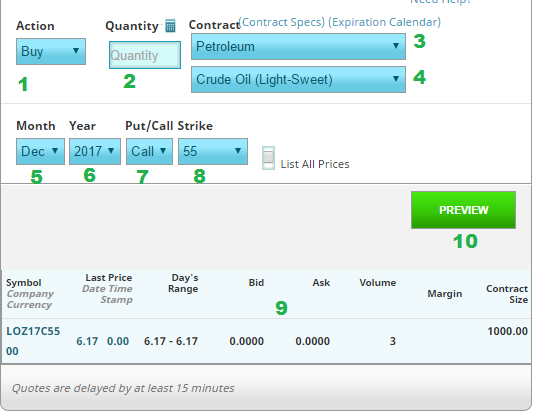

Trading Future Options acts like trading a normal option, but replacing the underlying stock with an underlying future. If your class or contest allows it, you can trade them from the [link url=”/trading/futureoptions” desc=”taradre”]Future Options Trading Page[/link].

Trading Pit

Parts of the trading pit:

- Action – Only “Buy” and “Sell” is available for future options (you cannot write a future option)

- Quantity – Remember, like stock options, your quantity will be magnified by the contract multiplier.

- Future Category – Indices, commodities, currencies and more. These are the same categories as the normal futures trading pit.

- Underlying Future – This is the specific currency, commodity, or other underlying future this option is based on.

- Contract Month – This is for the future contract itself, not the option

- Contract Year – This is for the future contract itself, not the option

- Call or Put – Select which type of option you want to trade

- Strike Price – The strike price here is 10x the quote price (for visibility)

- Quote – Note the “Volume” and “Contract Size”

- Preview Order

Future Options Trading Tips

Tip #1: Check the e-Mini!

It is already hard enough to find a full index future that has volume, finding a future option is nearly impossible. If you want to trade an index future option, make sure you choose the e-mini version of the underlying future.

Tip #2: No Expiration Selection

With a normal stock option, you can select the expiration date. This is because the underlying stock is not likely to go anywhere. On the other hand, all futures have a set expiration time. This means that almost all future options expire about 1 month before the future contract itself, so keep this in mind while trading.

Tip #3: Use Low Quantities

Futures each have a massive multiplier, and future options usually multiply that by another 1000. You can make or lose a fortune with a single future option with even small price swings. To curb your risk, only trade single-digits of future options, usually just one or two at a time. If you aren’t sure how much risk your portfolio can take, it might be a good idea to leave future options out entirely.