When trading mutual funds on this system, there are a few differences to keep in mind compared to trading stocks.

Trading Tip 1: Quantity = Dollars!

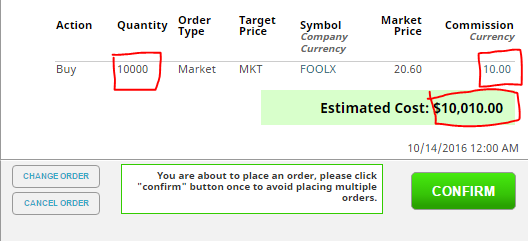

Unlike stocks, where you specify the number of shares you want to purchase, with Mutual Funds you specify how many dollar’s worth a mutual fund you want to buy.

This means if you want to buy $10,000 worth of that mutual funds, your quantity will be $10,000:

Trading Tip 2: End Of Day Order Execution

Unlike stocks, mutual funds do not trade throughout the day. If you place your “Buy” or “Sell” order for a mutual fund before the market closes (4:00pm New York Time), your order will execute around 6pm in the evening. This is the same as the actual markets – mutual fund managers are typically re-balancing the portfolio throughout the day, so the NAV (Net Asset Value) is not known until after the markets close, so the buying and selling of shares of the fund can only happen after the markets close.

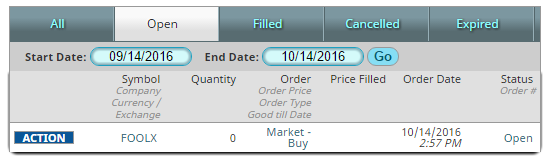

If you enter an order for a mutual fund before market close, it will appear as an “Open Order” on your “Order History” page:

Take note that the “Quantity” is showing zero – this is because we won’t know until after the market closes and your order executes how many shares of the fund can be purchased with the dollar amount you wanted to spent.

Trading Tip 3: Fractional Quantities

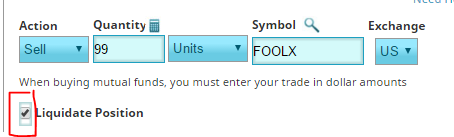

Since the dollar amount you purchased will almost never give a round number of shares, you can own fractions of a share of a mutual fund. This mean when you sell it off, you should check the box on the trading page to “Liquidate Position” to make sure it is selling your entire position: