Property rights is the foundation of all free-enterprise economic systems. It is what allows people to profit from capital and ideas, without fear of seizure by the government or theft.

Definition

“Property Rights” usually refers to a set of fundamental rights giving citizens control over their own land, capital, and ideas.

Land Property Rights

The property right to Land gives a landowner exclusive use of their property – other citizens and the government cannot use someone else’s private property (although the government does have the right to purchase any private land).

The right to Land is protected by the 5th amendment to the Constitution, which (among other things) requires the government to compensate landowners if their land is seized for public use, and the 3rd amendment, which prevents the government from requiring citizens to house soldiers on their own property.

Capital Property Rights

Capital property rights give people the right to own “stuff”. This includes economic capital goods, like tractors, factory machines, and tools, but also the accumulation of wealth. Capital property rights are important because it allows people and companies to build up the means for production without worrying about it being taken away.

The right to Capital is protected by the 4th Amendment to the Constitution, which protects against unreasonable searches and seizures, but is limited by Article 1 of the Construction, which does give Congress the right to levy taxes.

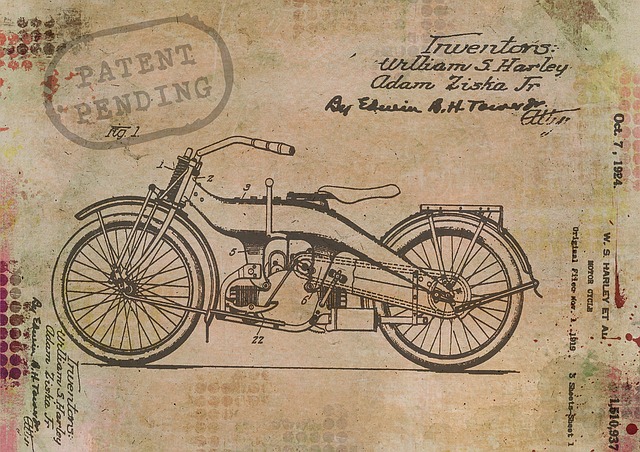

Intellectual Property Rights

Intellectual property rights give people and businesses exclusive rights to profit from their ideas though the use of patents and copyrights. This means if you write or invent something, another manufacturer cannot simply copy your idea and profit from it themselves.

Intellectual property rights give people and businesses exclusive rights to profit from their ideas though the use of patents and copyrights. This means if you write or invent something, another manufacturer cannot simply copy your idea and profit from it themselves.

Intellectual property rights are protected by Article 1 of the Constitution, which charges Congress with establishing the Patent Office.

Weak Property Rights

The United States has strong property rights. To understand what this means, examine some systems with weaker rights.

Weak Land Rights: Rents System

A country with weak property rights would typically bar most citizens from owning land. A clear example of this would be most of Europe during the Middle Ages: all land was owned by the royalty or nobility. Commoners would need to rent smaller parcels from the nobility for their own use, and could be evicted at any time.

This meant that if you were a commoner, you would have no incentive to make improvements on your land. If you were to work hard to build an extension to your house or improve your farmland, it could just be lost the next year based on the whim of nobility. This discourages investment and improvements to land, hurting long-term growth.

Weak Capital Rights: Excessive Taxation

If a country has weak capital rights, it means that businesses and savings can be easily “appropriated” by the government, usually through very high taxes, but occasionally through direct seizure.

If a country has weak capital rights, it means that businesses and savings can be easily “appropriated” by the government, usually through very high taxes, but occasionally through direct seizure.

With excessive taxes, the government levies extremely high income taxes on individuals and businesses. This effectively makes it harder to generate a profit from any innovation, and can discourage investment. There is no clear-cut point where taxes become “too high”.

An example of excessive taxation would be the “Plunder Economy” of Sweden in the mid 1300’s. The Plunder Economy started when a new King conquered Sweden, and immediately raised taxes on the commoners by over 700%. This caused a large “ripple-up” effect: forced between eating, paying taxes to the crown, and paying rents to their landlord, many commoners defaulted on their rent payments. The breakdown of rents meant landowners also failed to meet their tax obligations, causing the seizure of thousands of farms from small landowners to the ruling aristocracy (causing a further violation of Land Property Rights).

Weak Intellectual Property Rights – Piracy

Weak property rights means that there are little or no protections of unique ideas from being copied. This makes it much harder for individuals and companies to justify large expenses in tech-heavy or creativity-heavy industries.

A major example of weak Intellectual Property Rights would be the film industry of Nigeria. Nigeria is the second-biggest film producer in the world in terms of the number of movies produced – behind India, but ahead of the United States. However, most Americans may have never heard of it at all – and many of the industry leaders in Nigeria are concerned it is on the brink of collapse. This is due to rampant piracy. New films produced in Nigeria are often stolen by lower-level (and even higher-level) employees involved in the film’s production, and immediately sold in massive quantities on the black market (often before the movie is even released).

This means most films have an extremely hard time recouping their investment – with some filmmakers threatening to leave the country entirely. This led to a generation of extremely low-budget films (usually shot on home video equipment), since film makers usually only had a few days of theater sales to recoup their entire investment before legitimate copies are drowned by pirated sales.

Property Rights and Growth

Strong land and capital property rights mean investors and innovators are more likely to see a return on any profitable investment – strong property rights are usually seen as required for economic growth. The reasoning is simple – investors and innovators are more likely to pursue new ventures if they know that they will benefit if it is successful. If a potential investor believes their profits will be syphoned off even if their investment makes money, they will be more inclined to put their savings elsewhere (or simply spend it on consumption).

Intellectual Property Rights, Growth, and Development

Experts are less certain on intellectual property right’s impact on growth and development.

Growth

“Growth” means pushing out the total economic frontier – the most advanced technology that powers the growth in fully-developed economies.

“Growth” means pushing out the total economic frontier – the most advanced technology that powers the growth in fully-developed economies.

On the one hand, innovators are more likely to pursue their ideas if they know they will enjoy the exclusive right to benefit from their idea through a patent or copyright. Big companies like Intel and Microsoft file patent and copyright protections to their inventions and development, and use their exclusive rights to generate more profits from something that otherwise could be easily reproduced. These profits are fed back to feed more innovation within the company, which continues to push the cutting-edge of technology.

On the other hand, all innovation is based on the works that come before it. By restricting the use of innovative ideas, it prevents another innovator from pushing an idea up to the next level. This became a problem with the Wright Brother’s airplane – the brothers immediately patented their invention, and spent the next decade trying to sue other American aircraft designers who were developing other designs. This infighting caused American aircraft designs to lag French and German designs (who were busier competing for the best design rather than first design) for the next 10 years.

Development

“Development” is different from growth. A “Developing” economy is playing catch-up with developed economics, trying to evolve its stock of technology and expertise. Strong international intellectual property rights are usually more of a nuisance than benefit for developing countries because it makes it more difficult to catch up.

For example, if Monsanto (MON) develops a new type of corn that produces twice the output for the same size of farm, they will likely charge a much higher price for the seeds than generic corn. Richer farmers in developed economies can use some savings to invest in the more expensive seeds, which will greatly increase output. Meanwhile, poorer farmers in developing economies might struggle to afford the newer seeds, and can be stuck using the less-productive forms.

Since the farmers of the richer economies are now producing much more corn, it will also drive down the global price. This hurts the developing farmers even more, since they earn even less income than they were before. Companies like Monsanto know this, and usually have very different pricing strategies in different countries (after all, it is better for their business if the most farmers possible use their products).

Evolution of Intellectual Property

Economies experiencing very rapid development usually maintain “laxer” intellectual property protections to help drive their own growth. This is why the fastest-growing economies are often synonymous with cheap knock-offs: think the Nigerian film industry, or many aspects of the Chinese manufacturing industry.

However, as the level of technology in an economy catches up with the cutting-edge of the rest of the world, the government tends to start enforcing stronger intellectual property protections to help its own industries push forward in the global marketplace. For example, in the 1960’s, Japan had a reputation for producing cheap, flimsy knock-off products. Over the 1980’s and 1990’s, their development reached a point where their economy transitioned from knock-offs to some of the highest-quality merchandise, especially for tech-heavy goods. Today they are considered a global leader with strict intellectual property laws, since the their growth and development focus has shifted towards protecting their own innovation than catching up to innovators elsewhere in the world. This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Get PersonalFinanceLab

[qsm quiz=179]