Put and call interest does not involve the banking definition of interest, but the market excitement – or lack thereof – regarding puts or calls for a security. Before you start thinking we’ve all lost our analytical minds, try to understand that market prices for stocks and put/ call options The right, but not the obligation, to buy a stock at a certain price before the expiration date. are not totally based on sophisticated mathematical formulae and superior financial modeling software.

Just as the market adopts a Bull or Bear mentality for either good or undefined reasons, it reacts similarly to put and call options for different securities. Even if you spend hours at your laptop computer analyzing all available scientific data, the “mood” of the market must still be factored into your investment decisions, including buying or selling options.

For example, you’re considering call options on a few securities. You learn that much of the market is not in favor of these options on these stocks. On one hand, this may mean you can make beneficial deals on these options, as the “option price” will be lower than you thought. However, you also need to consider the reasons for this lack of popularity.

Might it affect the strength of your future purchase price on the negative side? Or, are you simply making a wise option purchase that might mean higher profits for you? Are there many more put than call options? Does the market, as a whole, believe the stock price will decline? Are their conclusions legitimate? Are they wrong, based on your analysis?

Interest, in this sense, is important for you to consider. It should not “dictate” your decision to execute a put or call option. However, you should consider the interest level in both put and call options as an indicator, along with your other evaluations, of what a stock might do, which is either increase or decrease.

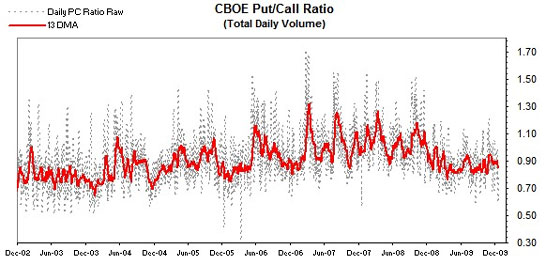

The Put verses call interest can also be used to measure market sentiment overall. When more investors are buying calls than puts, sentiment about stocks is generally bullish and they believe stocks will rise in the future. When more investors are buying puts, this indicates a bearish sentiment that stocks will fall. The historical average for investors to buy Puts verses Calls is, not surprisingly, about equal, for a 1 to 1 ratio.