When would I use this strategy?

A Covered Call Strategy is for investors who feel that the stock price will either remain stable or will grow. This strategy is NOT for investors who think the price of the stock will go down.

How do I execute this strategy?

The strategy entails two steps:

- Write a call option

- Buy the appropriate number of underlying stocks

How does a Covered Call work?

The reason the strategy is called a “covered” call is because the call option that is written is “covered” by the underlying stock in case the person on the other side of the option exercises it.

The best way to explain how the covered call works is to use an example.

Let’s say we are using Bank of America (BAC:NYSE) to write a covered call.

Remember, for a covered call, you write the option and you buy the stock:

Write one $15 call option (Option multiplier is 100): $2.50 X 100 = $250 Inflow

Buy 100 shares of the underlying stock to cover the written call option: $10 X 100 = -$1,000 Outflow

Scenario 1: After one month, the option expires and the price of BAC has doubled to $20

Chances are that the $15 Call Option you wrote would get exercised. This means that you HAVE to sell your underlying stocks for $15.

Your inflow: $15 X 100 shares = $1,500

By putting together your total inflows and outflows, we get:

1,500 + 250 – 1,000 = $750

That’s great!! You made $750!!!

Scenario 2: After one month, option expires and the price of BAC remains the same at $10

Chances are that your option will not get exercised.

You can choose to keep or sell the underlying stock. Lets say you decide to sell it.

Your inflows will be: $10 X 100 share = $1,000

You are better off by:

$1,000 + $250 – $1,000 = $250

That’s still great! You made $250!

Scenario 3: After one month, option expires and the price of BAC has dropped to $5

Your option will definitely not get exercised. But the stock that you hold has dropped in value. Lets see how badly it has affected your strategy.

If you sell your stock, your inflows will be: $5 X 100 shares: $500

You are worse off by:

$500 + $250 – $1,000 = -$250

That’s not good. You just lost $250 from your own pocket.

Visualize This

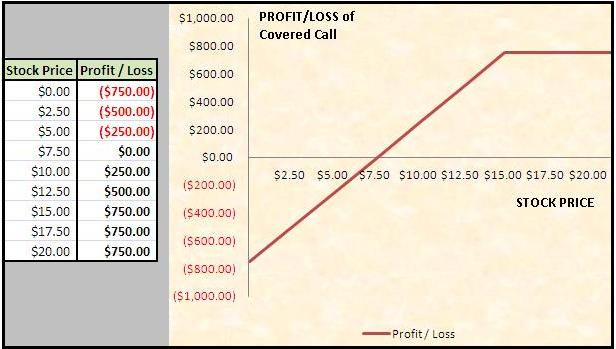

You can see what effect the price of the BAC stock has on the overall profit /loss of the covered call strategy below:

Another use of the Covered Call strategy

The covered call strategy is also used as a form of hedging or insurance by investors. These investors are banking on the price of the stock to go down, but want to feel safe in case the price turns against them.

This is different to the way covered call is used in the example above as the goal for that was to make money from an option exercise. The goal for this strategy is to cut your losses if the market turns against you.

Keep in Mind

A covered call is a better option than writing a naked call option, even though it might cost more up front to purchase the underlying stock.

Margin Requirements are lower than for writing a naked option as you are covered incase the market moves against you.

While the maximum amount of money you can make with this strategy is limited, the chances that you will make money becomes greater for you if you find the right option to write at a favorable strike price. For more information about writing call options, visit an introduction to writing call options.

Like anything you invest in, careful analysis is key.