Our team has been busy this summer rolling out improvements to make teaching financial literacy and personal finance that much easier. Check out all the new features that will be available for this fall semester.

Budget Game

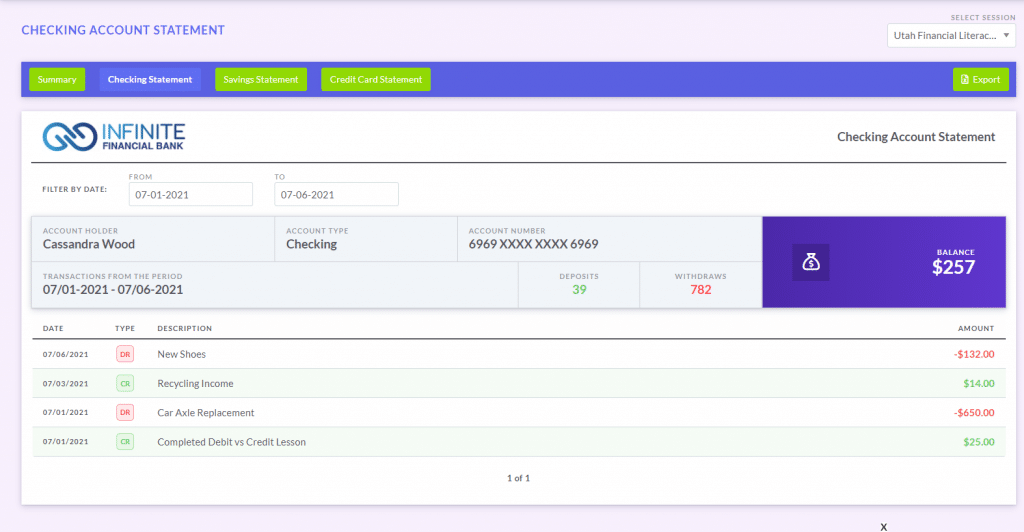

- Improved Bank and Credit Card Statements – student’s checking account, savings account, and credit card statements are new and improved to look like real online banking sites. You can see them yourself here!

- Summary Statements – brings all the relevant details for each student’s activities while on the site in one place for a birds-eye view of their financial health.

- Full-Time Mode Changes – the Budget Game has two game modes – a student with a part-time job, or a full-time worker who just started their first job. Both versions have a multitude of minor improvements, but the biggest difference is that paychecks are only distributed once every two weeks instead of weekly for full-time mode.

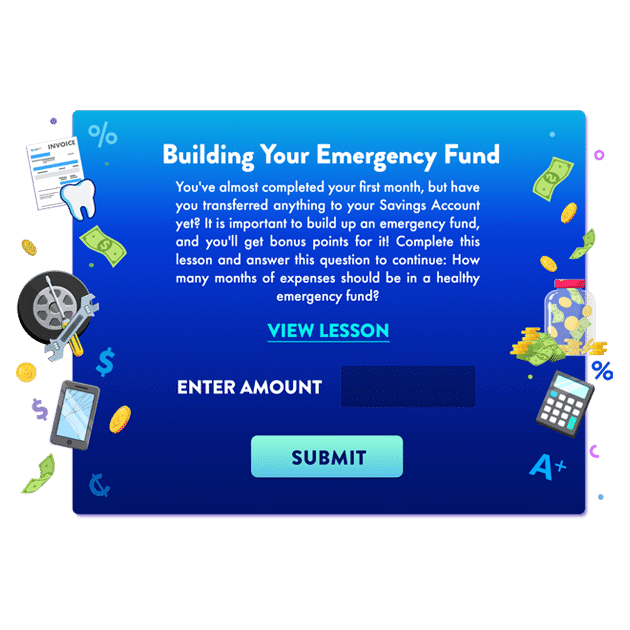

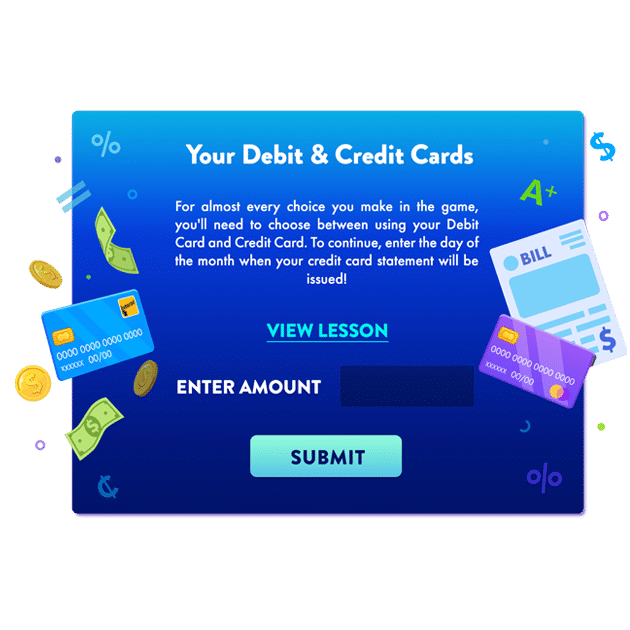

Better Graphics

Our graphic design team has been hard at work as well, adding new illustrations and graphics throughout the game to bring each scenario to life. Check out a sneak preview from the gallery below.

Advanced Assignment Tracking

- Time Tracking –you will now have the estimated time of completion for each lesson that you assign your students. This will give you a clear picture on how much time it will take to complete their work. We also are adding time tracking to each lesson, so you can see how much time each student in your class takes to finish each lesson and its accompanying assessment.

- Grade Tracking – previously our system would track the score students received on each assessment, but not their answers to each individual question. This update will give you question-level insights for each student. If you allow students to re-take the assessments associated with each lesson, you can see their answers from each attempt.

- Class Summary Statistics – this adds new class summary reporting, so you can see how long the average student in your class takes to complete each lesson, along with summary statistics on which individual questions in our assessments are frequently missed.

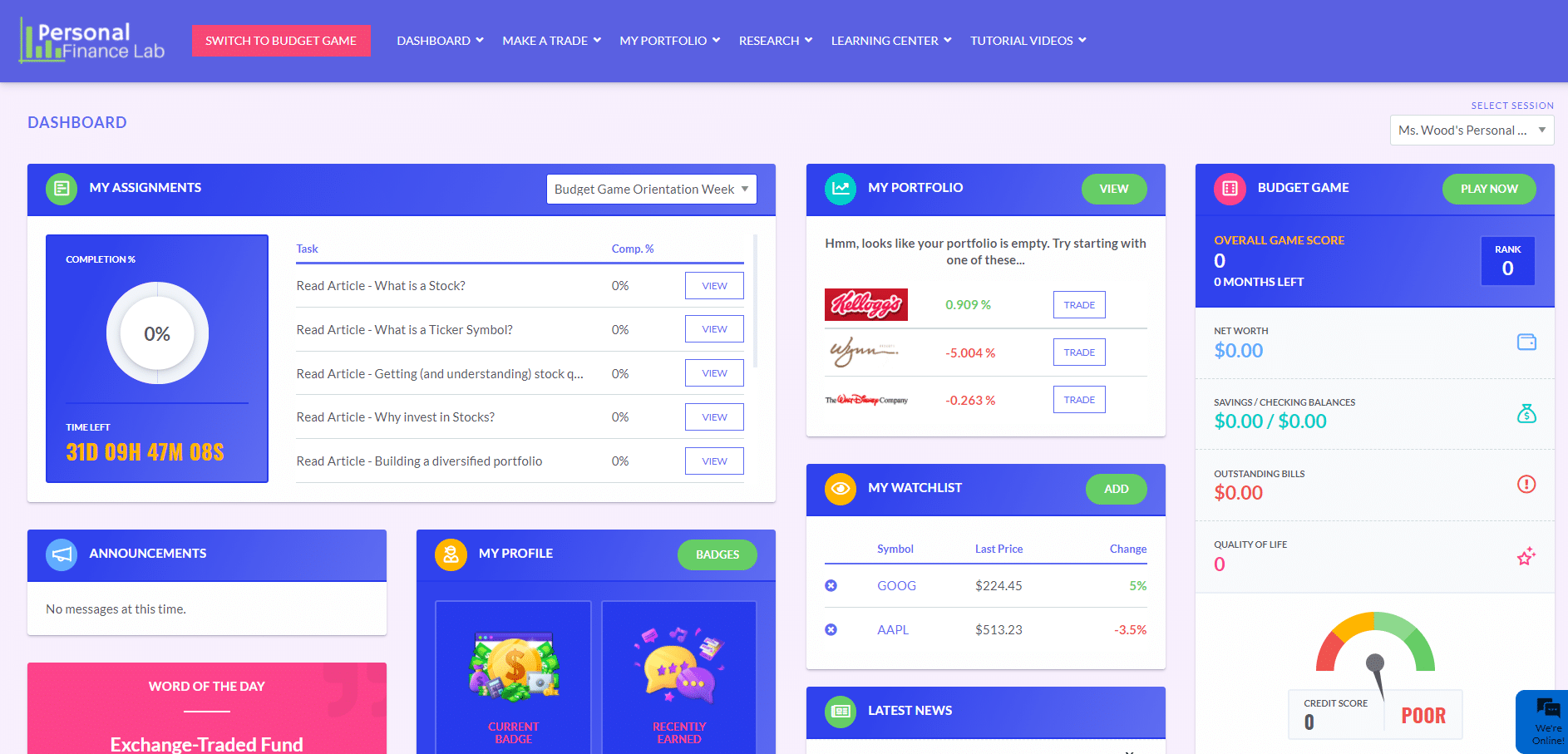

New Student Dashboard

We brought the student’s progress on your class Assignments front and center, so students are immediately greeted with what they need to focus on first.

If your class is utilizing our Budgeting Game, their current game progress comes up with a button to continue from where they left off. They’ll also see their open positions and a snapshot of their portfolio. If your class is not utilizing the budget game or assignments, this will appear right on top.

The new dashboard is the featured image for this post!

Financial Literacy Lesson Update

Investing101 Update

Our Investing 101 curriculum is a great refresher for students on the fundamentals of investing as well as an essential component to department-wide or campus-wide investing competitions to help promote financial literacy. Our 10-chapter, 100-lesson course has undergone a comprehensive overhaul in light of changing trends in the investing world since its first launch. Highlights to the update include:

- More and improved short video tutorials

- Enhanced introductions to each covered security type, what they fundamentally represent, and how they can be combined for specific investing objectives

- Complete revision of our chapters on Fundamental and Technical Analysis

- Both new and improved tutorials on utilizing stock screeners and making your first trade

- Improved focus on personal investing, including a discussion of tax advantages of “Buy and Hold” investing

- Revamped chapter on Current Hot Topics in Trading, including lessons on cryptocurrencies, short squeezes, and ESG investing

- Each chapter of Investing101 now includes two separate assessments – a short vocabulary quiz followed by a longer quiz on the substance of the chapter.

Financial Literacy Update

Our Financial Literacy lesson library has also received a major update. In addition to bringing our taxation lessons up-to-date with current tax policy and dozens of updates to our existing lessons, many new lessons have also been added. These include:

- Unit introduction on taxation

- Career development and the impact of different types of education

- Charities and including giving in a spending plan

- Simple and living wills

- Understanding apartment rental agreements and obligations

- Employer and employee rights and responsibilities

- Using spreadsheets to compare loan terms to see which is a better deal

- As with all of our lessons, each of our new lessons is bite-sized to take students 10 minutes or less, with an automatic assessment to check for understanding.

- Our financial literacy lessons are perfect for Personal Finance classes utilizing both our portfolio simulation and personal budgeting game, or an excellent supplement to any business or finance class to ensure your students have exposure to the essential skills they need after graduation.

Coming Soon…

Course outlines on budgeting, investing, credit and other financial literacy topics to make it that much easier to integrate our platform into your curriculum. Once all the materials have been prepared, we’ll have a separate announcement to help explain to teachers how they can integrate this in their classes.