Health insurance is usually the most complicated and expensive insurance you need. Unfortunately, it is also usually the most important, making it very difficult to avoid the cost.

With very few exceptions, health insurance is mandatory for all citizens in the United States, but the way you become insured will change drastically based on your age, income, and the company you work for.

Types of Health Insurance

Health insurance falls into three broad categories:

Public Insurance

Our government provides public insurance directly for some individuals. This includes Medicare, healthcare for the elderly, Medicaid, healthcare for low-income families and children, and some health insurance coverage for veterans. These public health programs are funded through payroll taxes, and the coverage provided is not free. The covered persons usually must pay some amount out-of-pocket before the public insurance takes effect.

About 50% of all healthcare spending in the United States is through public insurance programs, the largest portion being through Medicare.

Group Insurance

Employers often offer group health insurance to their employees. With group health insurance, a business will split the cost of health insurance coverage with its employees. Eligible employees are usually required to participate in the program, unless they have better coverage from somewhere else. (Since a husband and wife may both have group health insurance options through their employers, the couple will decide which option is better and cheaper for the family.) Group insurance is usually the cheapest option for individuals. This is because it groups many people from different age groups and different risk levels together and splits the cost with the employer. Big group policies also have bargaining power to negotiate better deals with insurance providers. About 60% of Americans have health insurance coverage through their employer.

Individual Coverage

You may need to purchase health insurance directly from a health insurance provider yourself if you cannot get it through your employer. The cost of insurance you purchase as an individual is usually higher because you are not splitting the cost with your employer. There are some subsidies and state-run insurance exchanges that can make this cheaper. About 9% of Americans are covered through individual health care plans.

Health Insurance Terminologies

Health insurance is built upon the same core concepts of premiums and deductibles, like other forms of insurance. The premium is the monthly charge you pay to have health insurance coverage. The deductible is the amount you pay first for medical expenses before your insurance pays. As with all insurance policies, there is a balance between the premiums you pay, the deductibles you pay when there is a claim, and the level of coverage you receive.

Health insurance also has other concepts that you need to understand.

Co-payments and Coinsurance

Co-payments and coinsurance refer to the amount of money you are responsible for paying, beyond your premium and deductibles.

A co-payment is what you pay per visit to be seen by a health care provider. There is no maximum to the amount of co-pays you would pay in a year. For example, if your policy states that you have a $50 co-payment for a doctor’s visit, you will need to pay the first $50 out-of-pocket for each visit, with your insurance covering the rest of the cost.

Coinsurance requires you to pay a certain percentage of the cost for treatment. For example, if your policy states a 10% coinsurance level, you would be required to pay 10% of any medical cost incurred. Your insurance provider would cover the remaining 90%.

Coverage Limits and Maxima

Heath insurance policies may put a ceiling on how much in total they will pay for medical expenses in a year. Once that maximum amount is reached, you now pay out-of-pocket.

The coverage limit is the term referring to the total amount an insurance company will pay out for a single policy over the course of the year. Sometimes, this applies to the maximum over your lifetime. Any additional expenses above this amount will be entirely passed on to the insured.

If your policy includes an out-of-pocket maximum, that means there is a cap on the maximum amount of money that you would be required to pay yourself before the insurance covers everything else at 100%. For certain policies, in order to keep premiums and deductibles low, the tradeoff may be a high coinsurance percentage. These policies would most likely include an out-of-pocket maximum to ensure that individuals would not be bankrupted by very expensive medical emergencies.

Networks, Authorization, and Emergencies

You may have noticed that health insurance can be quite complex. Unfortunately, it gets a bit messier from here!

When health insurance companies keep their costs down, this means your coinsurance payments are lower. To keep costs lower, the insurance companies often make specific agreements with hospitals, doctors, and other healthcare providers to set standard costs for routine procedures. They also negotiate prices for more complex procedures. As the insured, you do not necessarily need to worry about these negotiations and specific contracts, but you do need to be aware of which doctors and hospitals your insurance provider has agreements with.

In-Network and Out-of-Network

In-Network healthcare providers are the providers that your insurance company has contracts and agreements with. If you visit an in-network doctor or hospital, your costs will be much lower. If you visit an out-of-network provider, your costs will usually be much higher, and your health insurance company may refuse to pay at all unless you can prove there was no viable in-network alternative. These agreements often apply to prescription medications as well. Your health insurance may not cover all medications your doctor prescribes. You should always call your health insurance provider before visiting a specific health center to find out if they are an in-network provider.

Prior Authorization

For certain expensive tests and procedures, your insurance company may require that you get their authorization prior to setting an appointment. This is usually done by getting an in-network doctor to confirm that the procedure or test is necessary. If your insurance provider refuses to authorize your care, you can appeal it to an independent third party to review your case. It’s not that the insurance company doesn’t want you to have treatment. They just want to make sure that an in-network doctor truly believes it is necessary.

Emergency Care

Emergency Care is the exception to both your network and insurance pre-authorization requirements. If you are injured or very sick, you are entitled to use emergency services of almost any healthcare provider and your insurance will cover it.

Supplemental Health Insurance

Normal health insurance coverage does not cover many non-life-threatening health issues. Supplemental insurance policies exist to fill this gap.

Co-Insurance Supplement

If your insurance plan includes a high co-insurance percentage, you could end up spending thousands of dollars for an unexpected surgery and hospitalization. In order to reduce that financial risk for you, some companies offer supplementary insurance plans. Supplemental insurance provides an added layer of financial protection by covering the out-of-pocket expenses that your primary health insurance plan does not cover. This can include the cost of copayments, coinsurance, and deductibles. The policy coverage limit is normally set at the same level as your primary policy’s out-of-pocket maximum. This means that with both primary and supplemental insurance policies, your out-of-pocket costs could simply be the cost of your annual premiums.

Vision and Dental Insurance

Most health insurance policies do not cover glasses, contacts, routine eye exams, or dental care. You will need supplemental Vision and/or Dental Insurance Plans to cover these treatments and exams. Some vision and dental plans are designed to cover all costs at 100% after you pay the deductibles. Others do not provide explicit coverage such as paying for the cost of an eye exam or a filling. Instead they provide a list of “Network Providers” and the costs you will pay for specific treatments. These costs reflect a discounted price for Insured individuals. This works the same fashion as the provider network you get through your health insurance. Your dental or vision insurance provider negotiates with eye doctors and dentists to lower prices for the individuals covered through their insurance plans.

Specified Disease Coverage

Sometimes you are able to purchase insurance that explicitly covers one disease. For example, if your family has a history of breast cancer, it may be possible to get a specific breast cancer health insurance policy supplement.

These specific disease supplements generally emphasis preventative care and early testing. This helps catch the disease early which both improves survival rates and reduces total cost. Having specific disease coverage can reduce premiums on your primary insurance coverage. This is because it lowers the risk that your primary insurer will need to cover issues from that particular costly disease.

Why Health Insurance Is So Expensive?

For insurance companies, their ability to operate successfully comes from collecting more money in premiums and fees than they need to pay out in expenses. For individuals, they want to feel that the money they pay in premiums and fees will provide the coverage they need. When balancing these two parties’ needs, determining the “right cost” is key. How much to charge and how much to pay are questions that get re-evaluated on a regular basis.

Healthcare emergencies are often extremely expensive, and sometimes the needed care drags on for a very long time, accumulating hundreds of thousands of dollars in medical bills. This means even if your personal risk of having a medical emergency is fairly low, the potential cost for the insurance provider is extremely high. This is the main reason why health insurance policies are so expensive. The company needs to plan for potential costs. But there are a few other factors that contribute to rising costs as well.

The Self-Selection Problem

In the past, health insurance was not mandated for all citizens. Most people were insured through the companies they worked for or were covered by public insurance. Those who were not covered by these options could decide if they would purchase individual medical insurance or remain uninsured. They could self-select to be insured or not.

Because medical insurance is so expensive, it meant that most of the people who enrolled on their own were people at high risk of having medical problems. This increased the likelihood that the insurance company would have to pay claims for a higher-risk individual, and this probability caused the rate of premiums to increase. Preventing this “self-selection” problem is the main reason why health insurance is now mandatory in the U.S. Having more low-risk individuals in the insurance pool should lower the average premium.

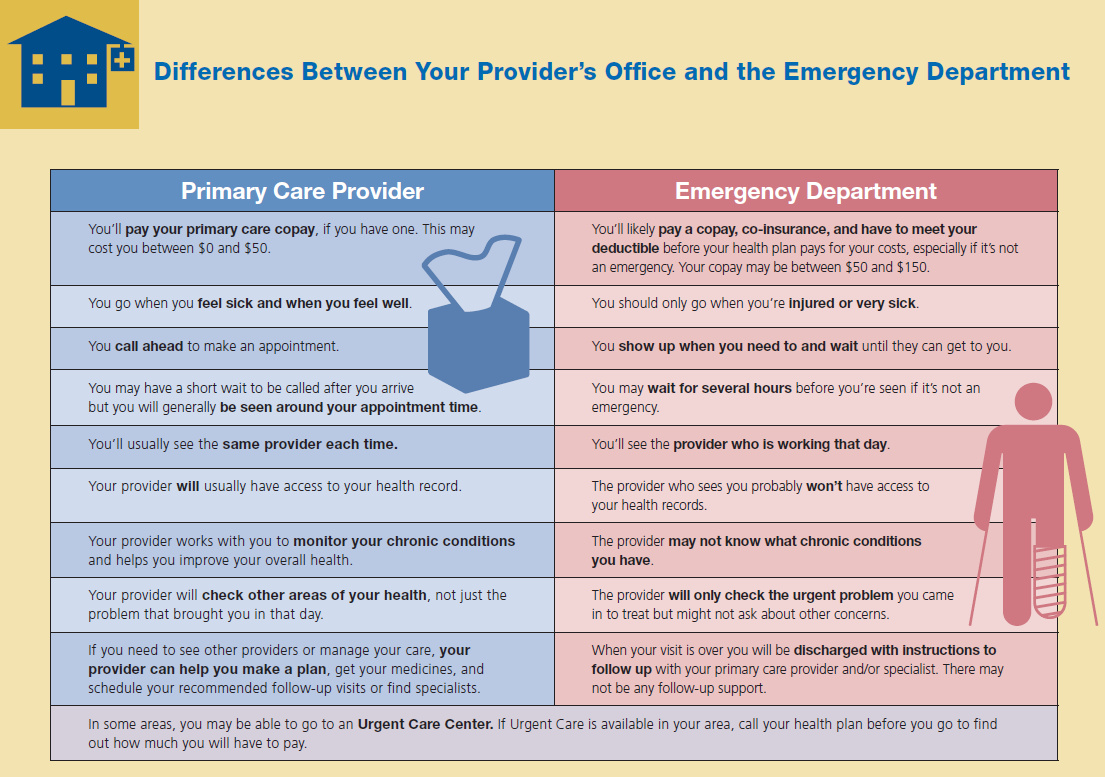

The Emergency Room Problem

In the United States, emergency rooms are required to treat every patient who arrives. Insured and uninsured individuals can get seen and treated there. However, people may not know that getting treatment at the emergency room is by far the most expensive way to receive medical care. Because ER doctors cannot turn anyone away, this means that an uninsured person with little savings and a chronic medical problem can use the emergency room to receive the treatment he needs. The emergency room provides the treatment, but who will pay the bill?

The cost of providing medical care does not evaporate if the person is unable to pay the bill. Instead, the cost gets redistributed among all the other patients at a hospital who are able to pay. This means the cost of every other type of care at the hospital goes up. This is why you may have heard infamous stories such as the $15 hospital Tylenol or experienced extremely high costs for your own emergency room visit. This financial dilemma causes a loop. As the cost of other treatments goes up, more individuals who are uninsured find it difficult to pay their emergency room bills, pushing treatment costs even higher.

Most people with insurance do not need to worry much about these costs. Insurance companies usually negotiate directly with the hospitals to force these costs back down. The government pays for people with public insurance coverage, but they do not usually negotiate prices as much as private insurance companies do.

The Regulation Stability Problem

You may have heard about some of the major changes that have been discussed by Congress over the last couple of years regarding health care in the United States. Usually those discussions center around how much insurance will be subsidized, what levels of care are mandatory, and how many people might be covered by public insurance programs. For health insurance companies, all of these changes create problems to be addressed. For example, it makes it difficult to engage in long-term planning regarding premium costs for current customers when the government is enforcing changes in the industry.

When insurance regulations are being rewritten and reformed, the fee structure becomes unstable. Health insurance companies often raise their premiums to protect against big changes in their insurance pool, the group of people covered. For example, the government currently provides a subsidy to encourage insurance companies to cover more low-income families. If health insurance providers hear that Congress is considering removing the subsidy at some point in the next few years, it is probable that these low-income families could drop out of the insurance pool, raising the insurance company’s average cost. The insurance company would also lose revenue, since they would no longer be receiving the subsidy. To protect against this potential change in the future, they raise premiums slightly in the short term to act as a buffer.

Get PersonalFinanceLab

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Learn More[qsm quiz=127]

Challenge Questions

- In your opinion, is it worth having Health insurance?

- Using examples, explain what a deductible is.

- What is the opportunity cost when considering whether you should have Health insurance or not?

- How do insurance companies calculate the premium they will charge people for their insurance policies?