Short-term financing means taking out a loan to make a purchase, usually with a loan term of less than one year. There are many different types of short-term financing, the most common of which are “Buy Now, Pay Later,” “Unsecured Personal Loans,” and “Payday Loans.”

Short-Term Financing vs Credit Cards

Short-term financing has terms similar to credit cards. It usually includes a grace period, a set interest rate, and monthly minimum payments.

The biggest difference is that credit cards operate on revolving credit. This means as you pay down your outstanding balance, you can continue using your credit card. In fact, your credit card company loves when you keep an outstanding balance because you will continually pay them interest. This is how credit card companies make their money.

In contrast, short-term financing is usually used for one specific purchase or for one single sum of money which is then expected to be paid off over a fairly short period of time. As a borrower, you probably would not be using the same source of short-term financing more than once or twice. If you do, this should be a red flag for how you are managing your finances.

Types of Short Term Financing

There are three major types of short-term financing – Buy Now, Pay Later, Unsecured Personal Loans, and Payday Loans.

Buy Now, Pay Later

Many stores offer Buy Now, Pay Later loans, both in person and online. With this type of financing, you can typically walk out of the store with your purchase immediately, then pay for it later either through installments or through monthly payments that begin after a set period of time. These loans can be attractive if you are low on cash since they allow for instant gratification.

How do they work?

Like credit cards, many of these loans include a “grace period” that allows you to pay the balance in full before any interest is charged. This is typically a main selling point for companies since “No payments for 3 months!” sounds great to consumers.

At the end of the grace period, you will be charged interest for the full grace period, and you will be required to make minimum monthly payments until the loan is paid in full. The main difference between this type of financing and using a credit card is that the grace period is typically longer, sometimes three to six months, and you will be expected to pay off the full amount of the loan after a set period of time. You are not able to maintain a “revolving balance” like you can with a credit card. Note: Some companies waive the interest charge in the grace period as well advertising something like “No payments and no interest for 30 days.”

Should I use these loans?

If a seller is offering you this type of financing, they generally are making money on selling the item you are buying, not from the interest on the loan itself. For them, it is okay if you pay off the full amount within the grace period because then they don’t have to worry about collecting monthly payments from you. However, they also know that the longer it takes you to pay, the more interest they are receiving from the payment of your loan.

If you don’t pay off the loan during the grace period, your interest charges will add up faster than if you made the same purchase with a credit card. This is because with a credit card, you have a shorter grace period, so you begin paying down the loan faster. With a longer grace period, interest is able to build up on the full loan amount for a longer period of time, so you end up paying more in the long run.

Buy Now, Pay Later loans are usually advertised to buyers who have low or bad credit and who may not have any other means of financing available. The bottom line is that if you are choosing between buying something with your credit card or using “Buy Now, Pay Later,” you will probably be better off using your credit card.

Unsecured Personal Loans

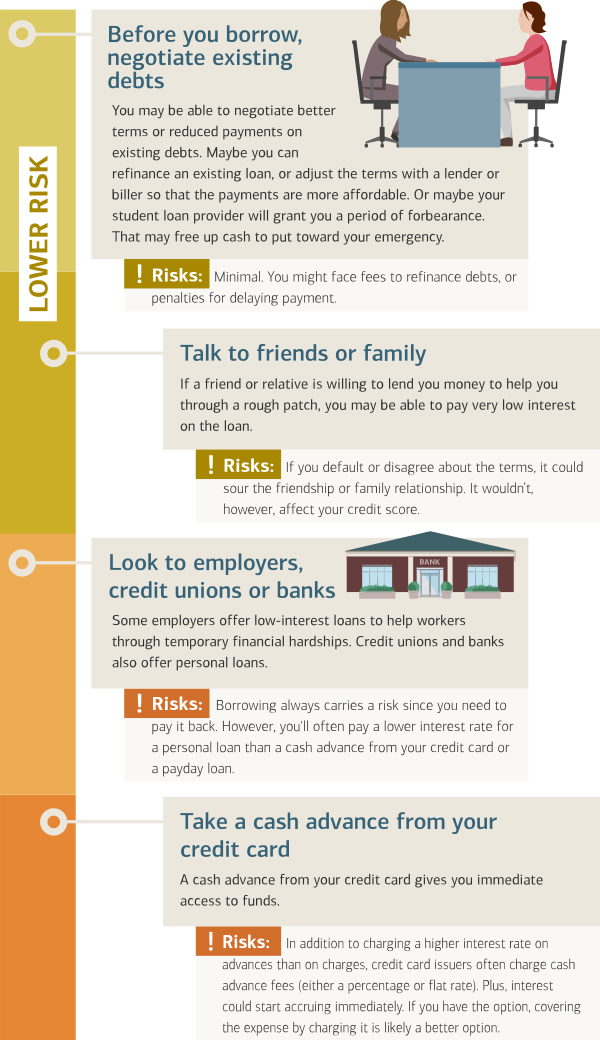

Unsecured Personal Loans refer to any loan you take out without providing collateral. In fact, credit cards are one type of unsecured personal loans. You can also go to your bank or another financial institution for a one-time unsecured personal loan. This works similarly to taking a cash advance from your credit card.

How do they work?

Receiving an unsecured personal loan is fairly straightforward. You go to your bank or any other lender and ask for a short-term line of credit. You will typically be approved for a set credit line, say $5,000, based on your credit history and income.

This type of short-term financing is most common for emergencies and unplanned expenses, such as car repairs or medical bills. These types of loans typically have a shorter grace period, about the same or less than a credit card. The interest rate varies, but is typically about the same or higher than for a credit card.

Should I use these loans?

Taking a short-term unsecured loan is usually not an easy choice to make because you will most likely be faced with them during times of emergency for expenses higher than your credit card limit allows. If you can, you will usually be better off putting these purchases on your credit card, which may have a longer grace period at a lower interest rate.

If the amount you need to borrow is higher than your credit card’s credit limit, try first to borrow money from friends and family or to get an unsecured loan from a commercial bank, credit union, or savings & loan. If you are tempted to work with an alternative creditor, beware. The more the creditor advertises that they work with people with low or bad credit, the worse deal you will probably get.

Payday Loans

Payday loans are the riskiest type of loan you can take. These loans are typically offered as a “bridge” between an expense (such as rent) and your next paycheck, usually with term lengths of less than 1 month. These loans can be either unsecured or secured. Secured payday loans typically require a car title as collateral. This means that if you fail to pay back the payday loan, your car could be seized and auctioned off to pay for your debt.

These loans include extremely high interest rates (often over 1000% APR) and little to no grace period. In theory, you could pay a very small finance charge if you take out the loan and immediately repay it within the next week or two, but over 80% of payday loans get “rolled over” into the next period. Rolling over a payday loan is what happens if you cannot repay the full amount on or before the due date, usually within 2 weeks (when you’d receive your next paycheck). Payday loan offices make most of their money on these rollover finance charges which are typically $15 to $20 for every $100 borrowed.

Here’s how you could be trapped in a payday loan cycle. If you take out a $500 payday loan with a 2-week repayment date and a $50 finance charge, you would need to pay $550 in 2 weeks. If you cannot pay the $550 and have to roll over the loan for another 2 weeks, you would be charged the interest again, another $50. So now you owe $600. This loan went from a 10% interest rate to a 20% interest rate in one month, and the interest owed piles up fast.

Should I use these loans?

NO! From a personal finance perspective, it is never a good idea to use payday loans. If you think you need a loan in order to make your rent or utilities payment, just talk with your landlord or utility company. They will almost certainly charge you less in late fees than you would pay in interest on a payday loan.

Payday loan offices appear most often in communities with a shortage of commercial banks, credit unions, and savings & loan institutions. This means that those communities are often cut off from unsecured loan options, leaving payday loan offices as the only source of short-term credit for emergencies.

If you ever find yourself in a situation where a payday loan seems to be your only option, remember this: From a personal finance perspective, you are almost certainly better off missing the payment entirely than taking a payday loan.

Try It

Try matching the characteristics to each loan type:

Short Term Financing – The Bottom Line

At the end of the day, if you need short-term financing, your best bet will probably be your credit card instead of any of these methods. If you do have an urgent expense that your credit card cannot cover, see if your bank can help or talk to friends and family. If you want to keep your personal finances healthy, avoid Buy Now, Pay Later schemes and Payday Loans entirely.

Get PersonalFinanceLab

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Learn More[qsm quiz=98]

Challenge Questions

- In your own words, explain with examples what short term financing is.

- How are credit cards and payday loan similar?

- How can missing a payment on your credit card or loan be a problem for you?

- How might buying something when you can outright afford it without the need for credit help you with your finances?