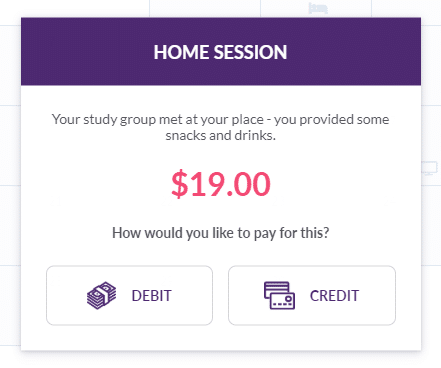

Once you get started on progressing through your first month, you’ll notice that you have two different ways to pay for almost every expense – your Debit Card or Credit Card.

Understanding the two, and how to use them, will be essential to effectively managing your budget.

Your Debit Card

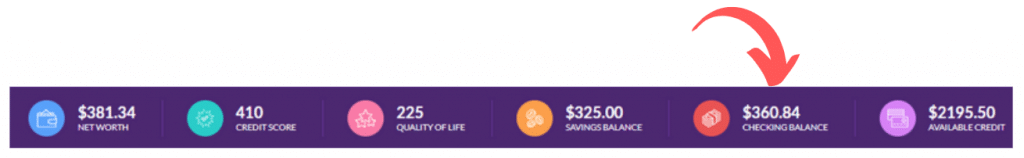

Making a purchase with your Debit Card withdraws the purchase amount directly from your Checking Account – it is the same as writing a check, or taking cash out at an ATM. You can monitor how much money you have in your checking account at any time at the top of the screen.

Since this uses money you already have available, paying with your Debit Card is usually a safe option. However, there are a couple things to keep in mind:

- If you overdraw your checking account, you might get an overdraft fee from your bank. These can add up fast – so be careful when your checking account balance is low.

- You won’t build up your Credit Score. Your credit score is a measure of how trustworthy you are with credit, which has huge impacts across your life. Better credit scores can eventually lead to better interest rates on your credit card, easier access to mortgages, and more favorable terms any time you need to borrow.

Your Credit Card

If you use your Credit Card, you are paying with Debt. Buying something with a credit card means you are borrowing money from your credit card issuer, which you promise to pay back later.

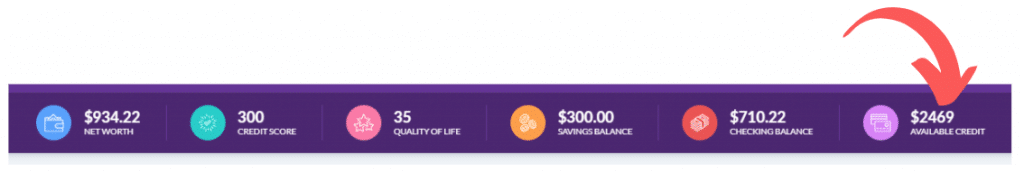

You have a Credit Limit at the top of the page – this is the maximum that you can borrow.

Buying things on your Credit Card means that you take out a loan, but there are some really good reasons to use your Credit Card regularly:

- If you don’t use your credit card, you can’t build up your Credit Score. Your credit score measures how responsible you are with credit – if you never use credit, you can’t show you can be trusted! Your credit score plays a big role in your overall Game Score, so building it up should be one of your main objectives.

- Your Credit Card can be an effective way to bridge gaps in your income without depleting your savings. In the budget game, you earn different income each week – and sometimes you might not have enough cash in your checking account to pay your bills. Using your Credit Card is a good way to make it to your next paycheck without draining your Savings Account.

- In the real world, most credit card companies offer “Cash Back” and other rewards for using your credit card. These are not present in the game, but in the real world responsible card holders can rack up a lot of rewards in the long term.

Debt and Interest

If you use your credit card, you will get a credit card bill every month. This will show your balance outstanding, and you will have one week to pay it off. This is called the Grace Period.

If you don’t fully pay off your credit card bill during the Grace Period, you will start to pay interest. Your credit card has a 20% annual interest rate. If you carry over a balance past your Due Date, you will start to see the daily interest get added to your card.

Since you have a 20% annual rate, this translates to 20% / 365 = 0.05% Daily Interest. This might not sound like a lot, but it can add up fast!

[close]