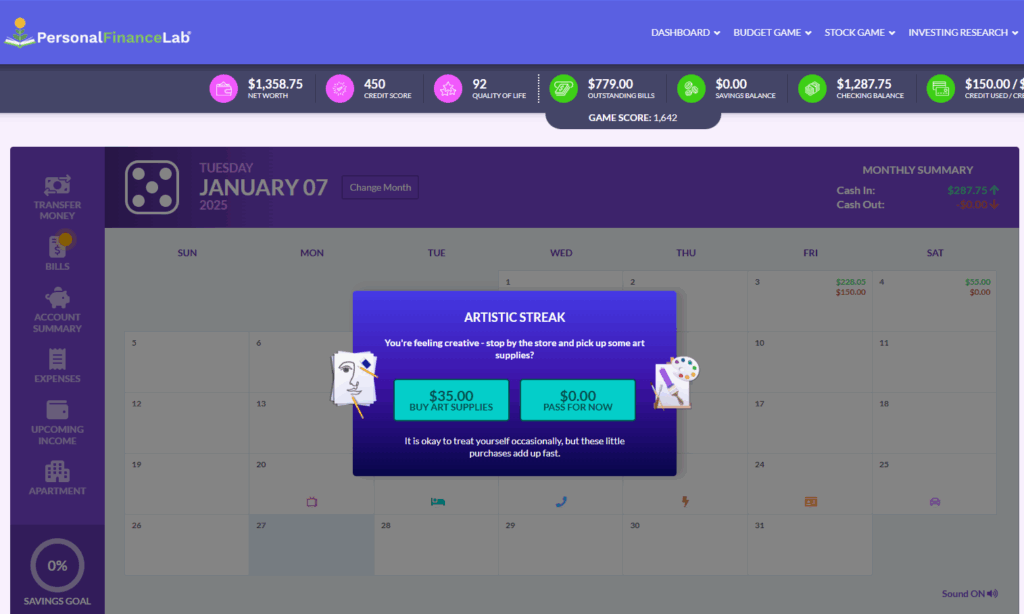

However, at PersonalFinanceLab, our goal goes far beyond exposure. We’re focused on mastery through repeated practice. Our platform revolves around immersive simulations like the Budget Game and Stock Market Game, where students make dozens (sometimes hundreds) of financial decisions that mirror real life. From paying rent to juggling savings goals and surprise expenses, students experience what it really feels like to live on a budget.

Budgeting: Where Real Learning Happens

When students use Everfi to learn budgeting, they often walk through pre-scripted scenarios, these are helpful, but abstract. At PersonalFinanceLab, budgeting comes alive through our virtual year-long simulation. Students take on part-time jobs, pay bills, deal with emergencies, and see the direct impact of their decisions on key metrics like their Credit Score, Net Worth, and Quality of Life.

And teachers? They see those “lightbulb moments” happen when students realize, for example, how missing a payment hurts their credit, or how skipping savings one month sets them back later. This kind of sustained engagement is simply not possible in standalone modules.

Investing: From Vocabulary to Real-Time Markets

Everfi introduces students to the concepts of investing through static examples and multiple-choice questions. Students might analyze a fictional character’s portfolio and decide what stock “Dax” should buy. It’s a good way to explain diversification, sure — but students never actually feel invested.

PersonalFinanceLab’s Stock Market Game, by contrast, drops students into the real-world market. They manage their own portfolio using live market data, make their own trades, and use integrated research tools to analyze companies, just like a real brokerage. They see their rankings shift throughout the day, prompting questions, research, and genuine curiosity. It’s experiential learning at its best.

Curriculum Depth and Integration

Everfi boasts a wide range of standards-aligned modules, and we respect that. But at PersonalFinanceLab, we pair 300+ self-grading lessons with simulations that make every concept stick. Lessons on “Pay Yourself First” or “Diversification” are immediately applied in the games and students can even transfer funds from their Budget Game savings into their Stock Game portfolios. This seamless integration of curriculum and action is a major advantage for long-term skill building.

Teacher Tools: Customization that Works for You

One of the biggest differences? Control.

Everfi is plug-and-play, and that’s great when you need something quick. But it offers virtually no customization beyond choosing which modules to show students.

PersonalFinanceLab was built for teachers who want to be in charge of their classroom. You can customize everything: game settings, trading rules, types of securities, savings goals, interest rates, and even how students earn in-game rewards for completing assignments. You can decide exactly how long the games run, what students see, and how they’re assessed. Our pre/post testing works across the entire experience, not just per lesson, giving you a big-picture view of your students’ growth.

So, What’s the Bottom Line?

Everfi gives you a solid introduction to financial topics. If you need fast, free, and easy — it’s there.

But PersonalFinanceLab is the solution when you’re ready for students to go deeper, to practice skills over time, and to develop real financial habits before they leave your classroom.

Hands-on simulations that mirror real life

Real-time stock trading using real market data

Deep curriculum integration with assignments and assessments

Full customization to fit your classroom needs

When you want your students to not just learn about money, but to actually learn to manage it — PersonalFinanceLab is built for you.