Personal Finance

& Investing Curriculum

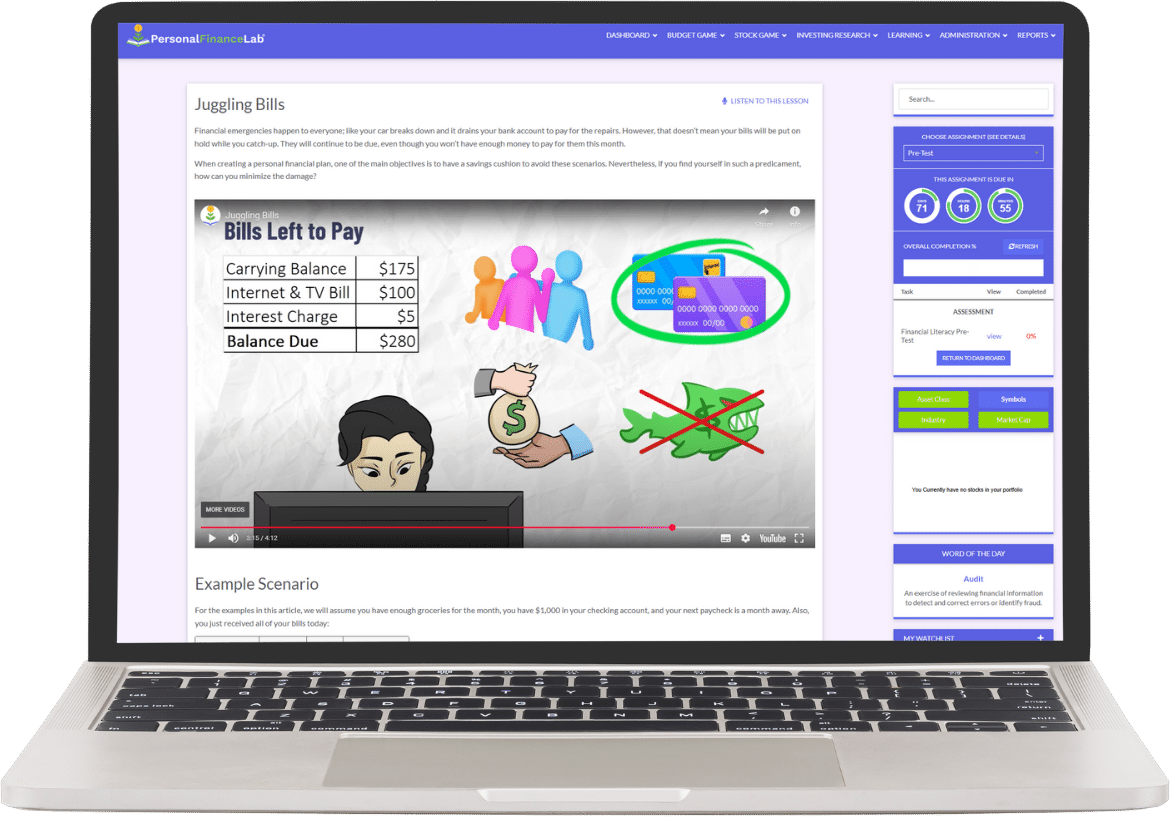

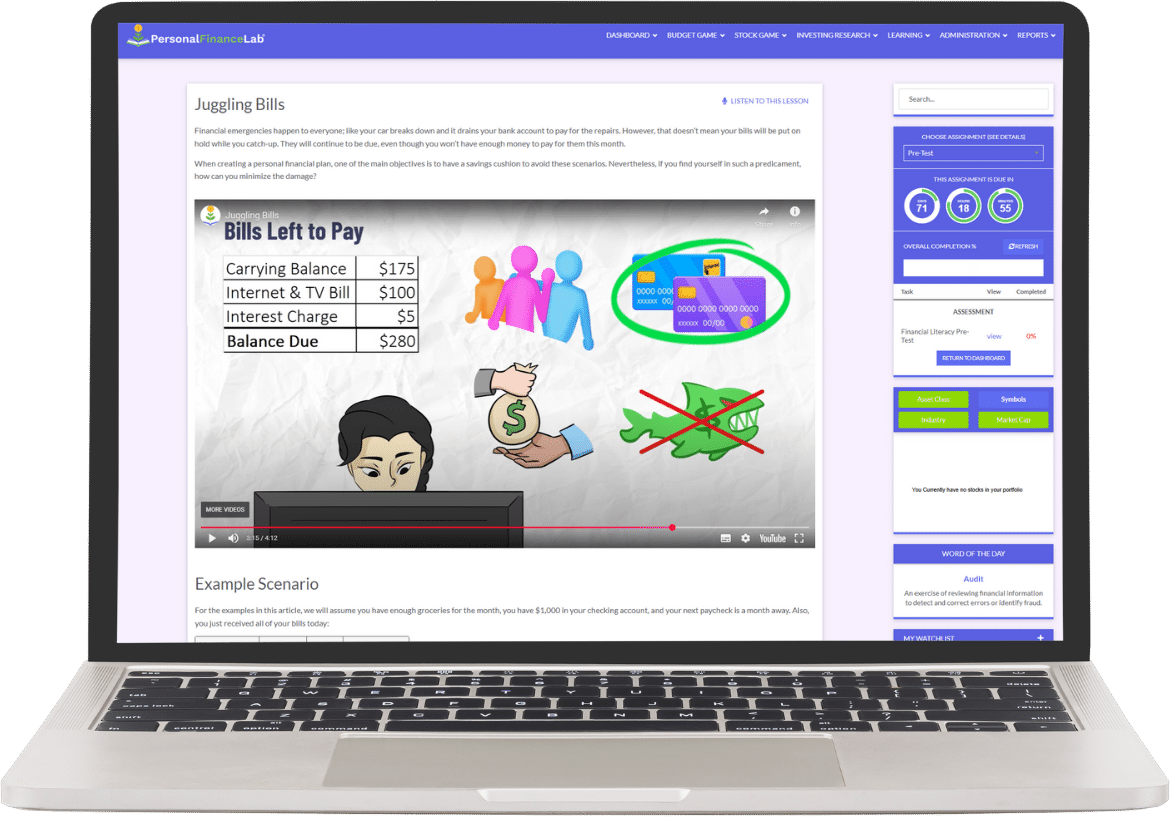

Discover the core financial literacy lessons in the PersonalFinanceLab Learning Library.

See how we align to State Standards

See how we align to State Standards

Each lesson takes about 5-10 minutes and ends with a short self-grading quiz.

Students receive credit upon completion—no quiz required.

Students use financial calculators to solve real-world problems presented in a quiz.

Legend:

Long-Term Game

Comprehensive Chapter

Short Lesson

Interactive Calculator

Includes Automatically-Graded Assessment

Video

You must be logged into PersonalFinanceLab to view the lessons. You can create a free demo account by registering for the Teacher Test Drive

Students learn how to build a budget and understand their spending habits.

Achieve Your Financial Goals with a Step-By-Step Budgeting Guide

9 min

Transform your spending habits and make better spending decisions.

6 min

Explore the history of money from bartering to debit cards.

10 min

Discover the 4 accounts you need to manage your finances better.

5 min

Try different scenarios with the compound interest calculator!

9 min

Find out how easy it is to set-up and stick to a spending plan.

18 min

Want financial freedom? Start by Paying Yourself First, here’s how.

9 min

From car repairs to dental bills & avoid derailing your budget.

7 min

Learn which receipts to save for returns, warranties, and taxes.

14 min

Discover smart spending tips and how to avoid buyer’s remorse.

12 min

Learn how to prioritize and pay bills when cash is scarce.

9 min

Learn to evaluate the lifetime cost and value of a purchase.

10 min

Discuss finances with a partner & budget for a growing family.

8 min

Use the Net Worth calculator to know your financial situation.

5 min

Crunch the numbers with our interactive calculator.

12 min

Use this calculator to get a handle on your monthly spending.

14 min

This assessment covers budgeting & spending topics.

10 min

Students learn how to build a budget and understand their spending habits.

Learn why building credit now helps you get better rates later.

2 min

Learn how to manage credit cards and personal loans responsibly.

20 min

Learn how minimum payments will always lead to more debt.

17 min

Here’s What You Need to Know to Get the Best Deal

23 min

When is taking on debt beneficial vs when it becomes a burden?

5 min

See how interest rates and down payments impact your car loan

16 min

Learn your short-term financing options and how to use them.

15 min

How to pay for your education without taking on unnecessary debt.

14 min

Review fixed or adjustable rates to see what works for you.

18 min

See how making only minimum payments can keep you trapped in debt.

8 min

Learn how to monitor your report to improve your credit score.

17 min

Review sources of debt and the impact of defaulting on your loans.

11 min

Explore professional services to help you regain financial control.

8 min

Learn how combining your debts can improve your credit rating.

13 min

Learn how to make a plan with your lenders and save your credit.

13 min

Learn the snowball & avalanche methods to find the best way out of debt.

15 min

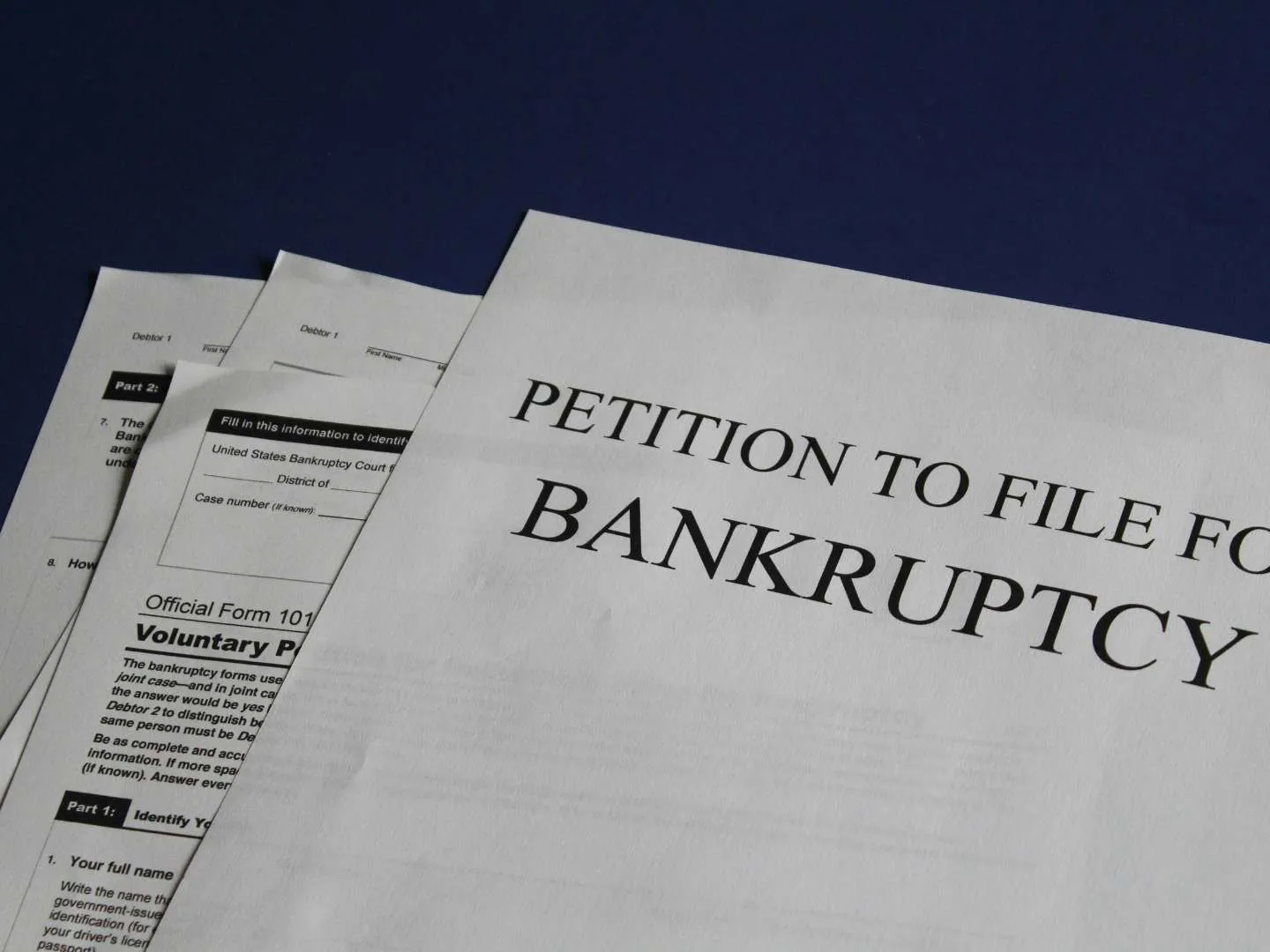

Discover the legal options available after all other methods fail.

9 min

This assessment covers credit, loans, and debt management.

10 min

Students learn how taxes and benefits shape their real take-home pay and long-term wealth.

Understand how taxes and benefits shape your real take-home pay.

2 min

From health insurance to retirement plans, learn what to look for.

14 min

Make informed decisions on how to negotiate the best package.

13 min

Learn how education and career choices impact your lifetime earnings.

10 min

Learn about your rights, taxes and job responsibilities.

8 min

Explore the government safety nets for food, health, and housing.

7 min

Learn the pros and cons of different financial institutions.

16 min

Learn how debit and credit cards differ, and what fees to watch for.

6 min

Learn how to use auto-pay safely and avoid costly overdraft fees.

6 min

Income tax, capital gains, sales tax, property tax, and more.

10 min

Helping you navigate the 1040 form, W-2s and 1099s with ease.

10 min

Step-by-step guide to filing a 1040, no real tax info needed.

10 min

Understand use vs sales tax rules, rates and exemptions.

9 min

5 common job application fails that get your resume thrown out.

9 min

Learn how to win over the hiring manager and secure the job offer.

6 min

Evaluate how paid vs. unpaid internships impact your career & salary.

10 min

Optimize your resume to help you get noticed & land more interviews.

6 min

Learn key strategies to build real, lasting wealth.

8 min

Learn how to choose the right charity and make a positive impact.

10 min

Learn how to set yourself up so you can enjoy your golden years.

14 min

Use this calculator to see how investing impacts your savings.

12 min

Make informed purchases, by knowing your rights and responsibilities.

8 min

Discover the 4 product types that shape all your buying habits.

10 min

Maximize your tax refund by learning what you’re eligible for.

11 min

Discover what you owe from side hustles, tips, rents and more.

8 min

Know when you should file yourself, use software, or hire a pro.

7 min

This assessment covers income, employment, and taxes.

10 min

Understand how to use insurance to manage life’s financial risks.

Understand how to use insurance to manage life’s financial risks.

2 min

Get to know what makes an agreement a binding contract.

10 min

Don’t get caught off guard. Learn about exclusions and exceptions.

6 min

Get a review of the types of coverage and types of reimbursement.

9 min

Learn how leases and HOAs control what you can do with your home.

8 min

Learn what coverage you need to protect yourself and your vehicle.

14 min

Find out the death benefit options of different policies.

14 min

Explore the pros and cons of this retirement savings product.

10 min

Find out how insurance can help you maintain your lifestyle.

10 min

Review how your coverage options impact your insurance rates.

11 min

Learn how to spot fraud & keep your personal information secure.

10 min

Compare APR, down payments, and promos for different car loans.

25 min

From receipts to tax returns, learn to track and protect your money.

12 min

Find and fix errors, avoid fees, and get your finances in order.

8 min

Find out why tax returns are audited and how the process works.

8 min

Make a strategic choice by weighing long-term costs, skills & goals.

11 min

Learn about simple wills, living wills, and estate planning.

7 min

Learn the steps to turning an idea into a successful business launch.

13 min

This assessment covers insurance, contracts, and financial security.

10 min

Students discover how to make their money work for them. They go from the basics of the stock market to more advanced strategies.

Discover how investing turns your savings into long-term wealth.

2 min

Get clarity on types of stock, benefits, and how to get started.

7 min

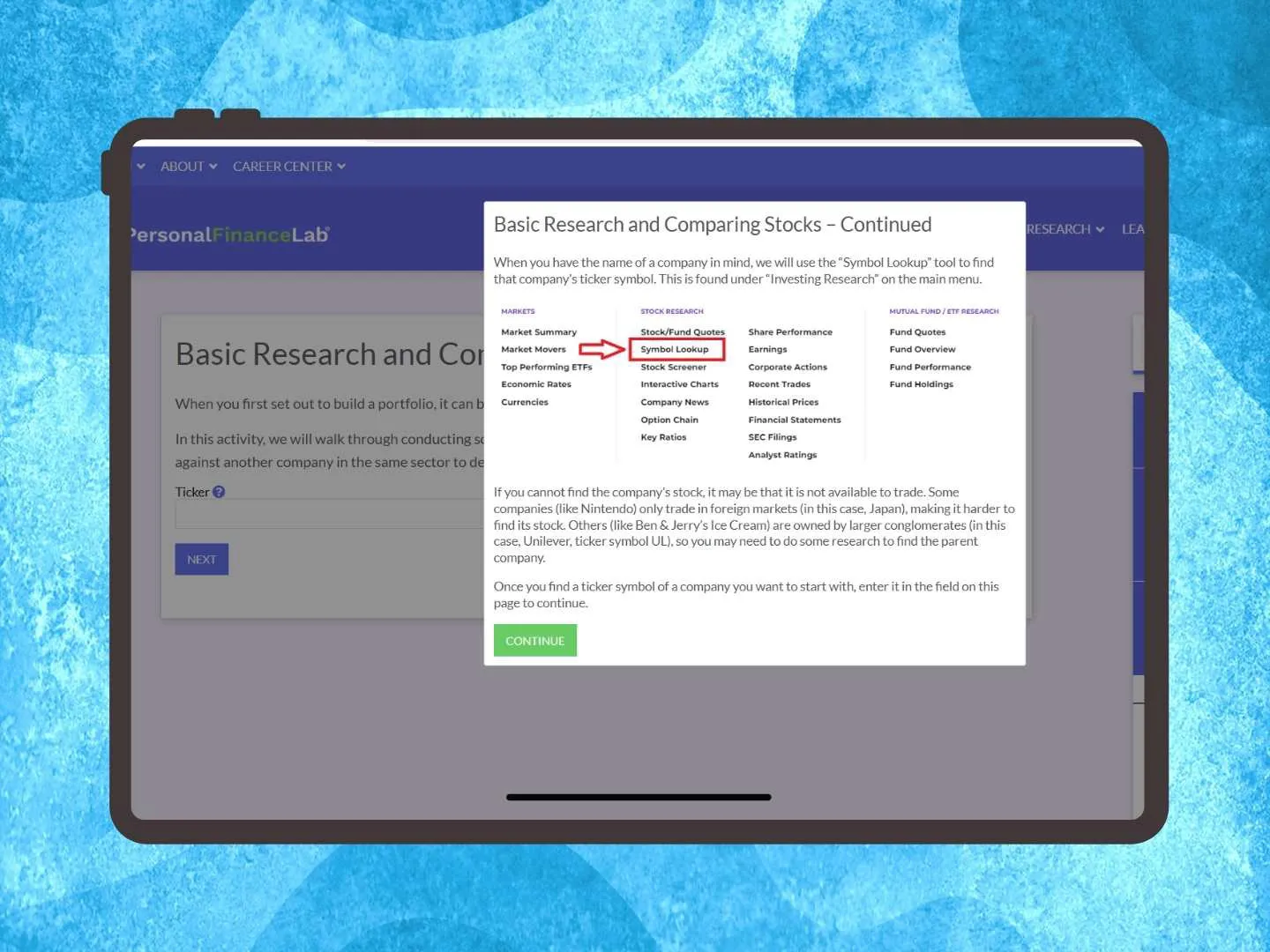

Learn how to find and use ticker symbols to invest in stocks.

3 min

Review the basics: last price, volume, bid/ask, day’s high/low…

10 min

Learn why stocks beat savings and how to grow your wealth.

14 min

Learn how to spread your investments to protect your wealth.

11 min

Use these simple tips to research and find your first stock picks.

16 min

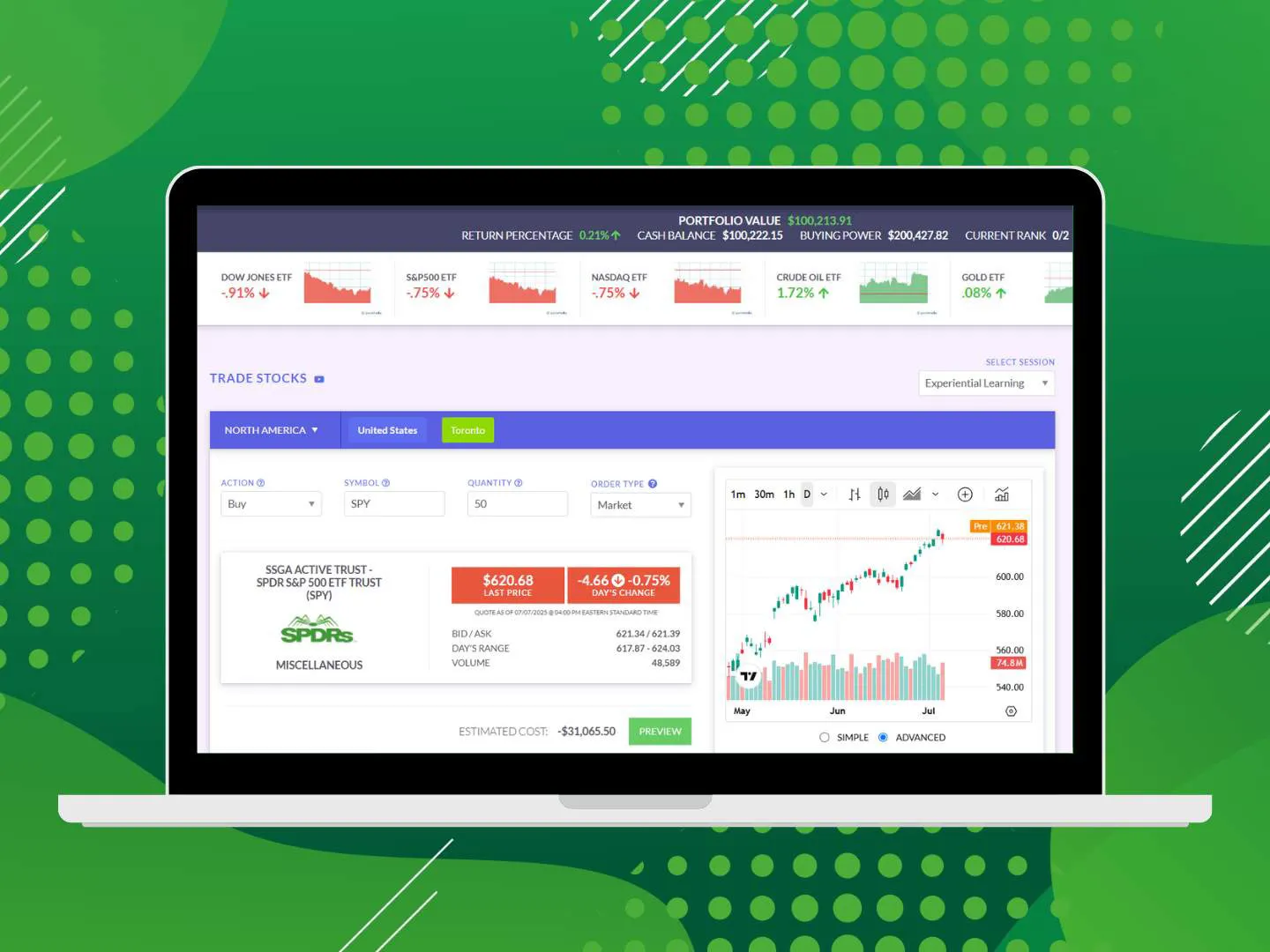

This video shows you how to get started building your portfolio.

14 min

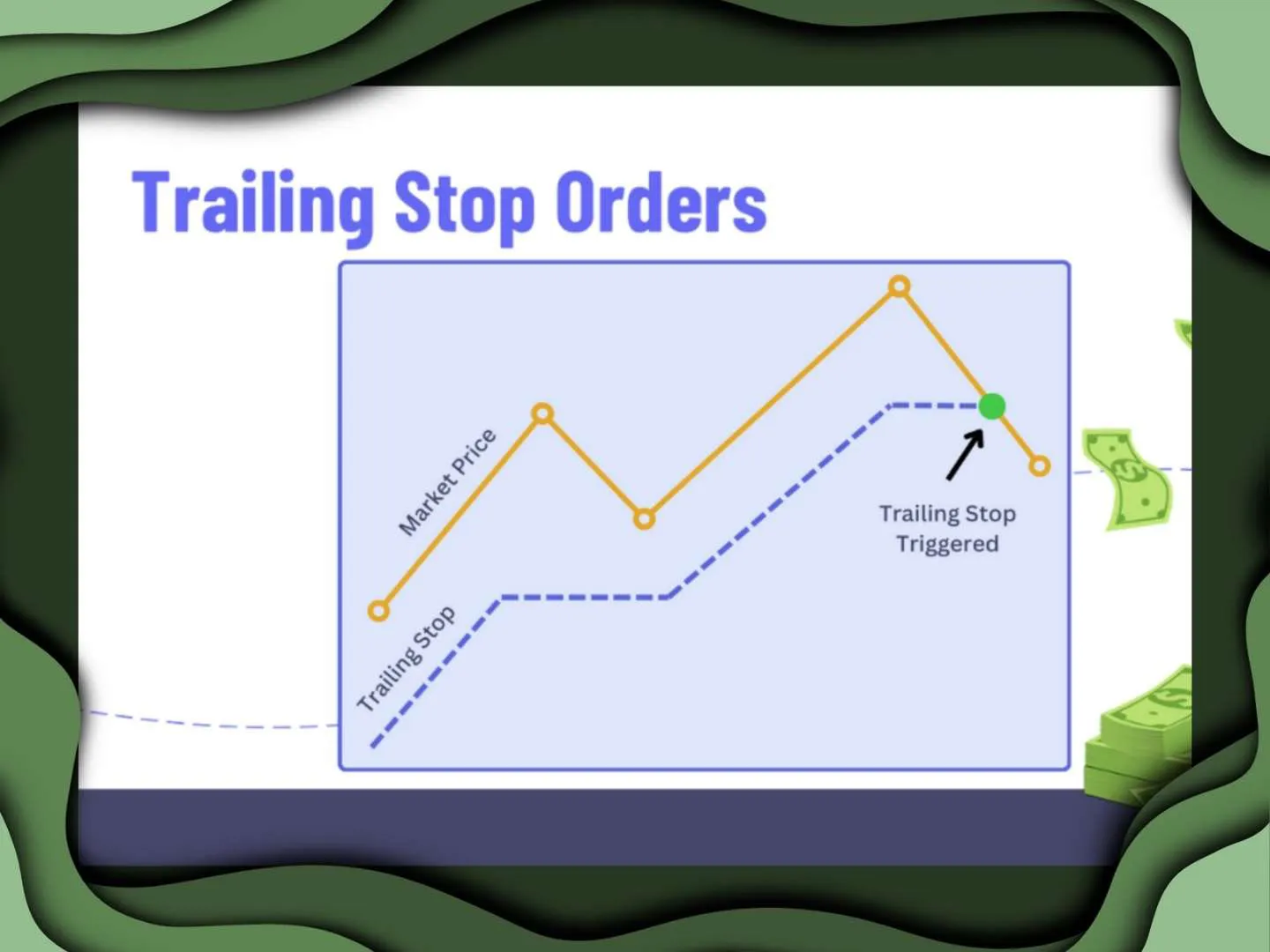

This video explains market, limit, stop & trailing stop orders.

8 min

This video walks you through placing your first trade from start to finish.

4 min

This assessment covers stocks, diversification, and the basics of investing.

14 min

Expand your investing knowledge to ETFs, mutual funds and bonds.

10 min

Learn the history of the world’s most famous financial district.

4 min

The stock exchange that financed the industrial revolution.

4 min

An intro to one of the oldest and most-watched market indexes.

10 min

Exchange Traded Funds: what are they and how to invest in them?

20 min

Learn how to trade mutual funds and the different types.

15 min

This video shows you how to trade mutual funds on the platform.

2 min

What you need to know about bonds for fixed-income investing.

9 min

This video shows you how to trade bonds on the platform.

2 min

Learn advanced trading strategies and the risks involved.

10 min

Discover the types of fees and commissions brokers charge.

15 min

This video explains how to use the platform’s built-in research tools.

8 min

Learn the basics of how to do technical and fundamental analysis.

17 min

Learn the key factors that cause market prices to change daily.

21 min

Learn how to assess whether a company is making a profit or loss.

30 min

Learn how to gauge a company’s worth by reading their balance sheet.

23 min

Discover how a company manages cash & debt to fund their operations.

19 min

Discover how to balance liquidity, risk and potential returns.

23 min

Plan your career path with this guide to financial certifications.

7 min

Learn about digital assets, from Bitcoin and other altcoins.

9 min

Calculate how compounding, inflation, and taxes impact your money.

8 min

Use this calculator to calculate the NPV of an investment.

15 min

This assessment covers bonds, funds, investing research and strategy.

10 min

This interactive tool helps you choose stocks based on real data.

12 min

A selection of lessons adapted for Canadian laws and regulations.

Learn more about our Canadian Financial Literacy Games.

Financial principles adapted for Canadian laws and regulations.

1 min

From your paycheque to the CRA, learn how Canadian taxes work.

10 min

Prioritize your future self by putting savings before spending.

9 min

Learn Canada’s credit bureaus & how they impact your finances.

17 min

From CPP to TFSAs, learn why government pensions aren’t enough.

14 min

Get the right insurance coverage in Canada without overpaying.

10 min

Simple steps to secure your accounts from theft and identity fraud.

10 min

Learn what happens when you file for bankruptcy in Canada.

9 min

A 10-chapter beginner course that covers how the stock market works, how to build a portfolio, fundamental and technical analysis and more. You can assign individual chapters or the whole course.

Students who complete all the content earn a completion certificate!

An overview of your investment options, from CDs to stocks.

Learn why the market moves and how to interpret its cycles.

Understand stock quotes, ticker symbols, and order types.

Learn how to balance rick & reward with your financial goals.

Learn when to hold, when to sell, and how to take profits.

Learn to research a stock’s underlying business and value.

Learn to analyze price and volume to identify key market trends.

Learn to navigate market hype, bubbles, and popular trends.

Learn when to use call & put options, and why investors use them.

The dos and don’ts for long-term investing success.

Schedule a brief consultation with one of our curriculum experts to discuss your specific goals, from a single personal finance class to a campus-wide financial wellness initiative.

Request More Info