How does the Challenge Work?

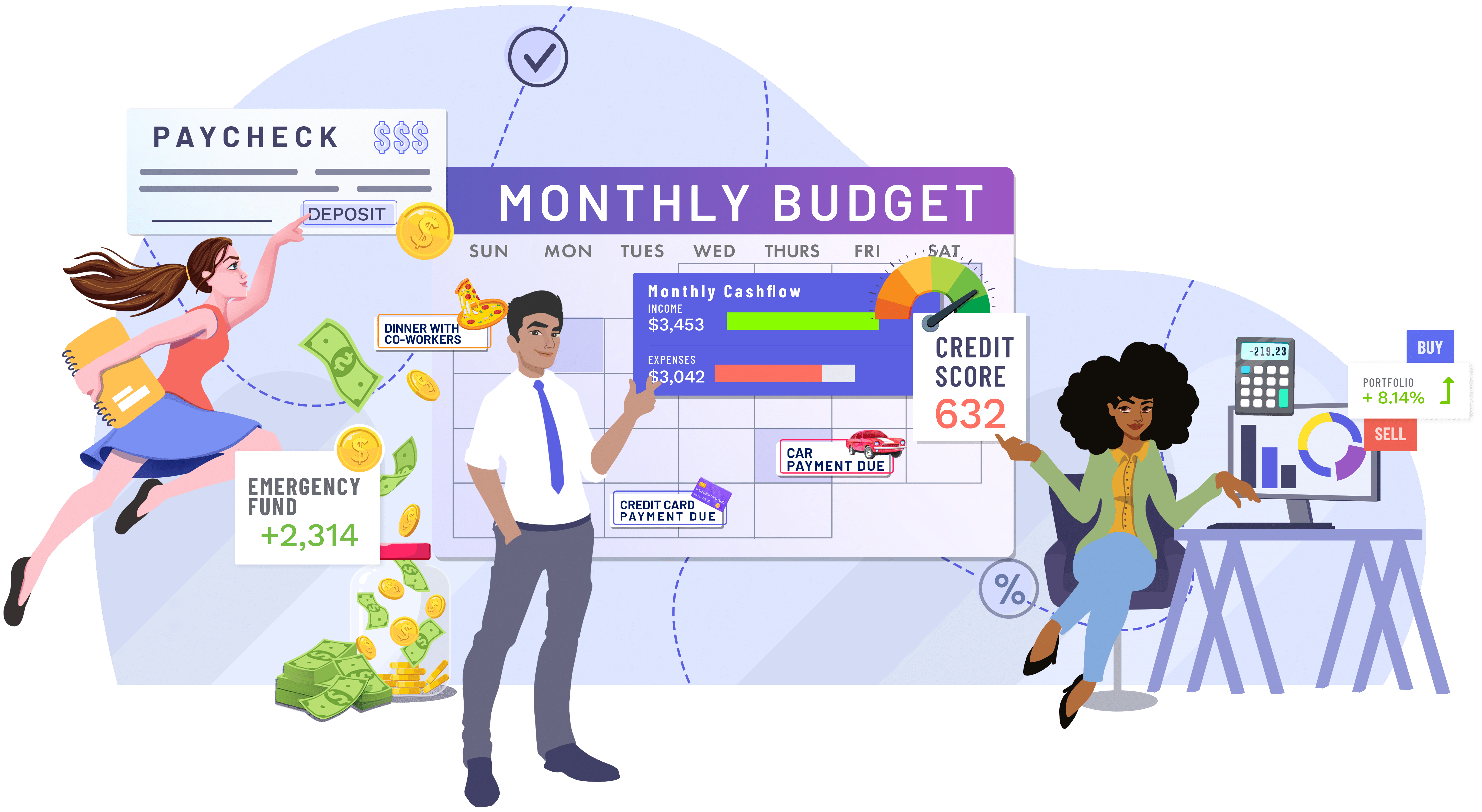

This is a free competition where students learn through playing an engaging budgeting game, and a real-time stock market game, with national rankings and prizes!

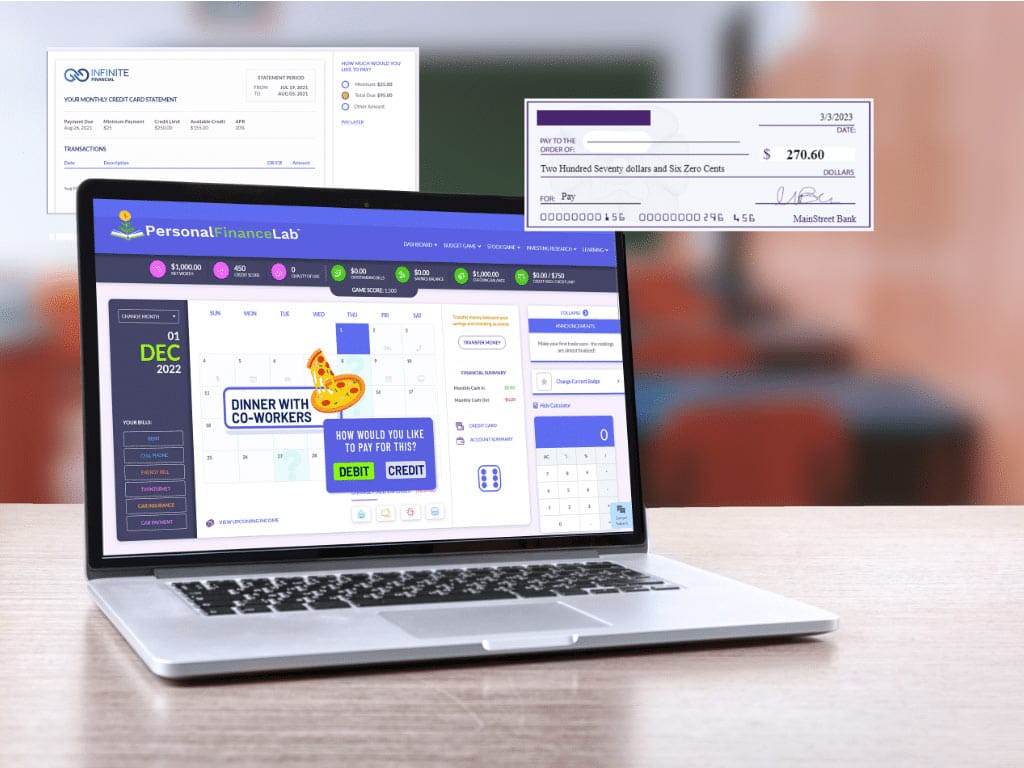

Students participate in our Budgeting and/or Investing games, starting with $500 in their investing account, and $500 in their checking account. Students can play through our budgeting game to earn (and save) more money, which can then be invested in their Stock Game portfolio.

If you are already using PersonalFinanceLab in your class this Spring, you do not need to register separately. Your students will be prompted with an invite to join when they log in during the registration and contest period.

If you are not already using PersonalFinanceLab this Spring but received a special invitation to join, or want to invite students who are not already using PersonalFinanceLab in their classes, see the FAQ information below for registration details.

Register Now!