The mere perception that a market is becoming Bearish is not a predictor of disaster. Fortunes have been made in Bear MarketsA prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices.. The trick is to know when one is coming and react appropriately.

The mere perception that a market is becoming Bearish is not a predictor of disaster. Fortunes have been made in Bear MarketsA prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices.. The trick is to know when one is coming and react appropriately.

If you can learn to anticipate market trends before they occur, you will become a very successful investor.

Be careful though. Timing, which can make or lose you money, is not easy to master. There is no underlying secret to getting it right.

Because timing markets requires you to be correct twice: first when you buy a stock at a cheap price and a second time when you sell it back at a higher price. Most investors have a hard enough time simply buying low, let alone selling high.

This difficulty in market timing has led many investors to adopt a “Buy and Hold” strategy where they buy a stock and hold it for as long as it is profitable. When famed billionaire investor Warren Buffet was asked how long he likes to own a stock, he shot back, “Forever.”

Also, remember that there can be serious costs if you have poor market timing. Unlike some other investments (e.g., real estate), stock trading often comes with a short clock. Prices can change – for better or worse – very quickly. Even expert stock traders experience losses because of timing. The best thing an investor can hope for is merely to be right a bit more often than be wrong.

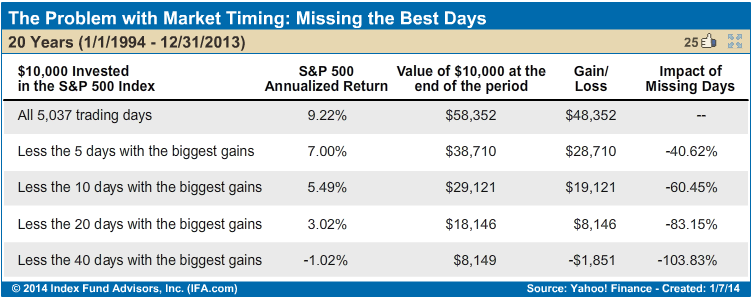

The table below shows that over 5,037 days (a 20-year period from 1994 to 2013), $10,000 invested in an S&P 500 index would have generated a gain of $58,352.

If an investor tried to time the market and missed the top 20 days with the largest gains in that 10-year period, they would have ended up with a different result—a loss of $360! Missing just 5 of the biggest days drops your annually return from 9.22% to 7.00%.

Nevertheless, don’t let the dangers of timing the market dissuade you from trying to learn and recognize the trends in order to buy low and sell high.