PersonalFinanceLab is packed to the brim with Financial Literacy Resources for schools, with the cornerstone being our library of 300+ standards-aligned, customizable lessons built into our Assignments engine that teachers can leverage for their class. Most of our lessons take students less than 15 minutes to complete, with a 3-5 question, automatically-graded quiz at the end.

But if your students are playing our budgeting game, they may face financial decisions that have not yet been covered in class, or your class may want to focus just on the games without setting up a customized assignment. Even without building a full assignment for students to complete before playing, it would be great to make sure students are gaining the key take-aways of the financial topics the game is meant to crystalize.

Introducing Mini-Lessons

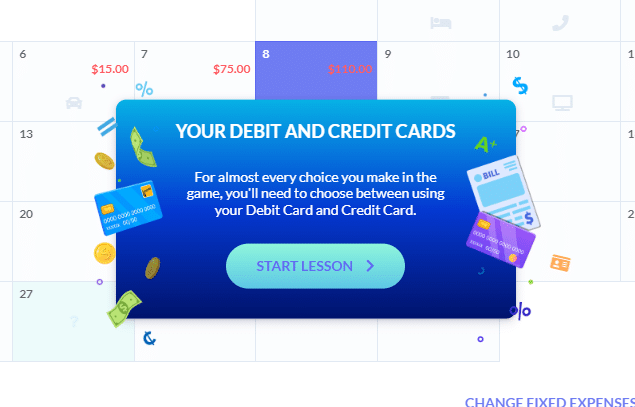

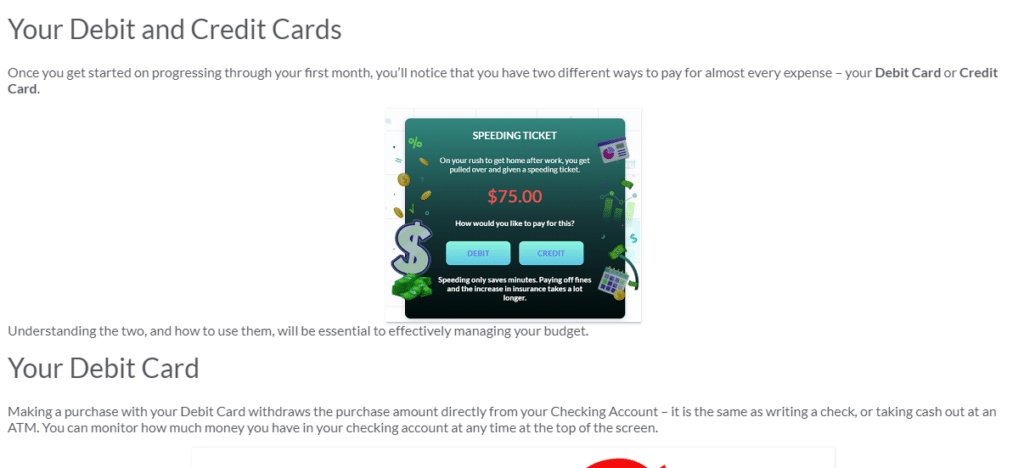

Mini-lessons are a key feature of PersonalFinanceLab’s Budget Game to help ensure students are familiar with the concepts they are practicing as they play. Mini-lessons pop up as a required event as students progress.

Unlike our full lessons as part of our Assignments tool, mini-lessons are designed to take students no more than 5 minutes to complete, consisting of a short article, video, or infographic, with a 1-question quiz at the end to verify they understand the key concept being presented.

For the first few months of the game, these mini-lessons are somewhat frequent, and cover essential concepts they need to be successful while playing (for example, the difference between a credit card and debit card). As the game progresses, the mini-lessons become less frequent, and cover a broader range of financial topics.

There is also a special mini-lesson that occurs on April 15 of every year – students need to complete a short lesson on Filing Taxes and the Form 1040.

Current Mini-Lessons

This is our current list of Mini-Lessons included in the Budget Game. Please note that this list is subject to change. At this time, all mini-lessons occur during the first 12 months of the game.

This list was last updated on December 28, 2023.

- Your Debit and Credit Cards

- Needs vs Wants

- Building Your Emergency Fund

- Budgeting and Estimating Expected Expenses

- More About Credit Cards

- Managing Your Bills

- Preparing For Spending Shocks

- Understanding Your Paycheck

- Writing A Check

- Net Worth

- Credit Reports

- Comparison Shopping

- Types of Insurance

- Opportunity Cost

- Financial Institutions

- Your Savings and Inflation

- Investing in Stocks

- Investing in Mutual Funds

- Investing in Bonds

- Mortgages: Facts and Fiction

- Filing Your Taxes

Disabling Mini-Lessons

If you want your students to complete the budgeting game without the mini-lessons (for example, if you are using the budgeting game as a capstone to your class and students are expected to already be familiar with these concepts), it is possible to disable mini-lessons by reaching out to our Support Team or your Account Manager.