A bullish collar is a protection strategy where you simultaneously buy a call at strike price 1 and sell a put at strike price 2. This strategy is for investors who has a bullish perception on the underlying asset. We can also create a “bearish” collar by simultaneously buying a put at strike price 1 and selling a call at strike price 2.

What are its components?

A “bearish collar” has two components:

- Buy put at strike price 1

- Short call at strike price 2

A “bullish collar” has two components:

- Buy call at strike price 1

- Short put at strike price 2

When and why should I have a collar?

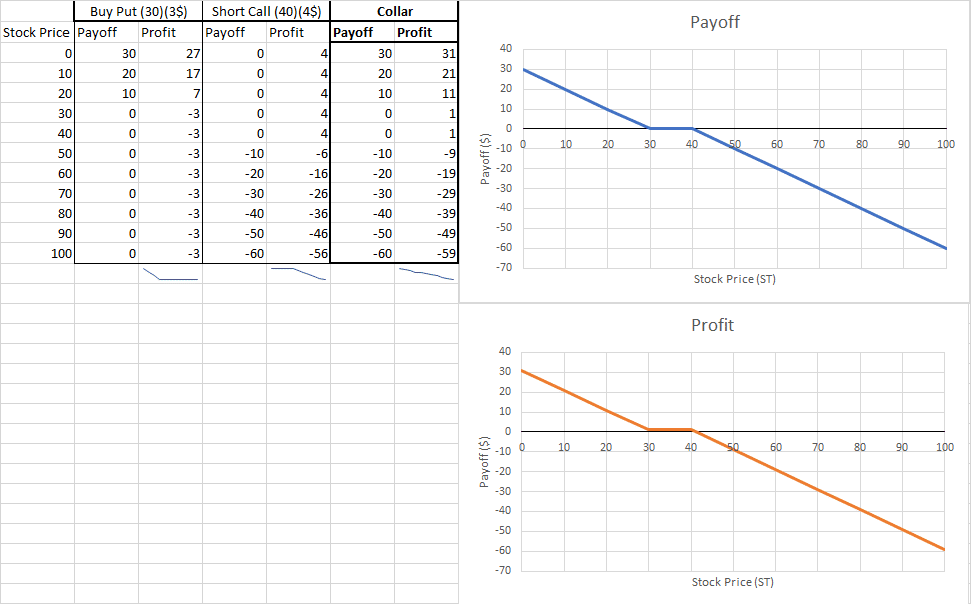

You should have a collar if you strongly believe that the stock price will either be bullish or bearish. Graphically, a collar looks like a stock’s graphs, but with a width where the payoff is stable. By shorting the second option contract, you are covering your options costs for the first option contract. However, should the price go in the opposite direction, you will have a large loss.

What is the payoff and profit graph?

What is the break-even point?

The break-even point of a collar spread can be defined by finding the stock price where the spread generates a zero-dollar profit. By adding all contracts and equating it to zero, you should solve for ST. However, there is a possibility where there is a range of stock prices that can break-even. To find that range, you should create scenarios to define the payoffs. For example, the payoff when ST<30, 30<ST<40, 40<ST.