Time To Read:

Interview with Leesa Hudak, a High School Finance and Economics Teacher at Bow High School in New Hampshire.

Overview

In this case study, we explore how a high school teacher the PersonalFinanceLab Stock Game to deepen financial literacy and economic understanding across multiple classes, ranging from introductory finance to advanced investing. Through long-term simulations, student-created rules, and differentiated assignments, students not only engage with real-world market trends, but also build analytical and critical thinking skills.

Implementation

Leesa creates separate simulations for each subject she teaches, one for basic personal finance, another for finance classes, and another for economics. Each simulation is tailored to fit the course content and classroom expectations, with different rules and levels of required activity. While many of her students are in semester-based courses, she adjusts participation accordingly, sometimes removing students at the semester break or allowing them to continue through the full year. “It’s fun for them to compete against more than just the students in their classroom,” she explained.

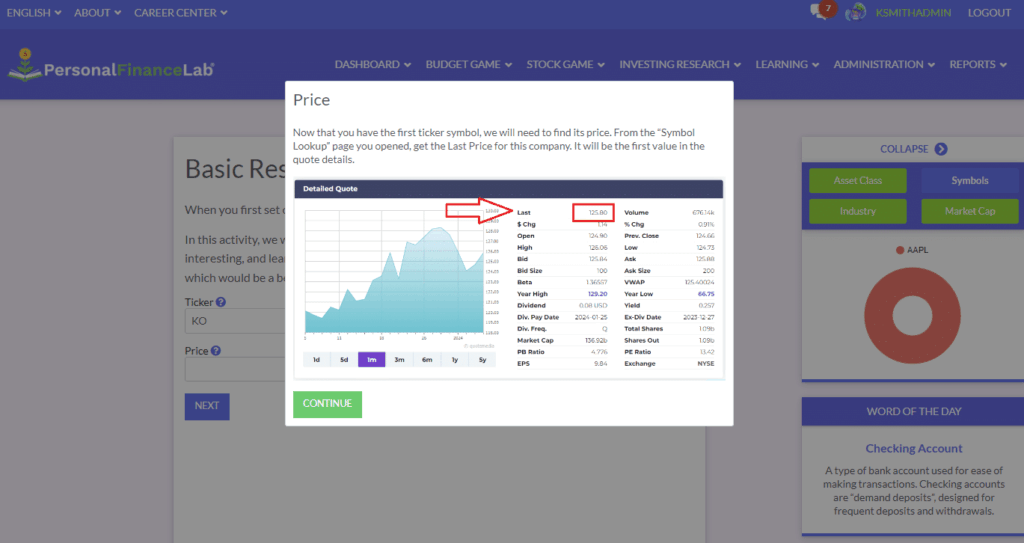

To help students get started, Leesa incorporates the Stock Comparison Tool as a key class activity. This tool allows students to research and compare companies side-by-side, making it easier to decide where to invest their initial funds. All students must invest in a minimum of five companies, a requirement that sparks discussions about diversification and exploring different economic sectors.

Introductory and Econ Classes

In introductory personal finance classes (Money Matters and Personal Finance I), the setup is simple:

- Students must purchase at least five companies.

- They can’t invest more than $500 in any one stock.

- Fractional shares are allowed.

- The focus is on understanding diversification and “buying what you know.”

To help students get started, Leesa leads a classroom activity where students list every product they used that day, then categorize those into sectors. This generates ideas for portfolio picks based on familiar brands and behaviors.

In economics classes, the stock simulation is used lightly. While it’s not a core focus, she occasionally incorporates major economic events into class discussions, such as Fed meetings or tariff news, and helps students connect those events to their portfolios.

Advanced Finance and Investing Courses

For more advanced classes, like Finance I, Finance II, and a dedicated Stock Market & Investing course (all with an introductory personal finance class as a prerequisite), Leesa creates separate sessions with more complex rules. In these, she enables advanced settings like:

- Weekly cash deposits (a popular feature with students)

- Limits on cash holdings (students must keep cash under $2,000)

- Diversification limits (no single stock can exceed 25–30% of the portfolio)

One key project required students to develop their own investing philosophy before making any trades. She prompted them to consider questions like, “What are you looking for in a stock? What makes you choose one over another?”

Student Engagement & Rule-Making

A standout feature of Leesa’s investing classes is that students help create the rules. She proposes the overall project structure, then lets students decide on detailed guidelines, like portfolio balance rules and performance benchmarks.

“We picked the S&P 500 as our index and gave a 3% grace. If their portfolio finishes within 3% of the S&P, they get full credit on one of the components of the project. If they beat the S&P, they can earn additional points. So they’re really paying attention to that index.” Leesa explained.

Weekly trading is a required component, and students submit short weekly updates. These updates not only describe their trades but also reflect on portfolio performance and link it back to economic trends or individual strategies. These reflections prepare students for a final presentation at the end of the semester.

Classroom Tools and Features Used

- Widgets and Rankings: Students don’t usually see each other’s portfolios directly (by choice—it’s “a little cut-throat,” Leesa noted), but they do love checking the leaderboard and celebrating top performers during weekly class sessions.

- Ticker Tape in Class: Leesa recently added a live market ticker to her classroom, which has sparked more interest and daily engagement.

- Admin Tools: She makes use of the “User Summary Report” to monitor students’ weekly trading and cash balances.

Conclusion

Leesa emphasized that giving students ownership of the rules dramatically increases their engagement, especially in advanced classes.

For entry-level students, she finds that tangible dollar amounts (like $1,000) might be more meaningful than traditional starting points like $100,000. However, the flexibility to buy high-priced stocks or fractional shares helps balance realism with opportunity.

She does not assign PersonalFinanceLab’s built-in trading notes for most students. Instead, she uses custom weekly updates, especially in advanced classes, where they tie into final projects.

Her students greatly enjoy the competition, and it’s clear that the real-world application of concepts through PersonalFinanceLab has deepened both their engagement and understanding of the stock market.

If you want to learn more about how Leesa structures her class stock game, you can find her Stock Portfolio Project and grading criteria in our companion blog post!