To celebrate the New Year, everyone here at PersonalFinanceLab is excited to announce our brand-new calculators, available now for all Personal Finance classes as part of our Financial Literacy Curriculum!

About The Calculators

Each calculator was developed and released to be part of a lesson on financial literacy – this semester we focused mainly on compound interest, loans, and debt repayment.

Note: to preview each calculator, you will need to log into your PersonalFinanceLab teacher account. If you do not yet have an account, sign up for our Teacher Test Drive to try it out!

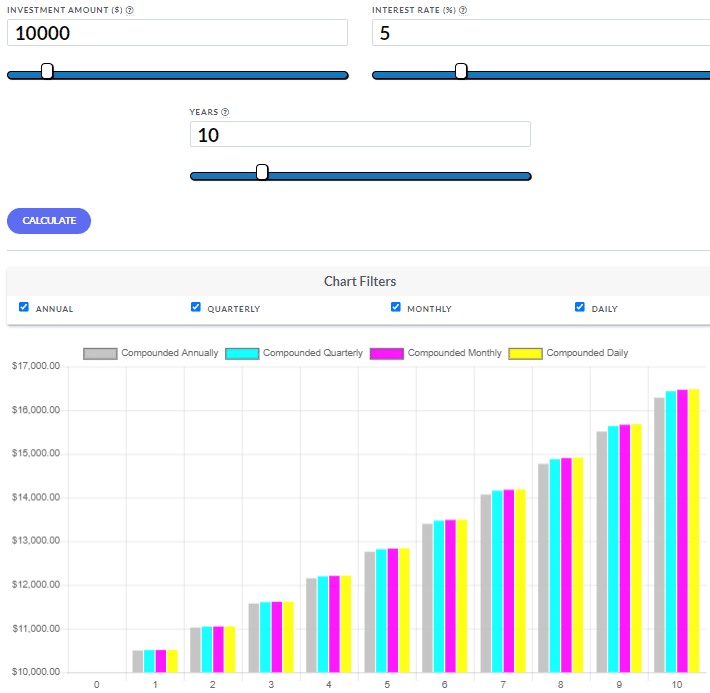

Compound Interest Calculator

This was the first new calculator we released back in the Fall of 2024. This basic calculator shows how an investment grows over time, and even includes a breakdown of how different types of compounding impact how an investment will grow.

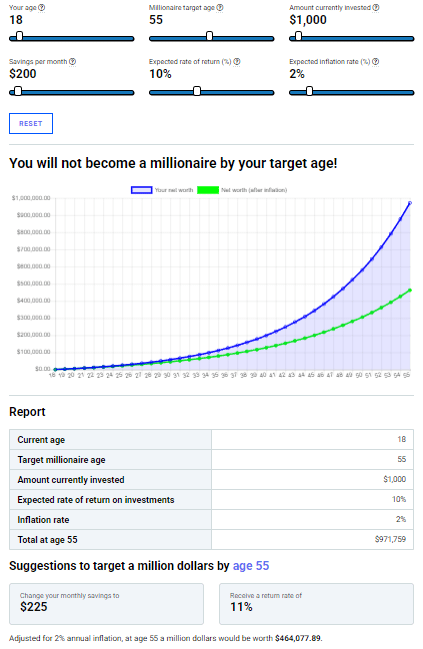

Saving to be a Millionaire Calculator

Our Saving to be a Millionaire calculator has been one of our most popular for almost 10 years – which is why this semester we released a huge update and modern version for classes!

The Millionaire Calculator asks students their current age, target age, how much they can afford to save each month, and how much they expect to earn on their investments. It then projects out into the future to see if they can reach a million dollars by their target age. If not, it provides suggestions (such as increasing your monthly savings, or targeting a higher rate of return) to try to help hit their goal.

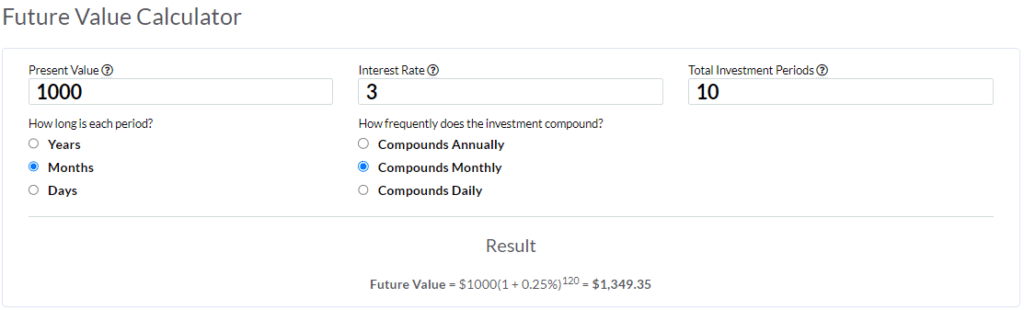

Future Value Calculator

Our Future Value Calculator is an addition to one of our new financial math lessons on – you guessed it – future value! This simple calculator shows students how much a potential investment will be in the future, including factoring in different types of compounding.

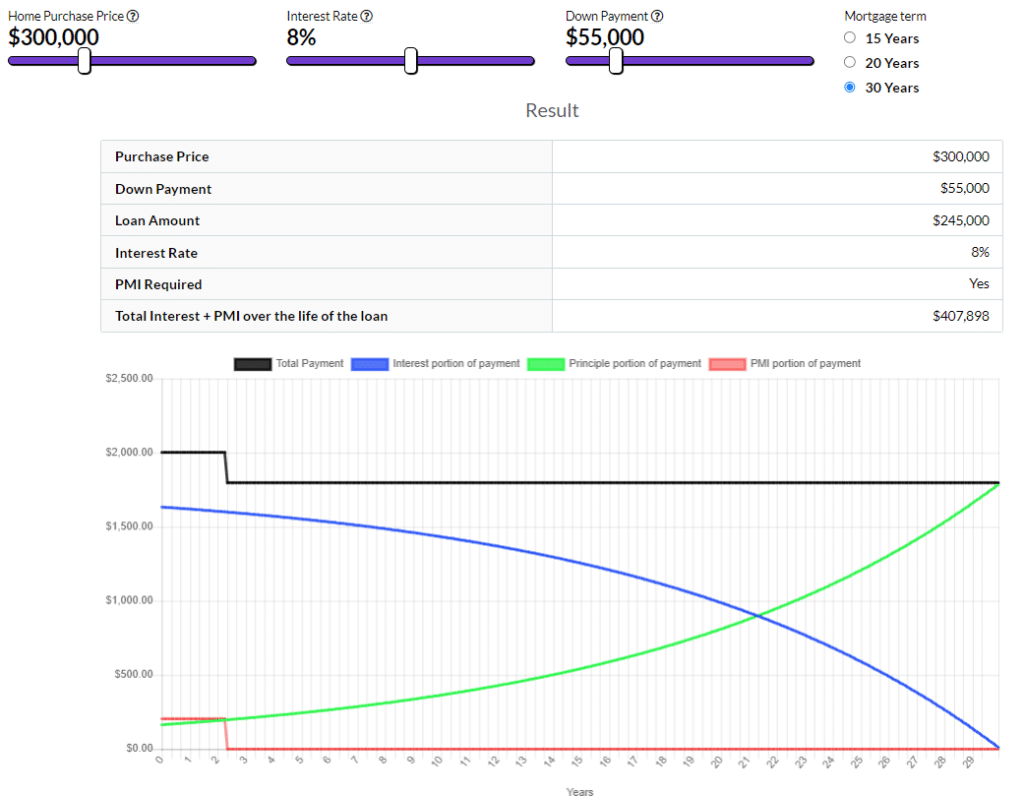

Mortgage Calculator

Our Mortgage Calculator is a feature in our new financial math lesson on Mortgage Math and Ratios, and shows students their amortized payment breakdown for the entire duration of a mortgage loan. Students can choose their home price, interest rate, down payment, and even mortgage term. What sets this calculator apart is that it even includes PMI as a factor in payments, until PMI is no longer required.

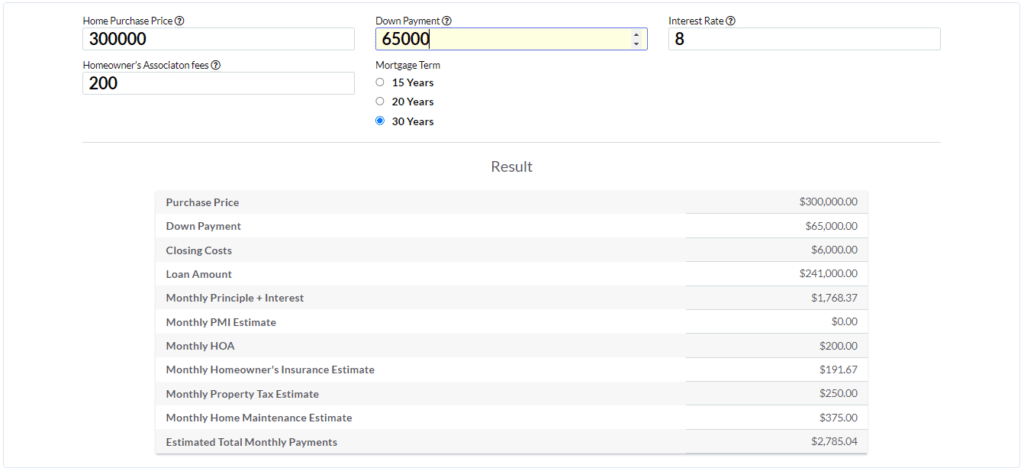

Mortgage Payment Calculator

Our Payment Calculator is the first calculator we introduced as part of our Rent vs Buy financial math lesson. This calculator replicates the “PMT” function of common spreadsheet applications, but is supercharged specifically for mortgages by also including homeowner’s association, home maintenance costs, PMI, and escrow (property tax and homeowner’s insurance) payments into the combined function – giving students a much more accurate picture of how much monthly costs to truly expect when buying a home.

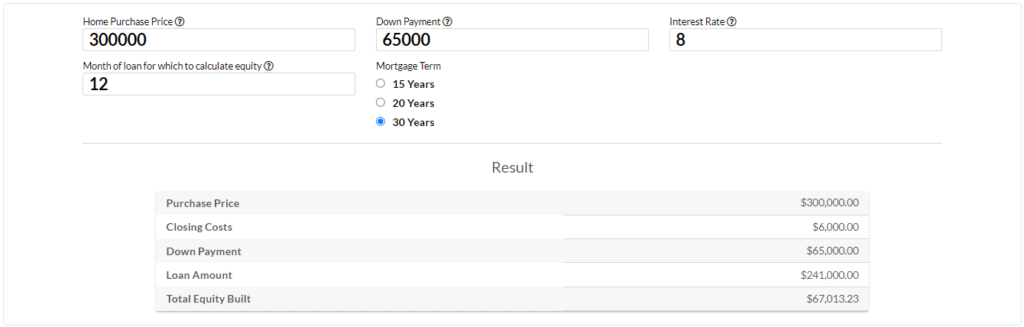

Equity Calculator

Our Equity Calculator is the second calculator we introduced as part of our Rent vs Buy financial math lesson. This calculator is used to illustrate to students how making regular payments on an amortized loan builds up equity over time – and that equity is an important factor in the final take-home cash when selling a home.

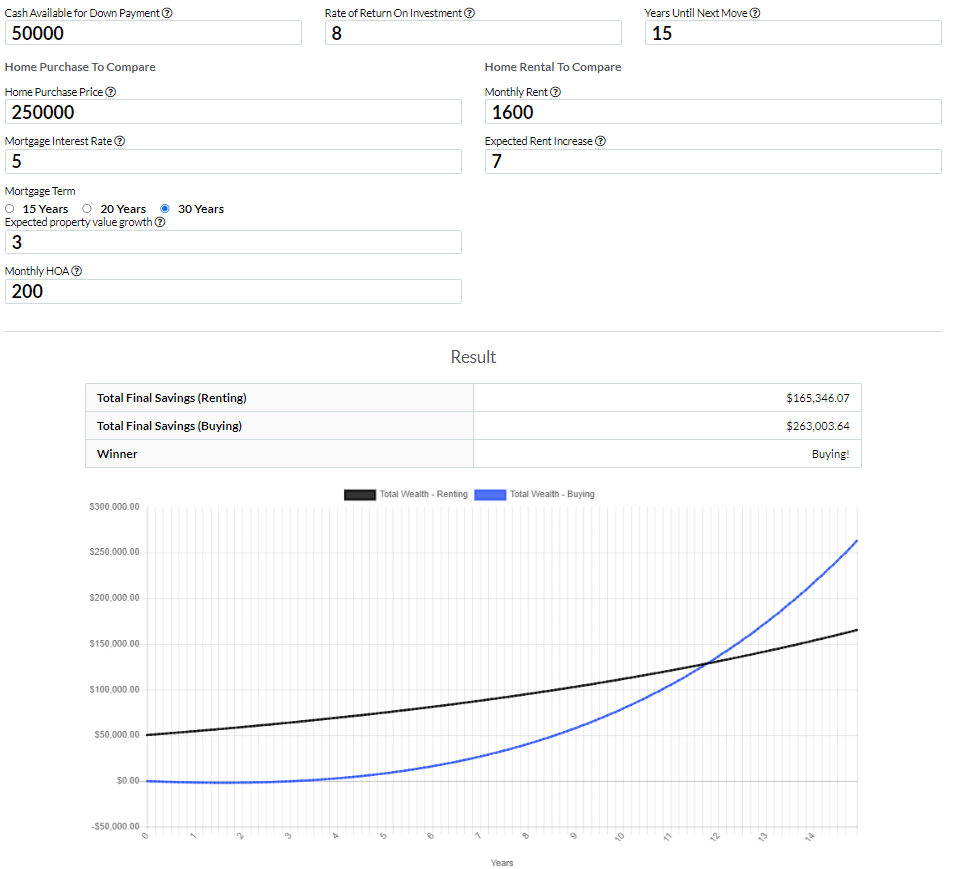

Rent vs Buy Calculator

This is the final calculator we introduced as part of our Rent vs Buy financial math lesson. This calculator combines the detail of the Mortgage Payment Calculator, the equity built over time from our Equity Calculator, and uses Future Value calculations to project a person’s net worth if they were to rent (investing the cash they have available in down payment now) vs buy (using money saved from total mortgage payment being less than rent to invest in the future).

It then provides students with a clear projection of both scenarios based on their inputs (including how long until they next plan to move), and a clear “winner” for their own personal situation!

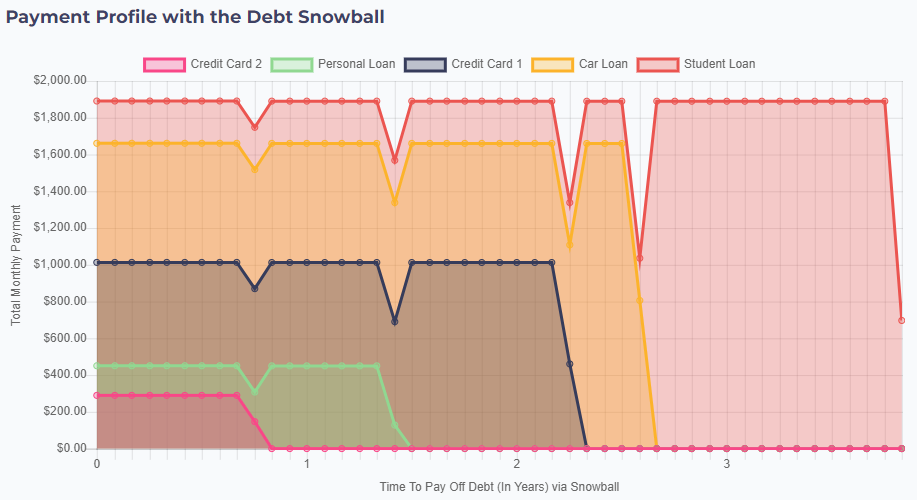

Debt Snowball and Avalanche Calculator

This calculator is a cornerstone of our new lesson on the Debt Snowball and Debt Avalanche accelerated debt repayment strategies. This calculator takes a set of existing debts (which may be amortized – like a car loan, or revolving – like a credit card), and applies both the Debt Snowball and Debt Avalanche repayment strategies to each, so students can visualize how their debt repayments might differ (including which is the cheapest total and which gets out of debt the fastest for their unique scenario).

We have new calculators (and updates to our old ones) coming throughout the Spring and Summer – we hope you are excited to use these in class as we were to build them!

Happy Learning!

-The PersonalFinanceLab Team