One of the most crucial aspects of developing a marketing strategy is determining an approach to pricing. A company could have a great product and a fantastic promotion campaign, but could still fail if the price isn’t right for customers. On one hand, high prices could repel value-seeking consumers and could result in poor sales and low profits. However, prices that are too low could mean narrower margins that could outweigh any boost in additional sales. The key is to select a strategy that fits the company’s product, their competitive environment, and their customer base.

This article will discuss how the forces of supply and demand impact pricing and the concept of price elasticity, cover some of the most common pricing strategies along with scenarios in which they are typically applied, and finally touch on how technological developments have impacted price determination.

General Price Concepts

Supply and Demand

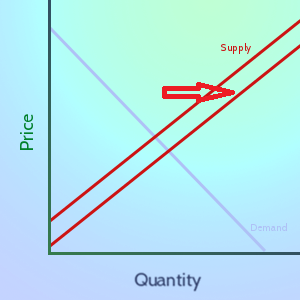

Supply and demand are among the most basic factors on market price for goods, and often an individual firm has little control over them. When there is an oversupply of a product in the market, assuming constant demand, the price of the good will decrease as firms attempt to unload their excess of inventory. Companies that refuse to lower price during a period of oversupply can be punished with huge drops in sales and a buildup of inventory they can’t get rid of. Oil is a prime example of an industry that is currently in oversupply—increased production has led to prices falling from well over $100/barrel down to around $50/barrel today.

Supply and demand are among the most basic factors on market price for goods, and often an individual firm has little control over them. When there is an oversupply of a product in the market, assuming constant demand, the price of the good will decrease as firms attempt to unload their excess of inventory. Companies that refuse to lower price during a period of oversupply can be punished with huge drops in sales and a buildup of inventory they can’t get rid of. Oil is a prime example of an industry that is currently in oversupply—increased production has led to prices falling from well over $100/barrel down to around $50/barrel today.

Likewise, any decrease in demand with no change in supply will also result in lower prices. With less aggregate customers, companies are forced to fight harder to win the demand of each customer, and this fierce level of competition leads to price decreases. During a recession, like the one that happened in 2008, demand often falls for a wide variety of goods as consumers are tighter with their spending, and this forces companies to cut prices.

To learn more about Supply and Demand, along with examples of how it works, read our article about Supply and Demand Examples in the Stock Market.

Price Elasticity

The basic impact that a company has in controlling their pricing is upon the quantity demanded by consumers. If prices are raised, less customers will buy the product and if prices are lowered, more customers will buy. Price elasticity concerns the relationship between the degree of the price increase (decrease) and the degree of the following drop (boost) in sales.

Elastic demand means that for any downward change in price, the boost in demand will be proportionally higher or vice versa. Therefore, for a product with elastic demand, the best move for managers is to lower prices to increase quantity demanded. Products with many similar substitutes, like McDonald’s hamburgers or Hershey’s chocolate, often have elastic demand because consumers can be more sensitive on price and easily switch to a different product choice.

Inelastic demand is the exact opposite; for any change in price, the percent change in demand is lower. So when goods are price inelastic, management should increase prices because the additional profit will outweigh any drop in quantity demanded. Luxury goods like diamonds are price inelastic because customers tend to be less price sensitive when they are spending on something that is essentially a status symbol of wealth. Also, goods with very few substitutes like gasoline and tap water are typically price inelastic because consumers do not have the ability to switch to another product; they are forced to pay the higher price.

Common Pricing Strategies

Below is a description of some of the most widely used pricing strategies:

Line

Line pricing is when a company offers products at several different levels of quality (typically low, medium, and high). Pricing is set to reflect the relative quality of each offering, so the low-quality product would be at a discount price, the medium product would be at an average price, and the high-quality product would be at a premium price. The iPad is an example of this strategy—customers have the choice of buying a very basic model or they can pay several hundred dollars more to get one with higher quality and better features. As its name indicates, the line strategy is effective when a firm has a product line with several items that have a distinct difference in quality level. Segmented pricing can help clarify to consumers the added value that buying a better model entails and it provides customers some flexibility on deciding how much they want to spend.

Line pricing is when a company offers products at several different levels of quality (typically low, medium, and high). Pricing is set to reflect the relative quality of each offering, so the low-quality product would be at a discount price, the medium product would be at an average price, and the high-quality product would be at a premium price. The iPad is an example of this strategy—customers have the choice of buying a very basic model or they can pay several hundred dollars more to get one with higher quality and better features. As its name indicates, the line strategy is effective when a firm has a product line with several items that have a distinct difference in quality level. Segmented pricing can help clarify to consumers the added value that buying a better model entails and it provides customers some flexibility on deciding how much they want to spend.

Loss Leader

The loss leader strategy involves a company selling certain items at a loss in order to bring customers into the store. The assumption is that once customers are tempted into the store, they will have a tendency to buy other things as well that will generate the profit for the company. One very basic example of this are restaurants that sell kids’ meals for very cheap (even for free sometimes). The restaurant loses money on the kids’ meal, but makes their profit when the adults accompanying the children have to order full-price meals. This can be an effective strategy to generate store traffic, but firms must be careful to make sure that customers actually are buying products besides just the loss leaders.

The loss leader strategy involves a company selling certain items at a loss in order to bring customers into the store. The assumption is that once customers are tempted into the store, they will have a tendency to buy other things as well that will generate the profit for the company. One very basic example of this are restaurants that sell kids’ meals for very cheap (even for free sometimes). The restaurant loses money on the kids’ meal, but makes their profit when the adults accompanying the children have to order full-price meals. This can be an effective strategy to generate store traffic, but firms must be careful to make sure that customers actually are buying products besides just the loss leaders.

Psychological

Psychological pricing is an approach where prices are set based upon a psychological reaction that they will cause consumers. The ultimate goal of this tactic is to increase sales without significantly reducing prices. The most common example of this is when retailers price items one penny below an even dollar amount, $9.99 instead of $10 for example. Customers associate the $9.99 with the lower dollar amount of $9 rather than actively realizing that it is just one cent below $10. The massive usage of that tactic alone illustrates the success psychological pricing can have. It can be effective both for relatively low cost goods like gasoline or for big purchases like cars– $19,999.99 for some reason just seems a lot cheaper than $20,000.

Psychological pricing is an approach where prices are set based upon a psychological reaction that they will cause consumers. The ultimate goal of this tactic is to increase sales without significantly reducing prices. The most common example of this is when retailers price items one penny below an even dollar amount, $9.99 instead of $10 for example. Customers associate the $9.99 with the lower dollar amount of $9 rather than actively realizing that it is just one cent below $10. The massive usage of that tactic alone illustrates the success psychological pricing can have. It can be effective both for relatively low cost goods like gasoline or for big purchases like cars– $19,999.99 for some reason just seems a lot cheaper than $20,000.

Penetration

Penetration pricing is when a firm introduces a product at a low price in order to generate a lot of early sales and “penetrate” a market. Then, once the market has adopted the product, the company attempts to raise the price. Netflix could be considered an example of the penetration strategy—they started out pricing their service at a low monthly rate, and now that they have a vast number of addicted customers they are able to slowly raise prices to try and generate profit. The biggest issue with the penetration strategy is that once consumers are used to paying a low price for a product, it can be very difficult to convince them to pay a steeper price for the same item.

Skimming

Skimming is sort of the opposite of the penetration strategy. In the skimming strategy, companies introduce products at a high initial price—often the highest price they think that customers would be willing to pay. Then, once the initial demand is satisfied, the firm lowers prices to capture a new group of consumers. This process can continue through several price decreases. The skimming strategy is often used by startups that have a brand-new, unique product. Through the early high pricing, these companies try to get as much profit as they can before competitors step in and force price cuts. One problem with skimming is that it entices competition to the market as rival firms perceive an opportunity to undercut the original company’s product.

Impact of Technology

Technology has led to a very different environment for pricing than has been the norm in the past. With an increased ability to quickly “price-check” online, customers have become more sensitive to prices and it is more important to either be priced below competitors or to clearly communicate the brand’s superiority to consumers. It is also easier for customers to switch brands in that they can shop online and avoid having to travel to multiple stores to find the best deal. In these ways, additional power has shifted to the consumer in determining the way prices are set.

Technology has led to a very different environment for pricing than has been the norm in the past. With an increased ability to quickly “price-check” online, customers have become more sensitive to prices and it is more important to either be priced below competitors or to clearly communicate the brand’s superiority to consumers. It is also easier for customers to switch brands in that they can shop online and avoid having to travel to multiple stores to find the best deal. In these ways, additional power has shifted to the consumer in determining the way prices are set.

With a shift towards e-commerce, new factors are added into a company’s pricing decisions. One key issue is shipping—will the business charge customers for shipping or cover the cost themselves? With Amazon offering free shipping on many items through its Prime service, there is additional pressure on companies to lower price through the shipping aspect. Overall, the emergence of online shopping has resulted in much lower prices through this type of direct, easily-comparable competition. This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Get PersonalFinanceLab

[qsm quiz=108]