Stock Trak – Week 1 Assignment

You are a portfolio manager at a private bank and have recently been assigned three new Naples based clients.

- Martha is 30 years old. She is a single parent and recently inherited a large sum of money. She is looking to buy a home in three years or less, save for her daughter’s college, plan for retirement.

- Keith and Debbie are both 45 years old, married, with two children. They both work and have retirement plans but don’t know anything about them at all. They are concerned about future college expenses and retirement.

- Bernie is 68 years old. He has been retired for 4 years. He owns his home outright (i.e., no mortgage).

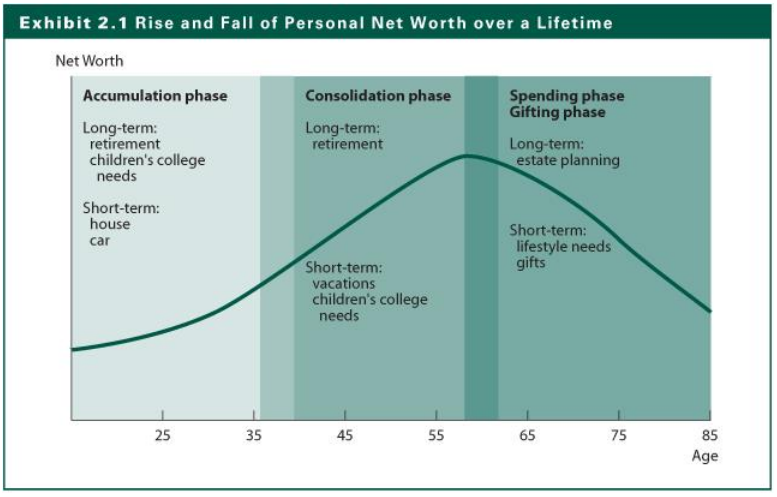

- Using Exhibit 2.1 of the text (page 35 or see below), create three portfolios suitable for each client. Each portfolio has a value equal to $500,000. The clients only want to invest in US assets.

Required Paper Discussion:

- Describe each of the clients, their needs and objectives.

- Describe why you chose the assets in the portfolio.

- How did you decide the amounts to invest into each asset?

- During this first week, you must make at least two trades/position adjustments. You are not constrained to the minimum number of trades. Describe what you traded, why and the portfolio results.

- How often do you expect to trade in each of the accounts?

Stock Trak – Week 2 Assignment

Changing the portfolio

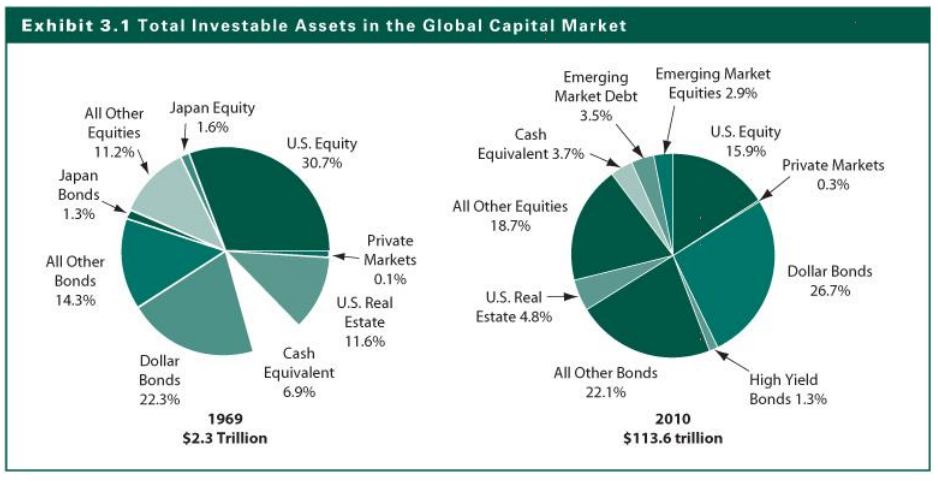

Martha was looking at textbooks in the Hodges University bookstore. She came across the Investment Analysis and Portfolio Management book we use in class. In particular, Exhibit 3.1 caught her attention.

Martha has decided that she wants to change her portfolio around some.

- First, she wants a global portfolio. You know, “the US is sort of small.”

- Second, I want active management because “I hear that a good portfolio manager can make me money. And you’re good, right?”

- So you must actively trade her portfolio during the rest of the term. Martha’s expected portfolio turnover is 30% per week.

- You are not allowed to sell something and then buy it back that same week. You must sell and buy different assets.

- You are allowed to sell something one week and buy it again if more than one week of trading has passed.

To help you find some ETFs, in addition to Stock Trak, you might look at: http://etfdb.com/types/ Stock Trak – Weeks 3, 4, 5, 6 Assignment EVERY WEEK for Martha’s portfolio:

- Present a summary log of the trades you did.

- Portfolio Values: Current, Last week, Weekly change, and Inception to Date Change (ITD).

- A short discussion on all the trades you did, what and why you traded.

Additional Rules:

- Ensure that Martha’s portfolio has a 30% WEEKLY turnover

- You are not allowed to sell something and then buy it back that same week. You must sell and buy different assets.

- You are allowed to sell something one week and buy it again if more than one week of trading has passed.

- For ETF’s, you might refer to: http://etfdb.com/types/

Example:

Martha: Current value = $XXX Last Week Value = $YYY Weekly Change = $$$$ and HPY ITD = HPY

Trades: what you bought and sold, INCLUDE Dates and Prices

(Note: Sum Total of Buys must equal 30% of the prior week’s value at a minimum.)

Short story – on why you did the above

Using the closing prices for Friday Oct 21, 2016 – do your final calculations.

Review the performance of the portfolio. Show:

- At the top of the paper, include a table that shows:

- Total Portfolio Value

- Total Portfolio Return

- Total Number of Trades

- Sharpe (available on Stock Trak)

- Alpha and Beta (available on Stock Trak)

- Discussion (i.e., essay):

- The SPY (S&P 500) closed on Sep 13 at 212.16.

- What was the closing value of SPY on Friday Oct 21?

- If Martha’s entire portfolio ($500,000) was invested into SPY at Sep 13’s closing value (price = 212.16), how many shares did she have? Do not include fractional shares.

- Assume the interest earned on this benchmark portfolio was zero. What is the SPY portfolio worth as of Friday’s close?

- How does your portfolio compare to that?

- Using the values from Stock Trak for Sharpe, Alpha and Beta FOR YOUR PORTFOLIO –

- Discuss what those values mean.

- Using this information, what can you say/extrapolate about your portfolio risk and return?

- Discuss your portfolio’s performance

- Lessons learned

- Include references when appropriate.