Definition

Spot and Futures contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the current date. The price is determined when the agreement is made.

The only difference between spots and futures is the delivery date. The current date is used for spots and a later date is used for futures.

Just like futures, spots frequently settle in cash instead of actual physical delivery of the asset traded but with some small differences.

Why use Spots?

Spots were originally created to buy and sell commodities such as wheat, currencies, gold, etc and then you would own those assets.

Spots can also, just like futures, be traded without physical delivery. You can buy a contract for wheat at $1 and then sell that contract when the spot price of wheat is higher to make a profit.

Trading currency spot contracts is a form of Forex trading.

Example

Two different trades buy gold at a spot price of $1000. The first trader decides to take delivery and receives the specified amount of gold in his contract at the price of $1000 which is delivered in the next few days. The first trader then puts his physical gold in his vault and holds on to it for five years and then sells his physical gold in the market at a given price.

The second trader holds on to his contract for five years and instead sells his contract at a given price.

Both traders will make a profit or loss depending on the price on that given day. However, the second trader that simply kept his spot contract will have had lower costs since he only traded through his broker. On the other hand, the first broker had to be able to store his gold, with a safe or other, and then physically sell his gold. We can see that in the example of wheat, this would not be a good idea as the wheat would probably have spoiled after five years.

This illustrates a key point in spot trading. It is possible to trade spot contracts for various prices but they can also be used for immediate delivery of the underlying asset. The easiest to understand is currency trade as that can be done through the banking system with “electronic” delivery of the currency bought.

Simulator Spot Trading

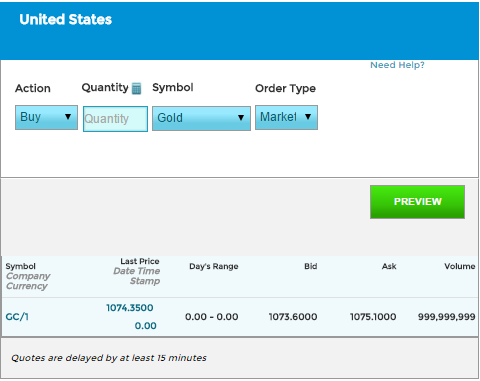

Spots are very easy to trade (if your contest allows it). Simply choose the action like you would with a stock, select the quantity and the spot you wish to trade from the dropdown from the Spots trading page.

Trading Details

There are a few things to note with spot contracts:

Types

There are 3 major types of spots, all of which will be in the same drop-down menu:

- Currencies, like Euros or Australian Dollars (purchased at the current exchange rate, like Forex)

- “Durable” commodities (like gold, silver, and oil)

- “Soft” commodities (like wheat, corn, and soybeans)

Not everything you can trade as a future will be available as a spot (for example, we have Cocoa futures, but not Cocoa spots). In real life, taking delivery of soft spots can be risky, since they can spoil, but you can’t take delivery here so that won’t be a problem.

Order Types

We only support market orders for Spot contracts

Quote Details

Unlike a stock, the quote for a Spot is very different. We will only show the last price, bid, and ask. We do not show the day’s trading range, and we set functionally infinite volume (you can buy as much of a spot as you can afford)

Pop Quiz

[qsm quiz=60]