Summary

Options are exciting investment “vehicles,” but to be used profitably, you need to understand what they mean and what they can or cannot do for you. You have now scratched the surface of the option world.

You’ve now reached a level that gives you some ammunition and skills to play the basic options game. You have some valuable tools that give you the chance to win, too.

Glossary

- The Black-Scholes Model:

- The most generally accepted option pricing model.

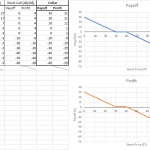

- Call Option:

- The right, but not the obligation, to buy a stock at a certain price before the expiration date.

- Covered Call:

- Writing/selling a call option on a stock that you currently own.

- Expiration Date:

- The date that the option expires, usually the 3rd Friday of the month in the U.S.

- Naked Call:

- Writing/selling a call option on a stock that you do NOT currently own.

- Put Option:

- The right, but not the obligation, to sell a stock at a certain price before the expiration date.

- Strike Price:

- The price at which the option contract can be executed.

- Time Decay:

- The reduction in an option price that occurs over time due to the reduced chance of a big price movement in the underlying stock.

Further Reading

- An Introduction to Trading Options

- How to Read an Options Table?

- How do you Find an Option Ticker Symbol?

- What is a Call Option?

- Implied Volatility

- At-the-Money

- Covered Call Writing Strategy

Exercise

In your virtual trading account:

- buy a call option on a stock that you think is going to go up

- buy a put option on a stock that you think is gong to go down

- write an out-of-the-money covered call on a stock that you have in your portfolio and see if it expires worthless

- buy a put on a stock that you have a profit on and try to lock in those profits

Teacher Introduction Webinars

Teacher Introduction Webinars Lease Terms

Lease Terms Collar Spreads

Collar Spreads Price to Earnings Growth (PEG)

Price to Earnings Growth (PEG)