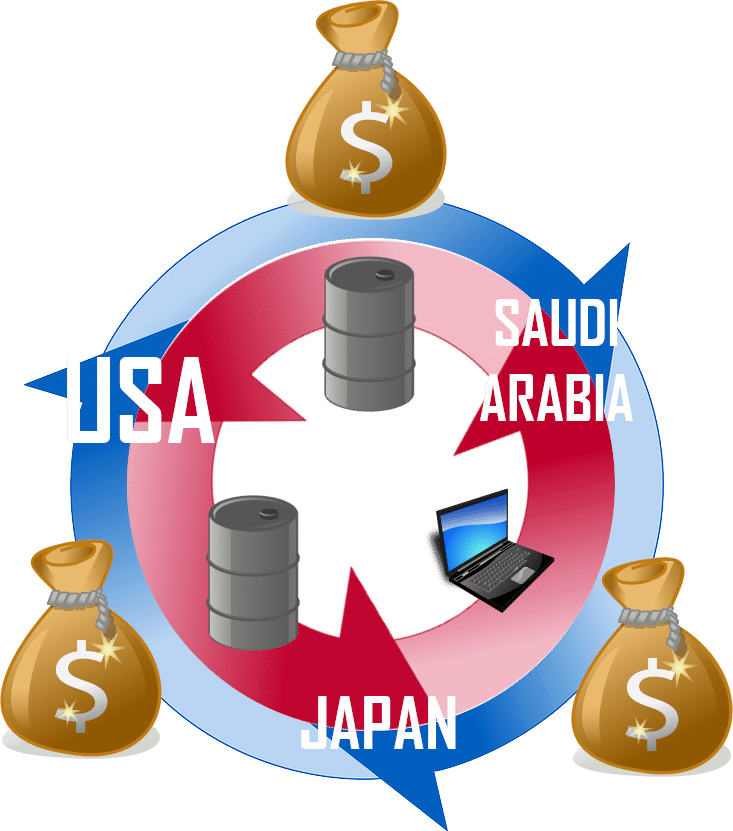

Comparative Advantage is the term used to describe how one person, business, or economy, is able to outproduce one product or service compared to another person, business, or economy.

Risk is one of the most important concepts in investing, economics, and personal finance, yet very few people really understand just how big a role risk plays in our everyday lives. Risk plays into insurance, investing, savings, and much more!

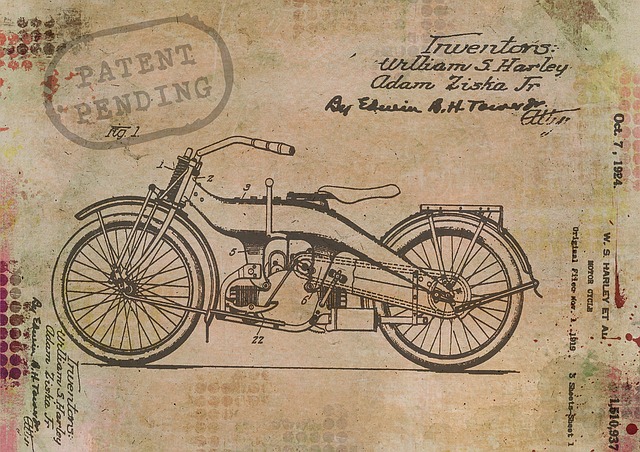

“Property Rights” usually refers to a set of fundamental rights giving citizens control over their own land, capital, and ideas. Property rights is the foundation of all free-enterprise economic systems. It is what allows people to profit from capital and ideas, without fear of seizure by the government or theft.

International Trade is the system under which businesses, individuals, and governments trade goods and services. This exchange from many different National economies is what makes up the Global economy. This is impacted not just by the supply and demand of goods, but the supply and demand of currenies, and the laws and policies of the different governments

“Inflation” means that the general prices of goods and services goes up from one year to another. There are a few ways to calculate inflation – from a simple “basket of goods” compared over time, to complicated economic models looking across thousands of factors

The way the government organizes taxes and their spending to influence the economy is called the Fiscal Policy. Fiscal policy is controlled by congress and the president, and boils down to how they adjust spending federal money to encourage economic growth

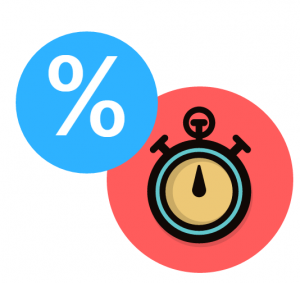

The Time Value of Money is a concept that a dollar in your pocket today is worth more than a dollar tomorrow – because you can use it right away. The time value of money is determined by interest rates and opportunity cost – what else could you be doing with that money?

“Labor” is how much a person works. It is the use of time an exertion of effort to produce something of value. Generally speaking, the more valuable a person’s labor is, the higher their wage.

“Unemployment” is a major economic indicator measuring how much of the working population is currently looking for a job. Just because someone is jobless doesn’t mean they are unemployed – they need to be looking for work!

“Price Controls” are artificial limits that are put on prices. If the limit is put in place to prevent prices from getting too high, they are called Ceilings. If they are in place to prevent the price from getting too low, they are called “Floors”.

Interest rates are a percentage that is used to calculate how much a loan or investment grows over time. A “Nominal” interest rate is just the percentage on the loan – the “Real” rate subtracts expected inflation

Scarcity refers to the fact that resources are finite – people and organizations need to allocate their finite resources between their infinite wants.

“Specialization” is when a labor force begins to divide total production, leading to a rise of experts or specialists. This is called the Division of Labor, and it typically results in much higher productivity of labor.

“Opportunity Cost” is what needs to be given up to get something. This is different from an item’s price – it refers to what you give up in order to get something. The opportunity cost for going to school is that you can’t stay home and nap. The opportunity cost of staying home to nap is not getting your diploma!

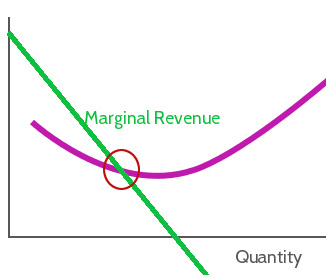

Everyone knows about costs and benefits of doing something – the pros and cons of making a choice. Marginal benefit and marginal cost are different – they look more closely at doing slightly more or less of different alternatives. Marginal costs and benefits are extremely important to producers when choosing their inputs and prices.

Competition occurs in market-based economies, and can be beneficial since it generally leads to lower prices, more choice, and better qualities of products for consumers than other types of economies.

This article describes the Business Cycle, which is the broad, over-stretching cycle of expansion and recession in an economy.

An Entrepreneur is someone who takes a risk to start a new business. Nearly every business that exists (apart those created as spin-offs of other businesses, or by government intervention) was started by one or several entrepreneurs, who took a risk to launch a new company.

Economic Incentives include anything that pushes people, businesses, and governments to do one thing or another. These include what products you buy, what career you choose, what products businesses produce, and what government programs are put in place

In Economics, an “Externality” is a benefit or cost that is not reflected in the price of a good or service. They can be positive or negative.

Economic Growth means that economy is growing – more goods and services are being produced and consumed than they were before. The most common measurement of economic growth is the Gross Domestic Product (or GDP), which measures the total number of finished goods and services produced in an economy in a year.

Economics studies the trade-offs from a variety of choices. Individuals make these choices everyday, in order to best improve their outcome.

Companies come is all shapes and sizes, with differing levels of liability for its owners. Different types of companies also have different levels of “Liability” – how “on the hook” the owners are for business debt

“Major Economic Indicators” are numbers that you can look at to try to get a picture of how well the economy is doing. This includes GDP, Output, Inflation, Unemployment, and more!

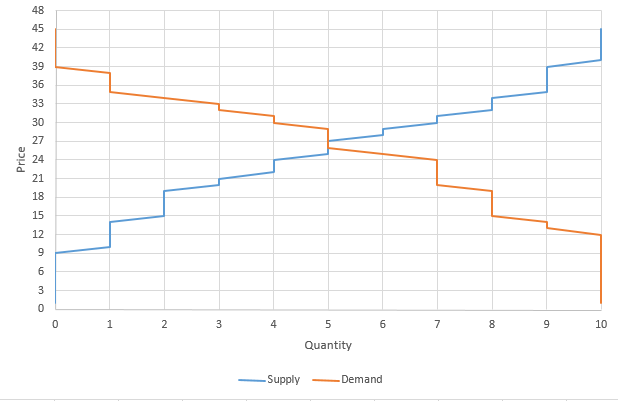

The stock market is the perfect place to see Supply and Demand in action! Many buyers and many sellers meet to trade – with the “market equilibrium” moving in real-time based on new information

There are many different economic systems that try to result in more equality or faster growth. The structure of a country’s economy has a lot to do with the country’s politics and the values of its population. However, the economy of every country also changes over time, and how it falls between these broad categories will often change with it.

The Federal Reserve Bank, or the “Fed”, is the central banking system of the United States. It serves as the primary regulator of the US dollar, as well as the “lender of last resort” for other banks.

Gross National Product (GNP) is the value of all goods and services produced by a country’s residents.

A price ceiling is a government-mandated limit on the price that can be charged for a given product, such as a utility or electricity. The intended purpose of a price ceiling is to protect the consumers from conditions that would make a vital product from being financially unattainable for consumers.

An oligopoly is characterized by a small number of sellers who dominate an entire market. All of the firms who partake in an oligopoly are considered to be very large in terms of profit, size and client base.

Monopoly, in economic terms, is used to refer to a specific company or individual has a large enough control of a particular product or service that allows them to influence it’s price or certain characteristics.

Monopolistic Competition is characterized as a form of imperfect competition, which exist when there are many sellers of a good or service but the products do not contain noticeable differences. There are several forms of imperfect competition, of which Monopolistic Competition is one.

Money supply is the total amount of money available in an economy at any particular point in time. Money is required for both consumers and businesses to make purchases. Money is defined as currency in circulation and demand deposits (funds held in bank accounts.)

Economists define elasticity as the ratio of the percent change in one variable to the percent change in another valuable. Its purpose is to measure how one variable responds to changes in another variable.

The consumer price index (CPI) is simply an indicator of changes in prices of goods and services experienced by consumers in a given country over time.

Stagflation is high inflation and high unemployment are occurring simultaneously.

Hyperinflation refers to out of control or extremely rapid inflation, where prices increase so quickly that the concept of real inflation becomes meaningless. The classical definition of hyperinflation is inflation greater than 50% per month.

The total amount that the federal government has borrowed including internal debt (borrowed from national creditors) and external debt (borrowed from foreign creditors).

Stock prices are a direct result of supply and demand. All the other influences like debt, balance sheets, earnings and so on affect the desirability of owning (or selling) a stock. This article details why supply and demand create changes in stock prices, and what a drop in price means in terms of supply and demand.

Decreasing the long-run average and marginal costs that come from an increase in the size of a factory or plant. Economics of scale can be from the inner workings of an organization. This would include the lower cost from adding technology and better organization.

Recession is generally described as a slowdown of economic growth over a sustained period of time.