What are they doing with your money? Have you ever wondered how well your money is really being managed by the corporations you hand it over to?

After all, the media is full of stories about CEO compensation reaching new heights, buy-outs of non-profitable holdings, million dollar birthday parties and other horror stories.

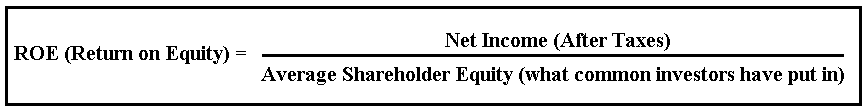

Formula for ROE

What is ROE used for?

Return on Equity (ROE) is used to measure how much profit a company is able to generate from the money invested by shareholders.

Think of this way; if your friend asked to borrow $1,000 to start-up a small side business then chances are you would comply. When they came back to ask for $10,000 you would examine how well they performed with the initial $1,000 before making the next loan.

It makes such good sense that you might wonder why more people don’t use this handy little measure before pouring massive sums into a money pit masking as a company.

What kind of ROE to look for

Join the ranks of those in the know. ROE is easy to compute and provides valuable insight into the workings of the company.

Think twice before investing in a company with a negative ROE. Instead, search out self-sustaining companies with a healthy ROE that indicates the willingness and ability to use invested dollars for future growth rather than operating expenses.

A good ROE is 15% or better so keep your eyes – and ears – open for opportunity.

DuPont Analysis and the need to break down ROE

ROE measures what kind of income can be generated for a given level of equity injected into the company. It is essential to understand that different sections of the company that return is generated from.

This in turn will help investors identify where their equity is being used wisely, and where it is being wasted in trying to generate income.

You need to perform a DuPont Analysis to identify where equity is going and returns are coming from.