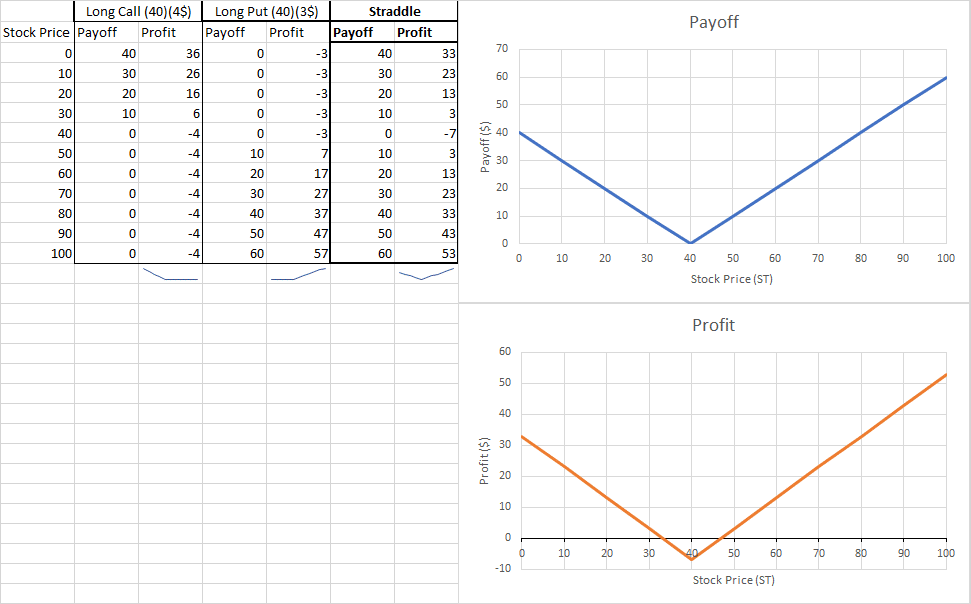

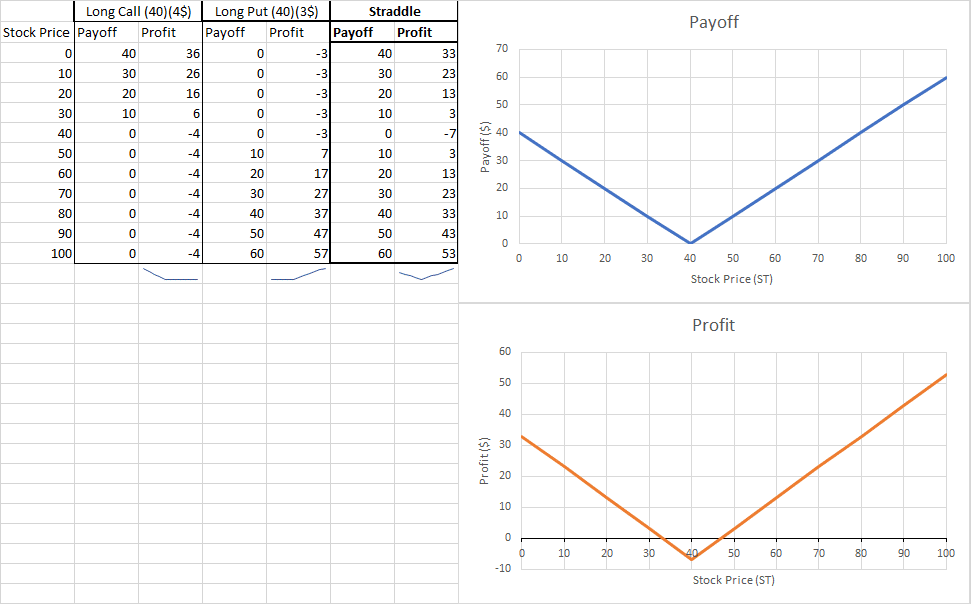

A straddle is a volatility bet where you simultaneously long a call at Strike Price 1 and long a put at Strike Price 1. This creates a triangular shaped payoff and profit graph where the reward is based on the volatility of the stock. Traders can also bet against volatility by shorting a call at Strike Price 1 and selling a put at Strike Price 1.

What are its components?

A long straddle has two components:

- Long put at strike price 1

- Long call at strike price 1

*(A short straddle can be created by short both the call and put at strike price 1)

When and why should I have a straddle?

You should have a straddle if you expect to see a lot of fluctuation in the underlying asset’s price. Creating a straddle does not infer that you have a specific view on the stock. It simply implies that the trader expects a lot of volatility and executed a strategy to gain something from it.

What is the payoff and profit graph?

What is the break-even point?

The break-even point of a straddle can be defined by finding the stock price where the straddle generates a zero-dollar profit. By adding all contracts and equating it to zero, you should solve for ST. However, there is a possibility where there are two stock prices that can break-even. To find those two points, you should create scenarios to define the payoffs. For example, the payoff when ST<40 and 40<ST.