Investor sentiment, sometimes also called market sentiment, typically relates to the stock market’s “attitude” towards specific securities, industries, or overall market conditions (bullish, bearish, or neutral. While of limited importance to a buy-and-hold investor, investor sentiment can be an effective tool if you decide to live in the fast lane by adopting a day or Swing tradingIdentifying “channels” or “tunnels” of price movements on a stock’s chart and then buying when the price gets to the bottom of the channel and selling when it gets to the top, usually over a few days. strategy.

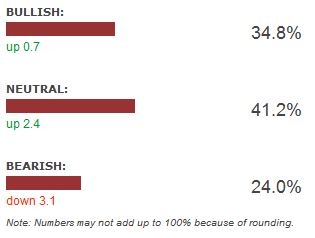

In the short-term, investor sentiment can affect market prices to a large degree. There are even companies, like Chartcraft, that publish “investor sentiment indexes” to indicate the level, positive or negative, of investor and market feelings.

As a newer investor, if you can get a sense of the investment community towards your stocks, you will have good information to make better trades. Even if investor sentiment is bearish (predicting a down market), you can adjust your strategy to make profitable trades in the short-term.

As a newer investor, if you can get a sense of the investment community towards your stocks, you will have good information to make better trades. Even if investor sentiment is bearish (predicting a down market), you can adjust your strategy to make profitable trades in the short-term.

Mark's Tip