Volatility is a concept that involves all stocks and other securities. For good reasons, high volatility is most often viewed as a negative in the investment world since rapid movements in market prices inherently involve both wins and losses. In investment language, volatility implies two scary conditions for you: uncertainty and risk.

Volatility is a concept that involves all stocks and other securities. For good reasons, high volatility is most often viewed as a negative in the investment world since rapid movements in market prices inherently involve both wins and losses. In investment language, volatility implies two scary conditions for you: uncertainty and risk.

For example, if you are smart (lucky) enough to buy at a stock’s “bottom,” positive volatility (a rapid price rise) could generate wonderful profits for you. Negative volatility, on the other hand, could make you less than pleased as the price of a stock swiftly falls.

Avoid a common misunderstanding that volatility also equals a trend up or down. It does not. Volatility is neither good nor bad, nor does it automatically indicate a trend. It simply measures the speed of price movement.

Everyone likes volatility to the upside (when the market rises quickly), but rarely to the downside (when the market is crashing).

As you’ll see, volatility is a key component in pricing options since the option writer has a great deal of interest in the likelihood of a large price swing (up or down) in the underlying security.

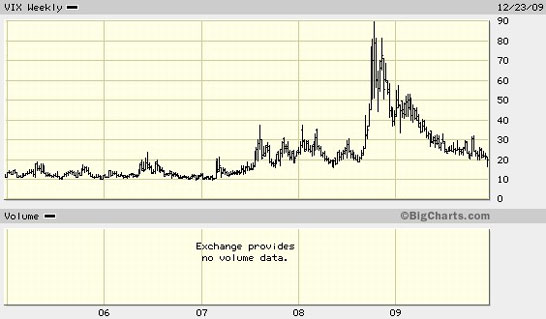

The general indicator for volatility in the stock market is called the VIX index and it measures the premium that options writers assign to stock market volatility. The VIX index is often called the “fear index” because the VIX will rise when the stock market is falling which simply reflects the higher premium option writers are demanding when they write put options The right, but not the obligation, to sell a stock at a certain price before the expiration date. as investors scramble to buy insurance policies (put options) for their stocks.

Historically, the VIX has been in a range between 10 and 20, but during the rocky stock market swoon in late 2008 and 2009, the VIX was more frequently in the 20- 30 range and even hit a high of 90 in October 2008 when investors feared the world was ending and the financial system was said to be at the brink of collapse.

The important thing to remember about the VIX is, when it is high, options become expensive to buy as the implied volatility in the options price rises. We’ll look at implied volatility next…