Options Spreads are option trading strategies which make use of combinations of buying and selling call and put options of the same or varying strike prices and expiration dates to achieve specific objectives (hedging, arbitrage, etc.). Option spreads are complex trades, but you can place two “legs” simultaneously using this trading platform.

Trading Option Spreads

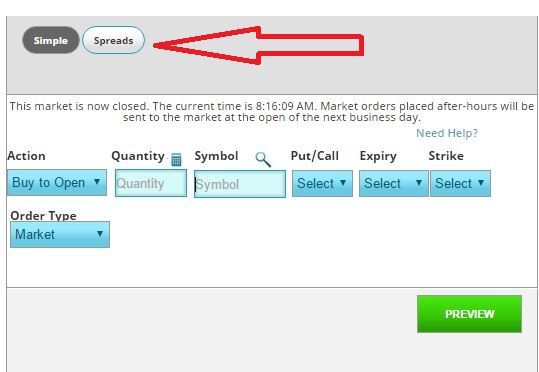

To trade an option spread instead of a simple option trade, click on “Spreads” on the options trading page:

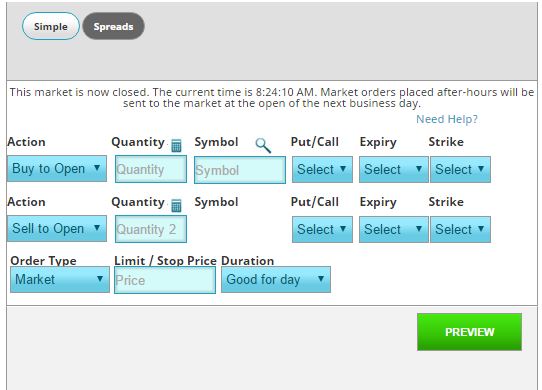

This will take you to the bigger Spreads trading pit:

For Spreads, you can notice that you are making two actions – “Buying” one contract, and “Selling” another. Both of these contracts need to be on the same underlying symbol, and both need to be a Call or both need to be a Put (you can’t have one call and one put).

One of the primary uses for option spreads is to limit your risk – by buying an option at one expiry and strike price, and selling a similar option with different strike prices and expiration, you can put a floor on the potential loss of each option (while still keeping an open ceiling).

Option Spreads Trading Tip #1: Matching Orders

You need to match 3 criteria to make an option spread:

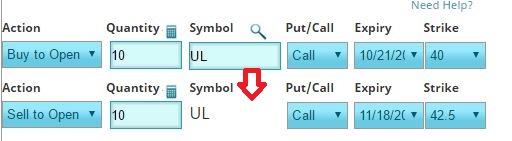

- Both of the legs in your spread need to be of the same symbol

- Both need to be the same option “type” (both calls or both shorts)

- Both legs need to be in opposing directions

Same Symbol

For matching symbol, you don’t have a choice – you will only enter your symbol once, and it is applied to both legs.

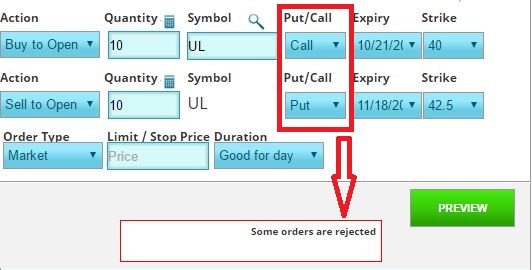

Same Type

If you do not match your option types, you will get an error: “Some Orders Are Rejected”.

Opposing Directions

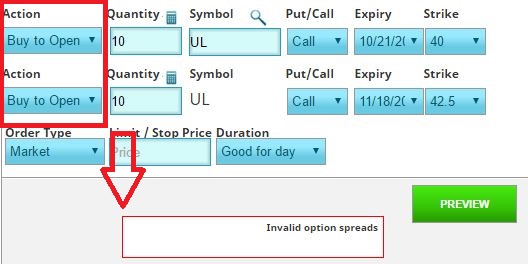

If both of your options are a “buy” or “sell”, then it isn’t really a spread! In this case, you will get an error “Invalid option spreads”.

Option Spreads Trading Tip #2: Your Orders Are Linked

When you create an Option Spread, these two orders are linked, which means one will not execute without the other.

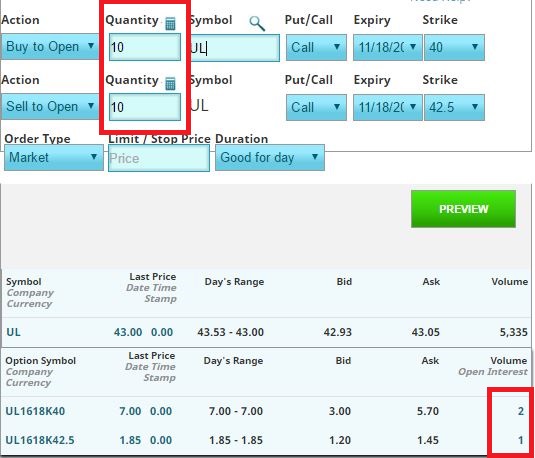

This means that the conditions for both orders need to be fulfilled in order for either of them to go through – for Options, the biggest roadblock to order fulfillment is when there is insufficient volume.

In the example below, we are trying to trade 10 of each contract, but these contracts only have a volume of 2 and 1 respectively in the actual markets. This means these orders will not fill until the volume of both the contracts I am trying to trade is greater than the quantity I am trying to trade. The exact limit is determined by your challenge administrator.

Cancelling Orders

Since your orders are linked, this means when you cancel one order, the other will be cancelled as well. Keep this in mind when browsing your Order History page.