What is a Student Loan? A student loan is exactly what it sounds like – a loan given to students to finance their studies. This is most common for college or university students, but also works for trade schools and other vocational studies. Most of the time when a person takes out a loan, they Read More…

Comparative Advantage is the term used to describe how one person, business, or economy, is able to outproduce one product or service compared to another person, business, or economy.

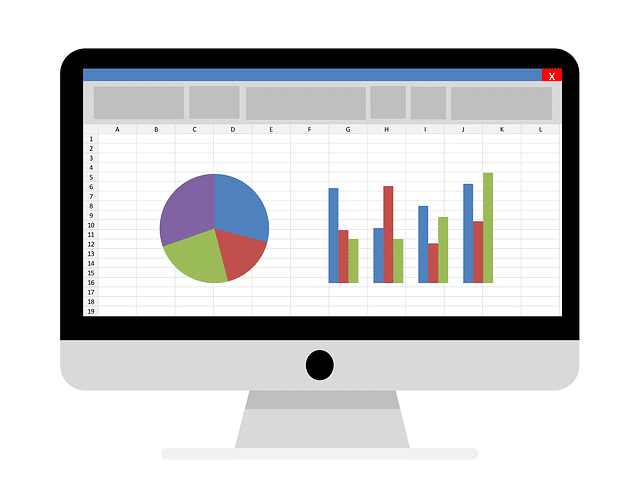

The Accounting Cycle is a series of steps that businesses take to track transactions and consolidate financial information over a specific accounting period (month, quarter, year). The end result of is the production of accurate financial statements for that period and preparedness for the next accounting period. Read this article for more information.

One area of accounting is cost accounting, which focuses on internal reporting for the purpose of improving managerial decision making. Key concepts include cost allocation, cost-volume-profit and the role of a double break-even!

A company’s financial statements give investors, managers, and other “users” a complete, honest look at its financial health. Finished financial statements follow a standardized format, letting investors compare different companies in the same industry apples-to-apples. These include Income Statements, Balance Sheets, and Cash Flow statements.

Risk is one of the most important concepts in investing, economics, and personal finance, yet very few people really understand just how big a role risk plays in our everyday lives. Risk plays into insurance, investing, savings, and much more!

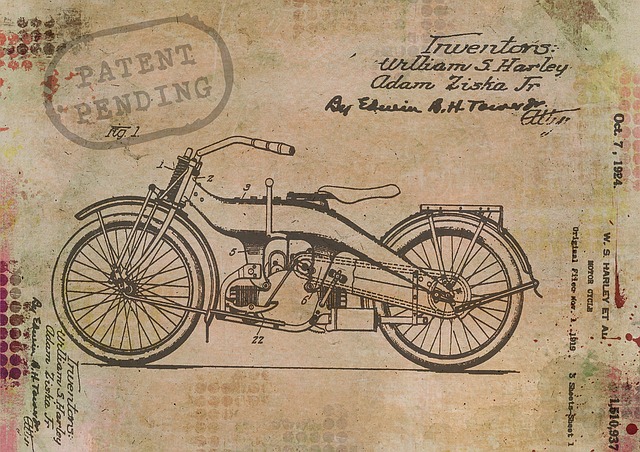

“Property Rights” usually refers to a set of fundamental rights giving citizens control over their own land, capital, and ideas. Property rights is the foundation of all free-enterprise economic systems. It is what allows people to profit from capital and ideas, without fear of seizure by the government or theft.

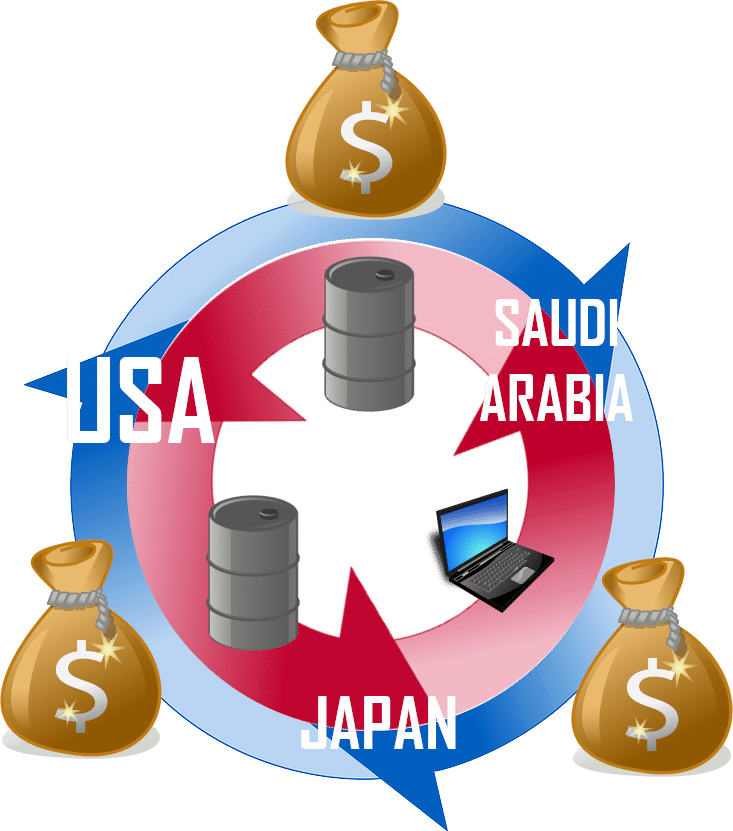

International Trade is the system under which businesses, individuals, and governments trade goods and services. This exchange from many different National economies is what makes up the Global economy. This is impacted not just by the supply and demand of goods, but the supply and demand of currenies, and the laws and policies of the different governments

“Inflation” means that the general prices of goods and services goes up from one year to another. There are a few ways to calculate inflation – from a simple “basket of goods” compared over time, to complicated economic models looking across thousands of factors

The way the government organizes taxes and their spending to influence the economy is called the Fiscal Policy. Fiscal policy is controlled by congress and the president, and boils down to how they adjust spending federal money to encourage economic growth

The Time Value of Money is a concept that a dollar in your pocket today is worth more than a dollar tomorrow – because you can use it right away. The time value of money is determined by interest rates and opportunity cost – what else could you be doing with that money?

Managerial accounting is the use of accounting tools to make internal decisions. This is different than financial accounting, which is used to communicate to auditors and investors. Managers in a company use managerial accounting to help with making strategic decisions.

Market Segmentation is a tool companies can use to personalize marketing to a target audience. It means tailoring both the product, and the promotion of a product, differently to different types of people

Brokerages exist to allow individuals to make investments into the larger market. In other words, they connect individuals to the markets as a whole

The core components of a case are a summary of the company’s background, analysis of their background, the company’s internal strengths and weaknesses, their opportunities and threats, the external environment the they compete in, an evaluation of your SWOT analysis, and some recommendations to remedy potential issues you find.

Greed most commonly manifests as financial fraud in businesses, driven by individuals looking to enrich themselves and their companies by ANY means. Financial audits are used to identify fraud (or general shady bookkeeping practices)

Marketing is a word often thrown around as an umbrella term for a wide variety of functions within organizations, ranging from the running of social media accounts to inside sales, and anything in between.

Do you ever wonder how companies have the money to build new stores, develop new products, or perhaps even buy another company? Usually companies do not keep enough cash for these transactions sitting in their bank account – it needs to be raised from outside investors. This process creates corporate debt.

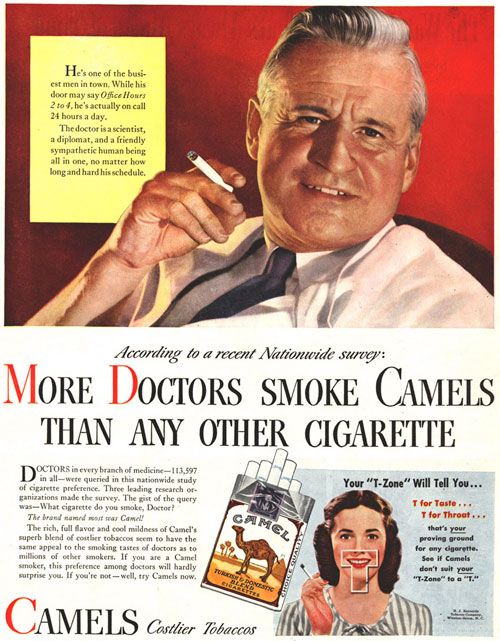

Ethics are a code of values and principles that govern the actions of a person regarding what is right versus what is wrong. Ethics appear in all facets of daily life, including how products are marketed to the general public.

Understanding human behavior helps us gain insight into what drives customers’ purchase decision-making, and how do they use the products and services that they obtain. Marketers need to be very in-tune with consumer behaviors, and ready to react to changing tastes and preferences

Owning a share in a company means that you are an integral part of the puzzle that helps the company tick. Typically, investors choose to own a stock for one of two profit driven reasons: the dividends they will receive from the company, or the hope that the stock price will increase and they will be able to sell it for a higher price than they purchased it at.

“Building Wealth” combines exercises from budgeting, spending plans, savings strategies, credit cards, and all points in between in a life-long strategy to build financial security

Raising a family is expensive. According to CNN, it costs over $230,000 to raise a child from birth to age 17 in the United States! Some say that no one is ever prepared to be a parent until it happens, but with a bit of wise financial planning, you can at least worry a bit less about money during the journey.

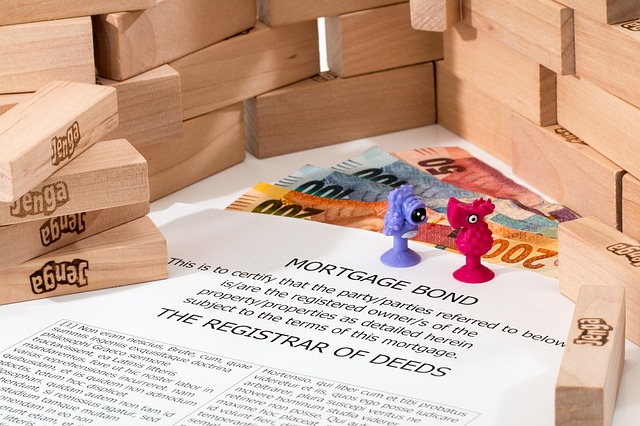

Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called a “Mortgage”, that breaks the principle and interest into equal payments over the entire term of the loan.

Want to buy a car? Stick to your budget! Besides the base price of the vehicle, keep in mind fuel costs, insurance costs, how much it would cost to replace commonly damaged parts (like the front and rear bumpers), and even things like vehicle registration!

Big corporations are very powerful entities that can possess more capital than some countries in the world. However, every company begins as a small start-up business. Once a private company grows large enough, they can become public, meaning they sell stocks to the public to finance future endeavors. After selling stocks to the public, the company will have to pay dividends to those who have chosen to invest in them.

“Spending Shocks” are large, irregular expenses. Many people do not budget enough to successfully deal with spending shocks, which can be detrimental to their personal financial health. If you don’t want to get struck with a shock, invest in your rainy day fund!

There are a variety of unemployment programs, and other assistance programs, that exist in order to help with people facing hard financial times, and low incomes. Some of these include Unemployment Insurance, SNAP Food Assistance and Housing Assistance, and more. If you find yourself in a tight financial spot, knowing about these programs can be the difference between a quick recovery and a spiral of debt

Solvency is the possession of assets in excess of liabilities, or more simply put, the ability for one to pay their debts. People and organizations who are not “Solvent” face bankruptcy

Every business requires a solid risk management program that addresses property, liability, customers, employment, products, services, and everything else an organization. It should provide adequate internal control mechanisms, and a plan on what to do if something goes wrong.

Building a budget or spending plan is tough. Sticking to the plan is even tougher. Remember to “Pay Yourself First”, and don’t lose your head – stick to the plan!

Budgeting, and trying to grow your savings, can be extremely challenging. However, there is one easy technique you can use to make sure your savings are always growing: Pay Yourself First. This is where you set aside your savings immediately after getting your paycheck – reducing your temptation to over-spend throughout the month.

Bankruptcy is a type of forced debt settlement, and is a legal procedure. When you declare bankruptcy, the courts will gather all your unsecured creditors together, and hear the debts you owe. They will then examine all your assets, and pay out as much as they can to settle as many debts as possible.

A cash budget is used internally by management to estimate cash inflows (receipts) and outflows (disbursements) of cash during a period and the cash balance at the end of a period. In other words, a cash budget is a plan for an organization to obtain and use resources over a specific period of time. Profitable businesses go bankrupt every day because of cash flow problems – don’t let it happen to you!

Leading and directing are important management functions, but usually do not appear in the main job description. A great manager needs to be able to both lead their team and direct their operations – failing either of these roles is a recipe for disaster!

There are a variety of Debt Management Services that are available via credit counselling such as debt management plans and debt settlement. Different services have different impacts on your credit score, but they can help avoid bankruptcy and get your life back on track.

Cash flow is a concept in accounting that refers to the spending or receiving of cash by an organization. For a given period, cash flow is calculated by ending cash balance less starting cash balance. It is important not to confuse cash flow with earnings, as cash flow is related to solvency, not profitability.

Consolidating your debt means taking out one big loan, and using that to pay off all outstanding balances from all your previous loans. This can make the debt easier to manage, and stop late fees and interest payments from building up.

Stock and bond prices move up and down every day – sometimes by very large amounts. Movement comes primarily from supply and demand of shares – which in turn is largely driven by information and how investors perceive the companies in the markets.

Planning and evaluating advertising is essential for businesses since it is the way the company communicates with the outside world, and can make a big difference in their success. There are four core factors to consider when planning and evaluating advertising: connecting with the customer, adhering to legal and ethical norms, the methods of communication with customers and measuring advertising effectiveness.

Everyone has had financial emergencies – when a huge spending shock breaks your budget or spending plan into pieces. If you have more than one emergency in a short time, such as if you lost your job, your outstanding debt balances might start to spiral out of control. But, you can try to ease these troubles by calling your creditor to discuss debt negotiation.

It happens to everyone: a monetary emergency happens, such as a car breakdown, draining your bank account. Bills are still coming in, and you already know that you will not even be close to paying off everything this month. How can you get out of this situation with the least pain?

Asset Valuation is the process by which an individual can assess the changes in a companies asset overtime. This is done largely through comparing ratios from a company’s financial statement, but can also be a more complex affair (depending on what is being valued)

Operating ratios are a class of ratios that are meant to analyze how well a company is using their assets. Specifically, these ratios show how well a company utilizes its assets to create revenue.

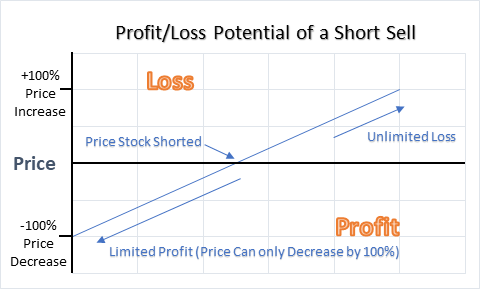

Margin trading is when you borrow money to invest. This increases the risk because now your returns need to not just make a profit, but more of a profit than you pay in interest. Market timing is also risky – instead of relying on fundamental business data, it means trying to pick the perfect hour, minute, or second to “beat” other traders who are trying to do the same thing.

Social Responsibility means managers are accountable to society at large, not just their shareholders. This is becoming an increasingly important pillar of management theory in the 21st century, as both the public and investors are expecting certain levels of social accountability.

Risk Management is when a manager tries to organize his company (or business unit) to prepare in case of, and try to prevent, something going wrong. Risk management is one of the most important parts of management and internal controls

One of the cornerstones of strong personal finances is knowing why you buy what you do, and knowing how to research your purchases in advance. What are some of the ways that you would research a purchase? What types of purchases demand the most research effort?

Every high school student makes a choice when they are about to graduate – enter the job market right away, enter a trade school, or enroll in a university? While you can always switch paths later in life, the year immediately after graduation will have a ripple effect that can last a lifetime!

Have you ever thought about a career in the finance industry? Have you wondered what is required to be considered a professional in the stock trading world? You’ll need to know about the SIE exam, Series 7, Series 63, CFA, CPA, CFP, and more!