Definition

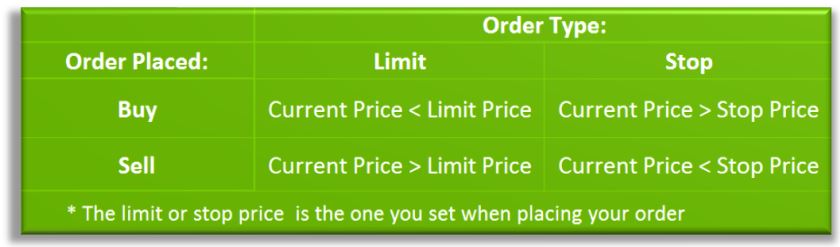

A Stop (or stop loss) order and limit order are orders that try to execute (meaning become a market order) when a certain price threshold is reached. Limit and stop orders are mirrors of each other; they have the same mechanics, but have opposite triggers.

When creating a limit or stop order, you will select a ticker symbol and quantity, just like a market order, but you will also select your “Target Price” as well. The target price is the price that triggers the limit or stop. Setting a target price does not guarantee you will get that price, it just means a market order will be created at that time. If there is not enough volume in the market to fill your order, it still may not execute.

Limit

A limit order will set the maximum price I am willing to buy(cover) at or the minimum price I am wiling to sell(short) at.

Example

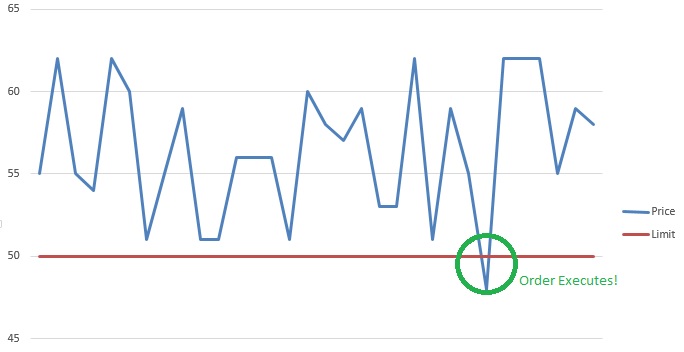

Let’s say Verizon (VZ) is at $50, but you think it is overpriced and want to buy it once it falls. By setting a limit order at a target price of $45 we can wait until the price reaches that without having to sit in front of a screen. As long as the price is greater than $45 it will not execute. As soon as the price drops to $44, your stop order becomes a market order, filling at $44.

Here is a chart showing how a “Limit Buy” order works, showing a sample stock’s price over the course of a day:

Stop

A stop order will set the minimum price I am willing to sell, or short a stock. It can also mean the maximum price at which I am willing to buy, or cover.

Example

Let’s say you own PayPal stock (PYPL) that you bought at $25. If the current price is $31, you want to keep holding the stock in case the value continues to rise, but you do want to protect the gains you made.

You can put a “Stop Sell” order with a target price of $30, so if the price of the stock falls to $30, you will be protected from any more losses. If the value continues to rise, you will continue to hold the stock.

The table below can be an easy reminder of when a stop or limit order will execute.

Uses

Stop and limit orders will help you protect you from loss, or help you take advantage of a gain, as well as give you access to more advanced trading strategies.

One of the greatest advantages of stop and limit orders is that they can be set and left with Good Til Cancel (GTC) order expiration, and thus you don’t have to watch the stock price constantly to get well-timed trades. If prices change past your limits, the orders will execute automatically, giving you less to worry about.

This also means that you can build a much wider portfolio. If you do not need to constantly watch the price of every single one of your holdings and watchlist items because you have already set up limit and stop orders based on your preferences, you can have a much larger range of symbols on your “radar”.

Another important use is that you can take some of the emotion out of your trading. By setting limits and stop orders beforehand, you don’t have to “panic sell” or “panic buy” to take advantage of price swings; you already will have standing orders ready to spring into action when your pre-determined criteria are reached.