The Accounting Cycle is a series of steps that businesses take to track transactions and consolidate financial information over a specific accounting period (month, quarter, year). The end result of is the production of accurate financial statements for that period and preparedness for the next accounting period. Read this article for more information.

One area of accounting is cost accounting, which focuses on internal reporting for the purpose of improving managerial decision making. Key concepts include cost allocation, cost-volume-profit and the role of a double break-even!

A company’s financial statements give investors, managers, and other “users” a complete, honest look at its financial health. Finished financial statements follow a standardized format, letting investors compare different companies in the same industry apples-to-apples. These include Income Statements, Balance Sheets, and Cash Flow statements.

Managerial accounting is the use of accounting tools to make internal decisions. This is different than financial accounting, which is used to communicate to auditors and investors. Managers in a company use managerial accounting to help with making strategic decisions.

Greed most commonly manifests as financial fraud in businesses, driven by individuals looking to enrich themselves and their companies by ANY means. Financial audits are used to identify fraud (or general shady bookkeeping practices)

Do you ever wonder how companies have the money to build new stores, develop new products, or perhaps even buy another company? Usually companies do not keep enough cash for these transactions sitting in their bank account – it needs to be raised from outside investors. This process creates corporate debt.

Owning a share in a company means that you are an integral part of the puzzle that helps the company tick. Typically, investors choose to own a stock for one of two profit driven reasons: the dividends they will receive from the company, or the hope that the stock price will increase and they will be able to sell it for a higher price than they purchased it at.

Big corporations are very powerful entities that can possess more capital than some countries in the world. However, every company begins as a small start-up business. Once a private company grows large enough, they can become public, meaning they sell stocks to the public to finance future endeavors. After selling stocks to the public, the company will have to pay dividends to those who have chosen to invest in them.

Solvency is the possession of assets in excess of liabilities, or more simply put, the ability for one to pay their debts. People and organizations who are not “Solvent” face bankruptcy

A cash budget is used internally by management to estimate cash inflows (receipts) and outflows (disbursements) of cash during a period and the cash balance at the end of a period. In other words, a cash budget is a plan for an organization to obtain and use resources over a specific period of time. Profitable businesses go bankrupt every day because of cash flow problems – don’t let it happen to you!

Cash flow is a concept in accounting that refers to the spending or receiving of cash by an organization. For a given period, cash flow is calculated by ending cash balance less starting cash balance. It is important not to confuse cash flow with earnings, as cash flow is related to solvency, not profitability.

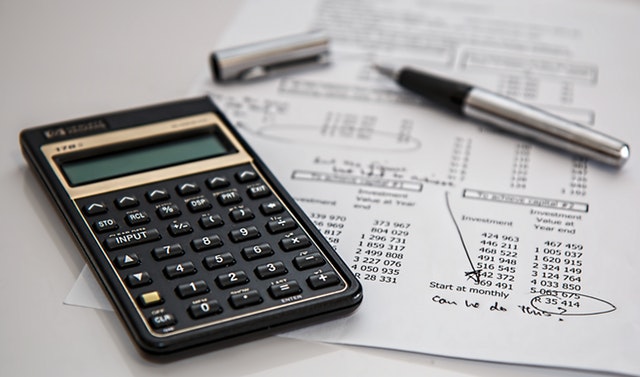

Operating ratios are a class of ratios that are meant to analyze how well a company is using their assets. Specifically, these ratios show how well a company utilizes its assets to create revenue.

“Gains and Losses” – this comes from investment revenue from a business, instead of regular operations. If they sell a piece of land at a profit, for example, that would be a “Gain”.

Since the accountancy profession is only as good as the quality of service provided by its members, regulations and ethical guidelines are essential to having effective accountants.

Liabilities are the expenses a company must pay in the future – and are subtracted from a company’s assets to find “Shareholder Equity”. Liabilities can be accounts payable (bills they have but haven’t paid yet), outstanding contacts (services they agreed to provide but have not yet completed), pension obligations, or any outstanding debt.

“Assets” are things a company owns that have value. This can be equipment, patents, cash in the bank, accounts receivables, property, or anything else of value that could be theoretically sold, if the company went bankrupt.

Payroll is run weekly, bi-weekly, monthly, or even semi-monthly, so for each pay cycle, taxes need to be calculated and reported. All tax payments need to be calculated for each pay cycle, then filed once per quarter. Therefore, Payroll Accounting is an involved process that properly accounts for all taxe

A company’s accounting department must meet several criteria that are used to recognize revenue when a sale transaction occurs, and when expenses are recorded. This recognition is essential for meeting the Generally Accepted Accounting Principles (GAAP).

GAAP – the Generally Accepted Accounting Practices. These are a set of a standard means of doing financial reporting and bookkeeping. This helps analysts and auditors can compare apples-to-apples financial data from one year to another, and even between organizations.

Auditing, Wealth Management, Forensic Accounting, Payroll, and more! There has never been a bigger demand for accountants in EVERY type of business. What certifications will you need to launch your career?

Equity (stockholders’ equity, owners’ equity, etc.) is the claim shareholders of a company have on assets once the liabilities have been satisfied. This is basically the “net worth” of the company – with each shareholder owning a fraction of the total.

Just like we all care about our personal health, managers and investors care about the health of their company. How can they perform a “check-up” on their business in order to determine its progress and financial health? Instead of weight or blood pressure, analysts use financial ratios.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Cash Flow Statement is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). This statement presents where the cash and its equivalents are coming from and where they are being allocated.