As students work through the PersonalFinanceLab Budgeting Game, they can see their class rankings, and might have some sense of how their game score or net worth has grown over time. But to really get a clear picture of how their financial future is shaping up, wouldn’t it be nice if there was a single place where they can get feedback on their decisions and see how their finances have fared over time?

Introducing The Budget Game Summary

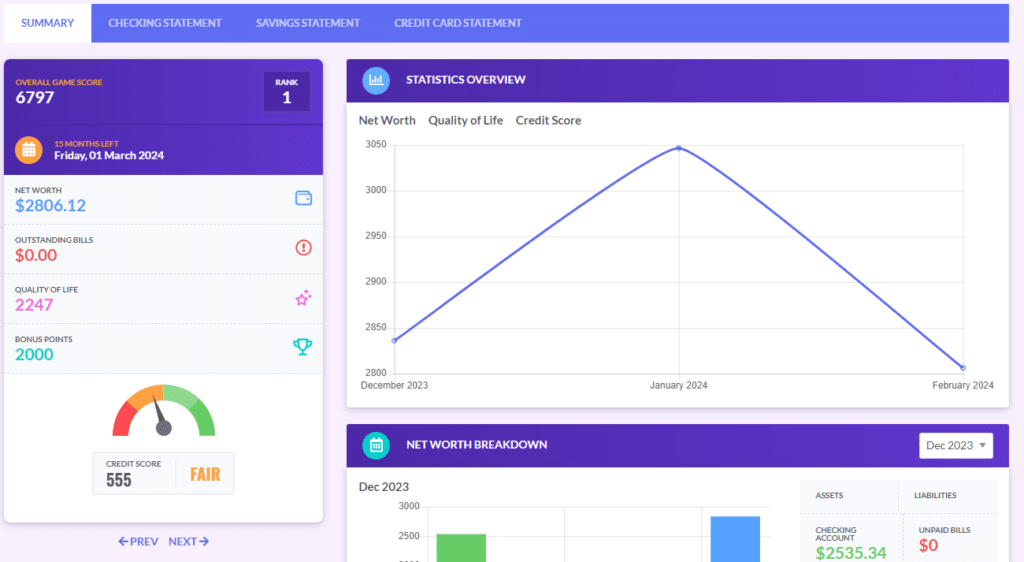

The Budget Game Summary is a report available to all students, giving them a breakdown on how their game has evolved so far. It consists of 4 modules: the Feedback Module, Statistics Overview, Net Worth Breakdown, and Recent Transactions.

Budget Game Feedback Module

The Feedback Module gives students personalized feedback on how they have performed so far in the Budget Game. This module is similar to the feedback students receive at the end of each month of the game, but encompasses their performance through the entire game (not just one month).

The Feedback Module has 6 components:

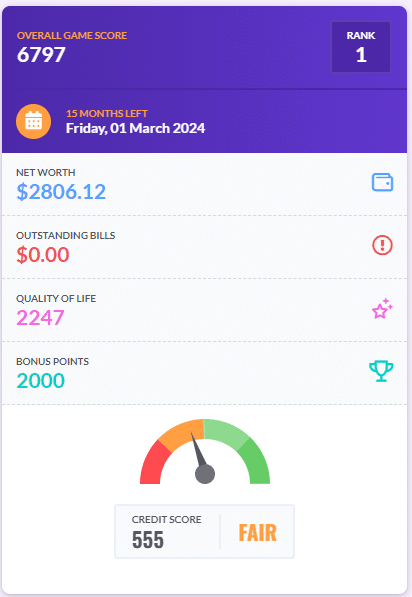

General Stats

The General Stats shows some of the same information that students see in the “ribbon” at the top of the budget game itself.

What is new here is their total “bonus points” (points they earned from hitting monthly savings goals and building their emergency fund), plus a gauge indicator for their credit score.

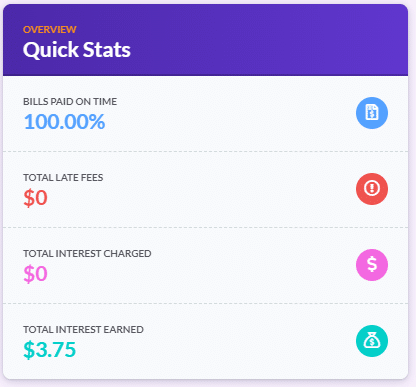

Quick Stats

“Quick Stats” is more about what students have accomplished financially through the whole game, in terms of big metrics that can really make-or-break their financial future.

- “Bills Paid On Time” is how many total bills they recieved that were paid on or before their due date.

- “Total Late Fees” is the total amount of money they paid out in late fee penalties through the game.

- “Total Interest Changed” is the total amount of interest payments they have made on their credit card through the entire game.

- “Total Interest Earned” is the total amount of interest earned on their savings account throughout the game.

Savings Goals

Savings Goals looks at how many months the student has played the game, and how often they set, and hit, achievable savings goals.

The system provides personalized feedback based on areas of improvement – particularly if they need to be more aggressive or more conservative with their goals, and tips on how to do better in the future.

Emergency Fund

One of the primary objectives of the budget game is for students to understand the importance of building an Emergency Fund. If students had not yet saved up a $1,000 cushion, the system will give them a reminder of how important this is, and to focus on building that safety net in the future.

Credit Score

Credit Score Feedback is based on how many total credit score points a student could have earned so far in the game, and gives them tips on what they can to to continue to improve in the future.

For example, this “555” credit score is after having played 3 months of the game (where students start with 450, this student has already improved their score by over 100 points), saying there has been an excellent use of credit. However, if after 5 or 6 months, the credit score has not continued to improve, the feedback would give specific examples of what steps they need to take to do better going forward.

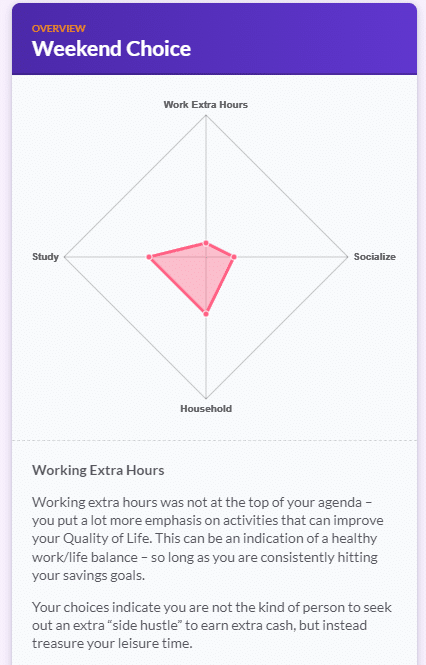

Weekend Choice

Last, students get a polar area chart of how they have chosen to spend their weekends throughout the game so far, so they can visualize how they have been spending their time.

The system also gives them personalized feedback in each of the 4 categories, outlining how they use their “free time” is likely to impact their personal finances in the real world.

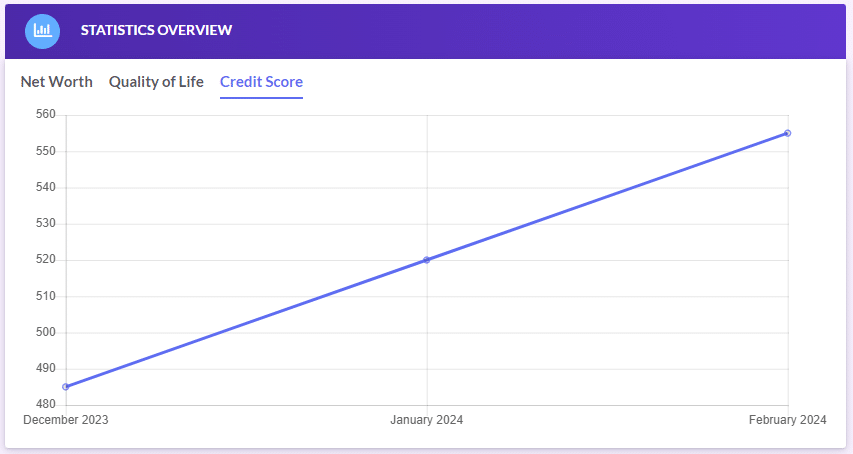

Statistics Overview

The next module gives students a line chart on how their key financial indicators have moved over time, namely their Net Worth, Quality of Life, and Credit Score. The data used for the chart is what their values were for each of these metrics at the end of each month of the game.

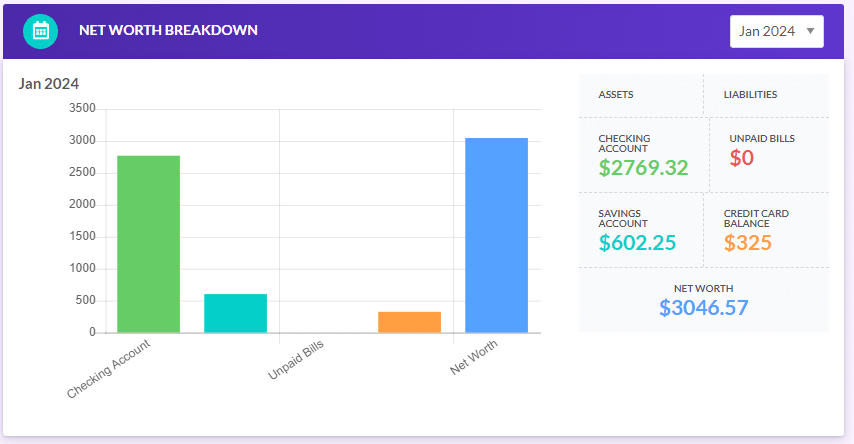

Net Worth Breakdown

Next, they can see a breakdown of their Net Worth, for the month-end of every month of the game. We break down their Net Worth by 4 categories: their “Assets” of their checking and savings accounts, vs their Liabilities of any unpaid bills or amount due on their credit card.

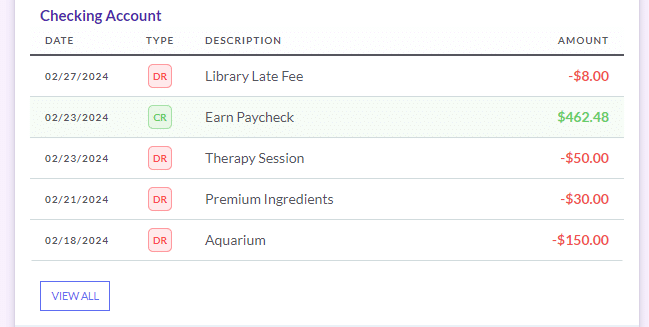

Recent Transactions

The last module is a snapshot of their 5 most recent transactions in their Checking Account, Savings Account, and Credit Card – with quick links to jump straight to each of those Statements for more information.

Conclusion

The Budget Game Summary is the secret weapon to helping students truly understand the financial impact of their decisions, and how they can improve in the future. This should be a quick-stop-review for each student every day they are playing the game to make sure their financial future is secure.

Happy Learning!

-The PFinLab Team