There are hundreds of small tips and rules you will hear about managing your personal finances, but putting everything together into one coherent plan can be a daunting task.

You have probably already heard about budgeting, spending plans, savings strategies, credit cards, and all points in between – now we will put everything together to make a plan to build lifelong wealth.

Manage Your Income

Your saving and spending will always depend on how much income you can start with. Your career goals and personal finance goals are the same thing, so always start by looking at your career.

Making a Career Plan

Interviewers often as “Where do you see yourself in 5 years?” You should always have an answer to this question, because it helps build a clear roadmap forward.

Make a Career Plan by trying to define your ideal job (and salary), and set a series of obtainable goals for the next 5 years. Start by looking at job postings – not for jobs that you can apply for now, but for jobs you want to land in the future. These job postings have all the information you need to make an effective career plan:

- Experience requirements: Use these to define the stepping stones for jobs between now and then.

- Skill/Education requirements: See what kind of extra education you need to obtain, or skills you need to build on your own time outside your day job.

- Salary offers: Usually included in job postings, this will give you an idea of what kind of lifestyle you are building towards. This helps put a cap on the debt you take on today, since it gives a good way to see your ability to pay it off in the future.

Once you do this for your “dream job”, rinse and repeat for each of the “stepping stone” jobs you need to meet the experience requirement. Before you know it, you will have a fully-fleshed out Career Plan with some specific actions you can take today to get there.

Making a Debt Plan

Once you have an idea of how your career can evolve, you know how much space you have for debt. Student loan debt usually comes first, as you try to knock out the Education Requirements for your career path.

You can estimate how much your first jobs will pay after school by looking at job offers for entry-level positions, so your key is to see how much of a debt load you will have as soon as you finish school.

Use Your Spending Plan

Always set aside 20 minutes a month to go over your spending by doing a quick account reconciliation updating your Spending Plan. The key to financial success is knowing where your money is, how it got there, and where it is going next. No matter how good you are at keeping track of these in your head, there is no substitute for a few minutes of dedicated planning with a spreadsheet and your actual spending habits.

Your Four Accounts

There is a secret way to effortlessly build wealth, while barely paying attention: Split your income automatically, keeping different amounts in different accounts. Most adults with healthy finances use four accounts, but it may be more or less depending on your personal situation.

Account One: Checking Account

This is your primary checking account. Deposit your paycheck here, and use it for all your bills and shopping. You should have all of your bills paid automatically by setting up auto payments, going through this account.

Account Two: Savings Account

This is a standard savings account, linked to your checking account. Set up automatic transfers every month, set as soon as you deposit your paycheck. This will help with your “Pay Yourself First” savings strategy by making sure your wealth is always growing.

Account Three: Investing Account

Have a brokerage account, and use it. A certain percentage of your savings should be invested in the markets, which will have a higher percentage return than just a normal savings account. Whether it is invested in bonds, mutual funds, index ETFs, or a balanced portfolio you build yourself, investing your savings is the most effective way to help it grow.

You can even set up regular transfers from your savings account to your brokerage account, which will help keep it growing.

Account Four: Emergency Fund

This is either part of your savings account, or an entirely separate bank account set aside for emergencies. Your Emergency Fund fund will have 3 to 6 months of income standing by, ready to be withdrawn in case you have a monetary emergency. The purpose of your Emergency Fund is to make sure that you do not “steal from yourself” by withdrawing from your savings. Every time you need to withdraw from your Emergency Fund fund, fill it back up with your next paycheck – your goal is to always keep this account “topped up” in case you need it later.

Optional – Account Five: Spending Account

If you struggle to control your spending, you may want to have a secondary checking account, specifically set aside with your “Spending Money”. Here’s how it works:

- Use your account reconciliation to determine the approximate amount of bills you have each month.

- Set up your main checking account to automatically transfer your savings, plus pay all of your regular bills.

- Transfer 80% of the money left over to this new “Spending Account” (also a checking account).

- Disable overdraft protection on your Spending Account to ensure you cannot over-draw.

- Use this “Spending Account” to go out with friends, buy things online, pay for groceries, and any other spending you do throughout the month.

Your “Spending Account” is the debit card you keep with you – if you are using a separate Spending Account, leave your normal debit card and credit card locked up at home, so you are not tempted to start spending out of other accounts.

By separating out your Spending Account, it ensures that all your bills will always get paid on time, and your savings will always continue to grow, regardless of how much impulse shopping or poor spending habits you might have. If you try to spend more than what you have in your Spending Account, the transaction will just be declined. The momentary embarrassment is well worth the damage you’re sparing your savings account!

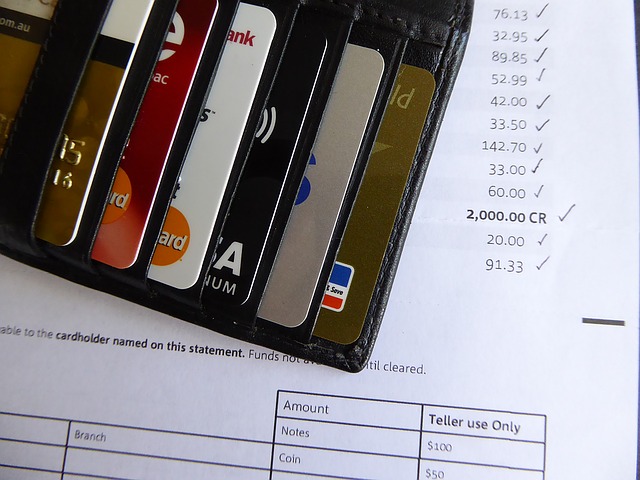

Your Credit Card

Your credit card is an extension of your Checking Account or Spending Account, NOT extra money. It is important to use your credit card to build your credit score, but you should always avoid spending more on your credit card than you can pay off immediately with your checking/spending accounts.

Budgeting Guidelines

It is hard to know exactly how much money to allocate to different expenses, so let this guide help show how much money you should put to different types. These are guidelines based on your net (after-tax) income.

Housing

Look for housing that takes 20-30% of your net income. Any higher and you are pulling too many resources away from all your other expenses, and it will end up seriously hurting your ability to save.

This may mean stepping out of your comfort zone, but you need to exercise willpower. If you hate roommates, then make sure you find a better-paying job before upgrading your housing.

Savings

Shoot for 10% of your net income to go straight to your savings account. Going higher is always better, but saving less than 10% will hurt your long-term financial goals (like saving for a house, or retirement). Of this savings, transfer 80% to your investing or brokerage account, keeping the rest in your savings account.

So far, we’ve allocated up to 40% of our monthly income, just on housing and savings.

Bills and Groceries

Miscellaneous bills and groceries will take up another 30% of your income. This is another set of spending that will be fixed month-to-month, and should be easy to plan for.

This account also includes all your insurance and car payments. If you are making car payments, this percentage could go up to 35% or 40%, but at this point you are stretching yourself very thin.

Other Spending

After everything else is spent, you should still have at least another 20% of income left for anything else you want to spend it on. Going out with friends, saving for holiday gift-giving, and buying yourself something nice should all fall into this group.

A rookie mistake for most budgets is forgetting to include this group, but most people cannot go very long without some entertainment spending. Failing to set aside 20% of your income to spend on “whatever” is a major reason why people end up racking up credit card debt. This 20% chunk should be the spending that you could “cut” if you are having a rough month and need to replenish your Emergency Fund.

Get PersonalFinanceLab

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Learn More[qsm quiz=158]

Challenge Questions

- In order to build worth, you have to learn to manage your money and save some of the money that you earn. Is this true, and if so why?

- How might your career over time help you build your wealth?

- Does earning more money guarantee to build wealth? If so, why? If not, why not?

- Why should you have a savings account and a checking account, rather than having one single account?