Each lesson takes about 5-10 minutes and ends with a short self-grading quiz.

Students receive credit upon completion—no quiz required.

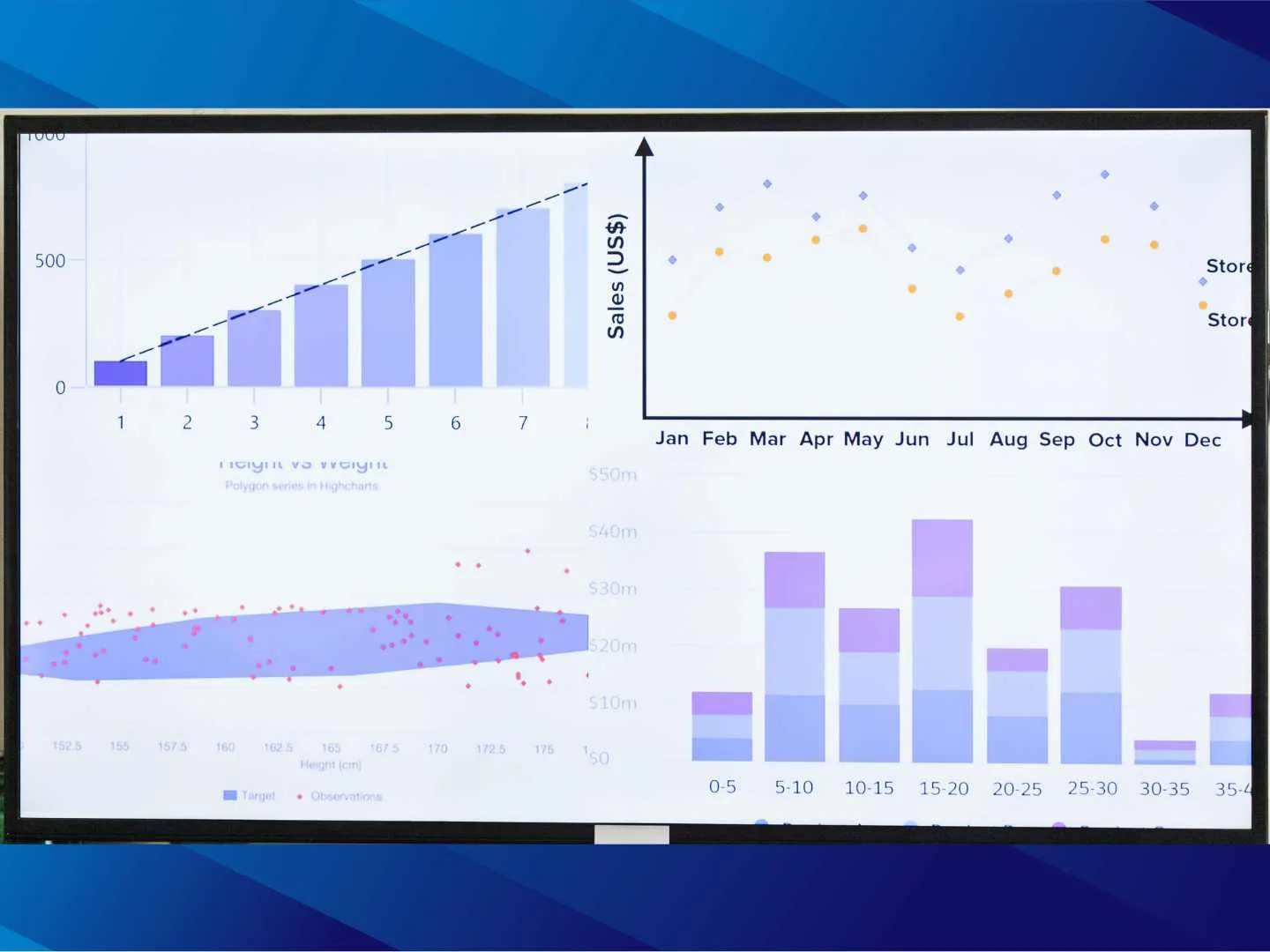

Students use financial calculators to solve real-world problems presented in a quiz.

Legend:

Long-Term Game

Comprehensive Chapter

Short Lesson

Interactive Calculator

Includes Automatically-Graded Assessment

Video

You must be logged into PersonalFinanceLab to view the lessons. You can create a free demo account by registering for the Teacher Test Drive

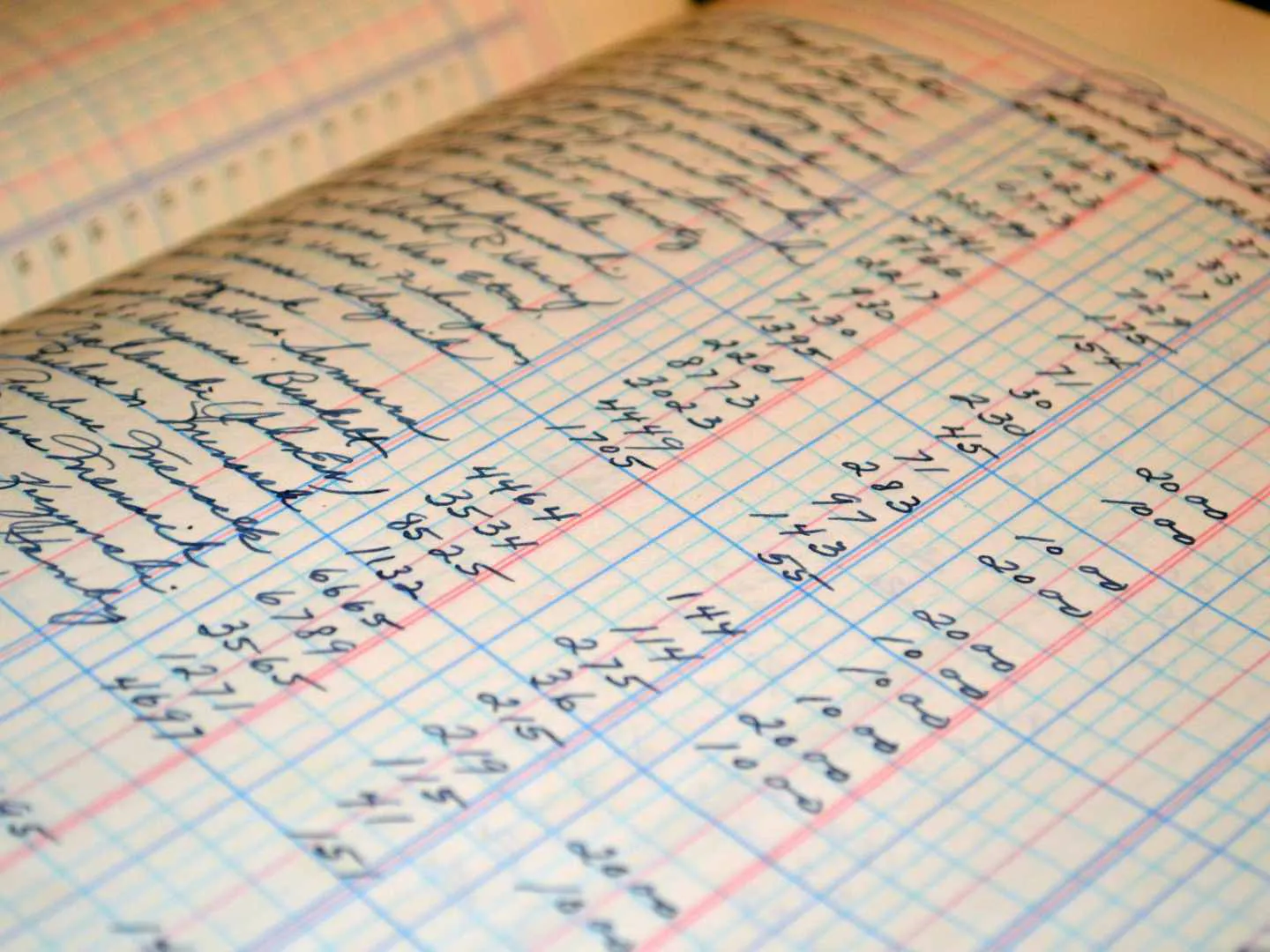

Learn to read the language of business, from analyzing financial statements to uncovering a company’s financial health.

Learn the cycle that turns daily business into key financial reports.

20 min

Discover how regulations and ethics build trust in our economy.

18 min

Learn the education requirements for top accounting careers.

15 min

Learn the key ratios for profitability, liquidity, and solvency.

21 min

See how GAAP makes financial statements reliable and comparable.

12 min

From FIFO to bad debt, learn the GAAP rules for tracking assets.

24 min

Understand how businesses account for short and long-term debt.

24 min

See how profits, dividends, and stock sales affect equity.

10 min

Learn when to record expenses to match the revenue they create.

15 min

Learn how GAAP separates core profits from incidental gains.

24 min

Discover the payroll taxes that are withheld from your earnings.

15 min

Learn how companies go public and reward their shareholders.

10 min

Use operating ratios to see how well a firm uses its assets.

12 min

Discover how cash flow reveals a company’s ability to survive.

25 min

Learn to plan for cash shortfalls and surpluses in your business.

25 min

Learn the difference between issuing corporate bonds and stocks.

22 min

From dividends to voting on mergers, learn what ownership means.

12 min

Explore the key ratios for measuring a company’s solvency.

18 min

Dive into financial reports to see how businesses make decisions.

12 min

Find out if they can keep growing, or if they can weather any storm.

24 min

Use cost-volume-profit analysis to guide any business decision.

18 min

Learn to use P/E ratios and CAPM to analyze the value of a stock.

22 min

What red flags forensic accountants find that expose financial crimes.

24 min

Discover how business leaders build winning teams, manage risk, and guide their business toward its goals.

Learn how strategic planning guides a business to achieving its goals.

12 min

One supreme ruler, or are teams empowered to navigate on their own?

24 min

Explore the management skills that inspire and guide winning teams.

13 min

Learn what practical strategies will unlock their untapped potential.

24 min

Discover the 7 most common ways to organize a new business.

20 min

Learn how to navigate ethical dilemmas in the marketplace.

20 min

Discover how companies can “do the right thing” for everyone.

9 min

Learn how HR plans for who and when to hire & train their workforce.

12 min

Learn how a company needs a competitive advantage to beat its rivals.

14 min

Learn how businesses manage their money for the short and long-term.

16 min

Learn how businesses prevent and manage risks from within.

25 min

Learn the 3 stages of managing risk and the 3 ways to regain control.

17 min

Learn how to analyze any company to write their blueprint for success.

24 min

Find out how to build a powerful marketing plan that connects with any audience.

Find out what every marketing guru does to reach their audience.

24 min

Find out how marketers are influencing you, every time you click, Buy.

10 min

Learn to find & attract people who want to buy what your selling.

10 min

Discover how misleading ads and data privacy issues lead to new laws.

16 min

Learn what decisions to make for each stage in the product’s journey.

24 min

Learn what pricing strategies businesses use to win more customers.

24 min

Learn how to plan and measure an effective advertising campaign.

12 min

Find out the proven process to close more deals in any industry.

13 min

Don’t just hope for success, research and create a solid game plan.

15 min

Schedule a brief consultation with one of our curriculum experts to discuss your specific goals, from a single personal finance class to a campus-wide financial wellness initiative.

Request More Info