In today’s complex financial landscape, Arizona teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Arkansas teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Meeting Arkansas Personal Read More…

In today’s complex financial landscape, California teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Colorado teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Delaware teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Florida teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Georgia teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Idaho teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Illinois teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Indiana teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Iowa teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Kentucky teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Louisiana teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Maine teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Maryland teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Massachusetts teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Michigan teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Minnesota teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Mississippi teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Missouri teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Nebraska teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Nevada teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, New Jersey teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…

In today’s complex financial landscape, New York teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…

In today’s complex financial landscape, North Carolina teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…

In today’s complex financial landscape, Ohio teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Oklahoma teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Pennsylvania teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Rhode Island teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…

In today’s complex financial landscape, South Carolina teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…

In today’s complex financial landscape, Tennessee teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Texas teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Meeting Texas Financial Read More…

In today’s complex financial landscape, Utah teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Washington teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, Virginia teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

In today’s complex financial landscape, West Virginia teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on Read More…

In today’s complex financial landscape, Wisconsin teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

New Career as a Finance Teacher “I’ve been passionate about finance my entire life; I’ve been working in it in some fashion for 27 years,” Mason Renfer said at the beginning of our interview. He was nominated by his students and won the “Nominate Your Teacher” Award in the Fall 2024 Financial Literacy Challenge on Read More…

In today’s complex financial landscape, Alabama teachers have a unique opportunity to shape the financial futures of their students, and it starts with providing them with the right resources to learn. PersonalFinanceLab was designed to engage your students with hands-on learning experiences, making complex financial concepts more accessible and fun to learn. Click on the Read More…

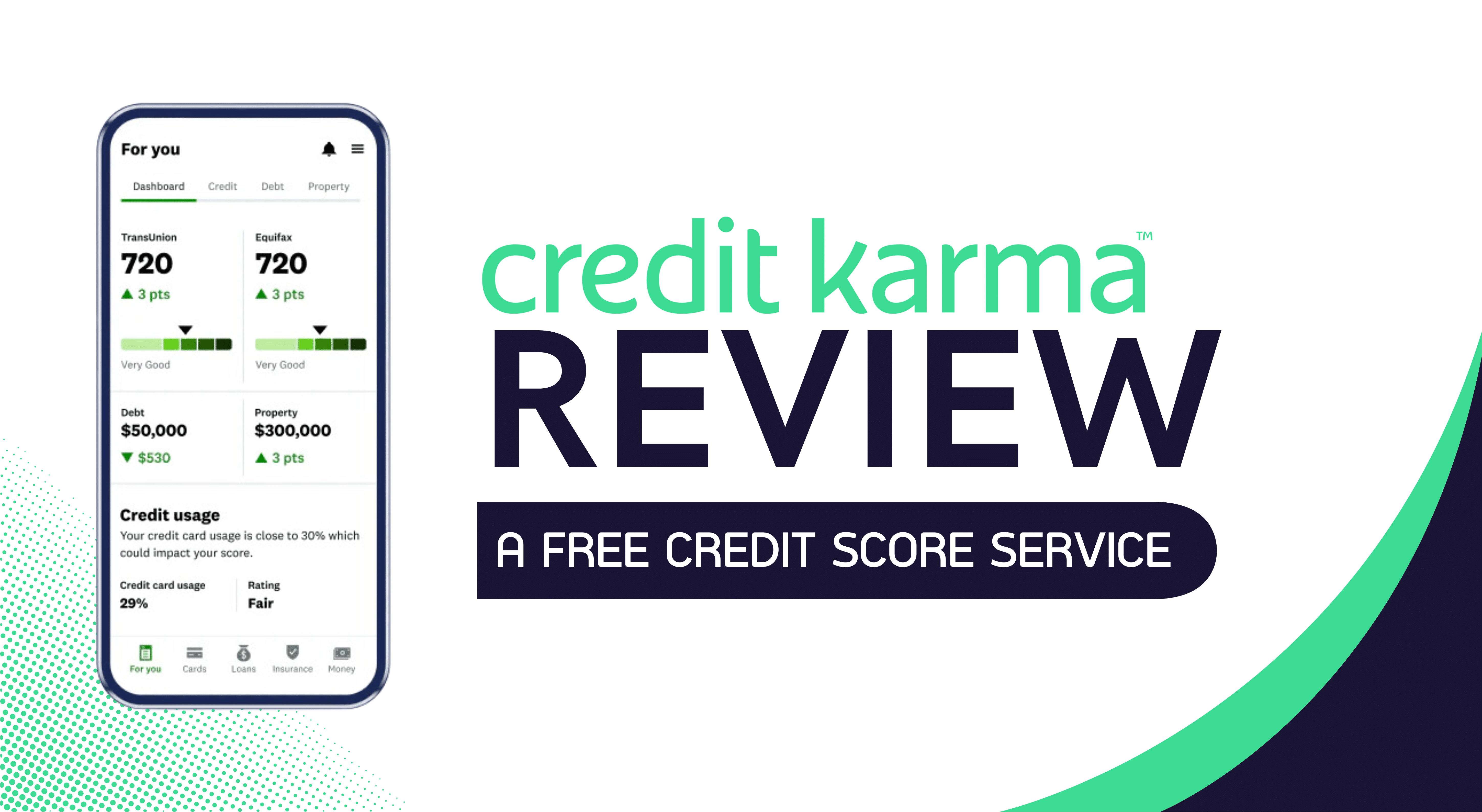

Credit Karma is a popular online platform that offers free credit scores and reports from Equifax and TransUnion, two of the three major consumer credit bureaus. With over 100 million users, Credit Karma has become a go-to destination for individuals seeking to monitor and improve their credit health. In this review, we’ll dive into the Read More…

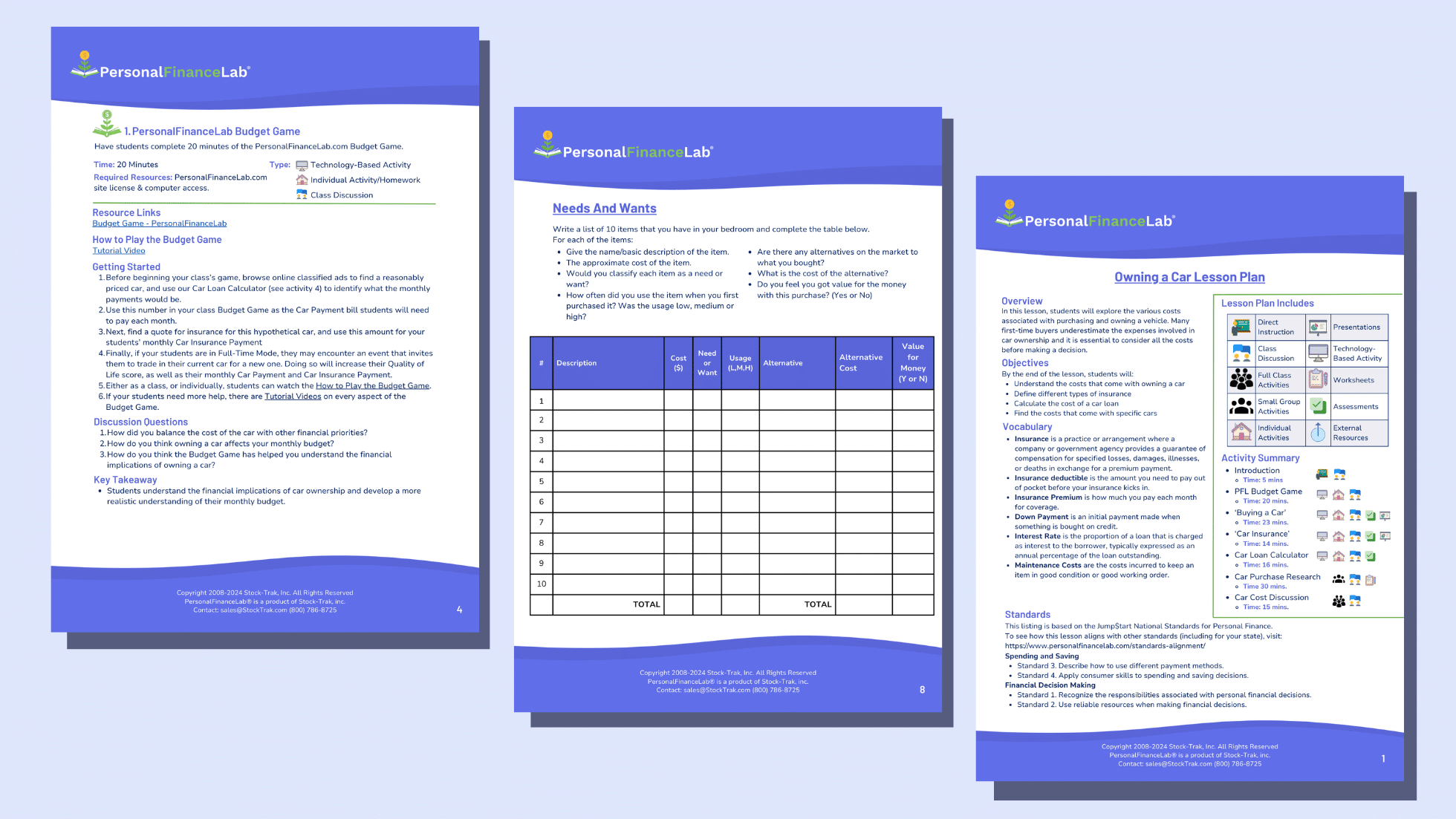

To help teachers make the most of our interactive games and self-grading lessons, the PersonalFinanceLab team has updated our personal finance lesson plans. As part of this update, we’ve refreshed our content to reflect the latest trends and best practices in financial education. Each lesson plan includes: In each lesson plan we’ve included individual as Read More…

In this presentation, students learn the difference between nominal and real interest rates, how to measure inflation and impact of inflation on the economy. Students are introduced to concepts like hyperinflation and deflation, and how inflation can encourage economic growth. Click Here to download this presentation in Google Drive Click Here to download this presentation Read More…

This presentation explains the reserve banking system and how banks create money through loans. Students are introduced to reserve requirements and currency backing. Click Here to download this presentation in Google Drive Click Here to download this presentation as a PowerPoint

This presentation explains how stock markets find an equilibrium between the buyers (demand) and sellers (supply) of stocks. Students will be introduced to consumer and producer surpluses. Click Here to download this presentation in Google Drive Click Here to download this presentation as a PowerPoint

This presentation introduces students to the central banking system of the United States, the Federal Reserve. They will learn its objectives and functions and why it operates independently. This presentation is best followed by the Monetary Policy Presentation. Click Here To Copy This Presentation in Google Drive Click Here to download this presentation as a Read More…

This presentation examines the costs and benefits of different economic decisions (trade-offs). It defines key terms like supply and demand, market outcomes, resource allocation and different allocation methods. Students will learn about the pros and cons of wealth redistribution, and different redistribution methods. Click Here To Copy This Presentation in Google Drive Click Here to Read More…

This presentation explains how the Federal Reserve uses monetary policy tools like interest rates, bond buying (quantitative easing QE) and managing the money supply to encourage economic growth and control inflation. This presentation is best used after the Federal Reserve Presentation. Click Here To Copy This Presentation in Google Drive Click Here to download this Read More…

This presentation explains how stock prices are determined by the company’s financial performance, market trends, investor sentiment, and economic conditions. Also, the Initial Public Offering (IPO) process is reviewed. The presentation also covers the key terminology for bonds including; the principal, coupon rate, maturity date and yield. It explains the mechanics of bond trading and Read More…

This presentation explains the functions of money: as a medium of exchange, a unit of account and a store of value. It includes the 3-item test of Bitcoin and gold to assess whether they perform all these functions. Click Here To Copy This Presentation in Google Drive Click Here to download this presentation as a Read More…

This presentation provides a brief overview of the benefits and negatives of competition in a free market economy. Key concepts are defined such as the profit motive, externalities, the role of innovation, monopolies, cartels, and real vs artificial barriers to competition. Click Here To Copy This Presentation in Google Drive Click Here to download this Read More…