Calculating your buying power can be tricky, and it gets trickier with more complex contest rules. This will be a quick primer on how to see exactly how your buying power is calculated, what affects it, and how to recover it when you want to make more purchases.

What is Buying Power?

Your buying power is the money you have available to use to purchase securities. It is NOT your cash balance. A number of things can affect how much buying power you have, but the basic idea is that you might have cash you’ve already set aside for another purchase, you might have the ability to borrow money for trades, or you might have some of your buying power tied up in “Margin Requirements”. Each of these items will affect your buying power differently.

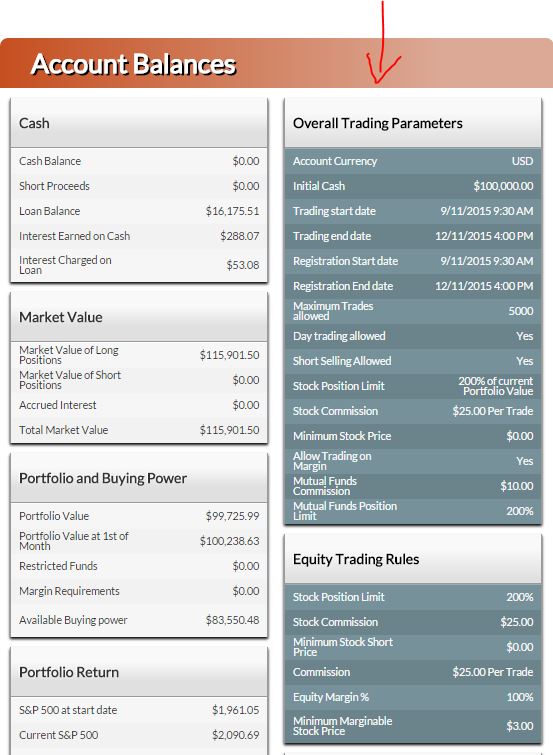

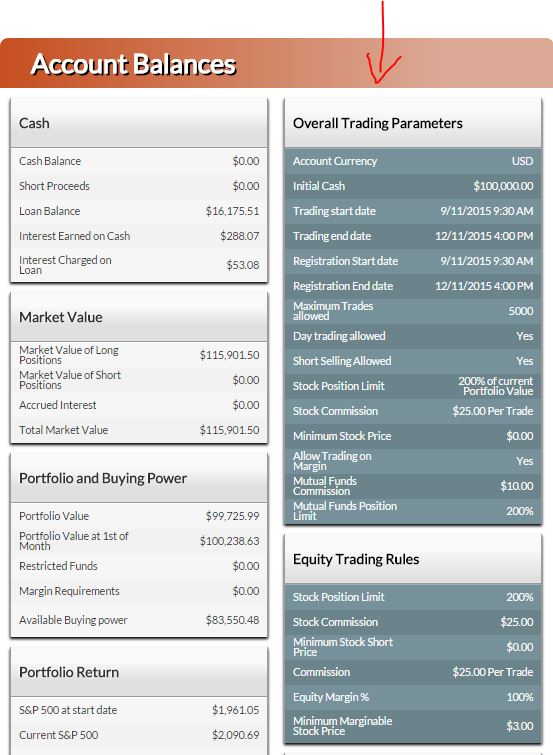

You can review the rules for your contest on your Account Balances page, on the right side:

Calculating Buying Power

The “complete” formula to calculate your buying power can be complex, depending on your contest rules, so we will start with the most simple forms and work towards the most complicated.

Contests With No Margin, Short Selling, Or Futures Trading

If your contest does not allow short selling or day trading, your buying power will be easy to calculate:

Buying Power = Cash – Open Orders

Your open orders are trades you’ve tried to place, but have not yet executed (for example, if you try to buy a stock while the markets are closed). If you have very low buying power, but lots of cash, chances are you have a big order sitting open. You can either wait for it to execute, or you can cancel the order to get your buying power back immediately.

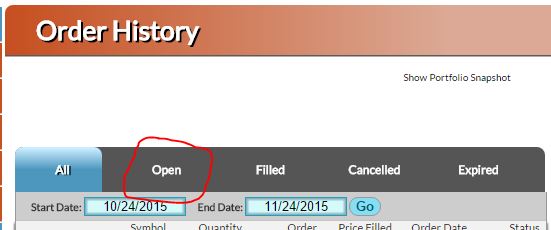

You can see open orders on your Order History page:

Common Reasons Orders Will Be Open:

- Orders placed after the markets close will not execute until the next morning when the markets open

- All mutual fund orders execute around 6:00 pm New York Time (if they are placed before the markets close, otherwise they will execute the next business day at 6:00 pm)

- You are trying to buy a security with very low volume – generally speaking, you can only buy as much of a security as trades in the actual markets (more or less, depending on your contest rules). This is especially relevant with Options trading, and penny stocks.

You can see the volume for the securities you’re trying to purchase on the Trading screen:

Contests With No Margin Or Futures Trading, But Allow Short Selling

If your contest allows short selling, the mechanics work a bit differently. When you short sell a stock, you get cash immediately after the short sale, but this cash is held in reserve (you can’t use it to buy stocks), along with enough cash to “cover” your short (since you need to be able to repay the stocks you short sold). Click Here To Read Our Article On Short Selling.

In real life, you cannot short sell without a margin account, but since we allow it here, this is the formula used to calculate your buying power:

Buying Power = Cash – Short Sale Price of Shorted Stocks – Market Value of Shorted Stocks

Contests With Margin Trading, But No Short Selling Or Futures

Margin trading changes how your buying power is calculated by quite a lot: the idea behind margin trading is that you can borrow money from your brokerage, using your stocks as collateral. This means you can spend more than your starting cash, but you’ll be charged interest on the amount you borrow (the default is 8% annual interest, but this can be changed by your contest creator).

Buying Power = (Cash x 2) + Market Value Of Securities Purchased With Cash

This means if you start with $100,000 starting cash, you’ll have $200,000 in buying power. If you spend all $100,000 in cash on stocks, you’ll be able to borrow an extra $100,000 using the stocks you bought as collateral.

Borrowing money on margin is automatic: once you use up all your cash, you will start buying on margin automatically if you keep trading. You can keep track of your loan balance on your Account Balances page.

Contests With Futures Trading, But No Margin or Short Selling

Futures trading is very complex: when you buy a futures contract, no cash immediately changes hands, but you make an agreement to buy a commodity at a future date at a certain price.

This means when you buy a futures contract, your cash will not go down, but your buying power will reduce by the amount that would be needed to fill your agreement on the future expiration date (which is called the “Margin Requirement”). The margin requirement won’t be the full contract price, only a certain percentage of the final contract’s price (usually between 2 and 10%).

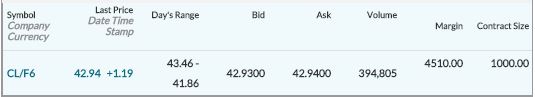

For example, this quote below is for Oil futures:

This quote tells us that each contract is for 1000 futures (“Contract Size), and the margin requirement will be $4,510. So the buying power calculation is:

Buying Power = Cash – Margin Requirements

Where To Find The Components

We keep track of every component of buying power separately to help you see the calculations. You can see every component on your Account Balances page.