| Loans |

| | | | | |

| Compare and contrast credit, savings, and investment services available to the consumer from financial institutions. |

Lesson – Banks, Credit Unions, and Savings and Loans

| | | | | |

| Recognize that banks and other financial institutions are businesses that loan funds received from depositors to borrowers. |

Lesson – Banks, Credit Unions, and Savings and Loans

| | | | | |

| Recognize that a credit card purchase is a type of loan from the financial institution that issued the credit card, that financial institutions may charge a fee for credit card use, and that credit card interest rates tend to be higher than those for other types of loans. |

Lesson – Credit Cards

Lesson – Using Credit

| | | | | |

| Research and report on the long-term consequences for borrowers of failure to repay loans, such as negative entries in a credit report, repossession of property, garnishment of wages, the inability to obtain loans in the future, and bankruptcy. |

Lesson – Managing Debt

Lesson – Short-Term Financing

Lesson – Bankruptcy

| | | | | |

| Explain a consumer’s rights for full disclosure of credit terms for a loan and for a free copy of his or her own credit report so that the consumer can verify it. |

Lesson – Credit Reports

| | | | | |

| Interest and Interest Accrual |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Predict how interest rates act as an incentive for savers and borrowers. |

Lesson – Importance of Interest Rates

| | | | | |

| Explain the relationship between principal (the initial amount of money deposited in a bank by a person), interest (the amount earned from a bank, usually annually), and compound interest (interest earned on the principal and the interest already earned). |

Lesson – Importance of Interest Rates

Lesson – Using Credit

Activity – Use the Credit Card Payments Calculator

Activity – Use the Compound Interest Calculator

| | | | | |

| Explain the difference between the real interest rate of return on savings (adjusted for inflation) and the nominal interest rate. |

Lesson – Importance of Interest Rates

Lesson – Inflation

| | | | | |

| Recognize that a credit card purchase is a type of loan from the financial institution that issued the credit card, that financial institutions may charge a fee for credit card use, and that credit card interest rates tend to be higher than those for other types of loans. |

Lesson – Short-Term Financing

Lesson – Credit Cards

Lesson – Using Credit

| | | | | |

| Formulate a credit plan for purchasing a major item such as a car or home, comparing different interest rates. |

Activity – Use the Buy vs Lease Calculator

Activity – Use the Home Budgeting Calculator

Lesson – Mortgages

Lesson – Buying a car

| | | | | |

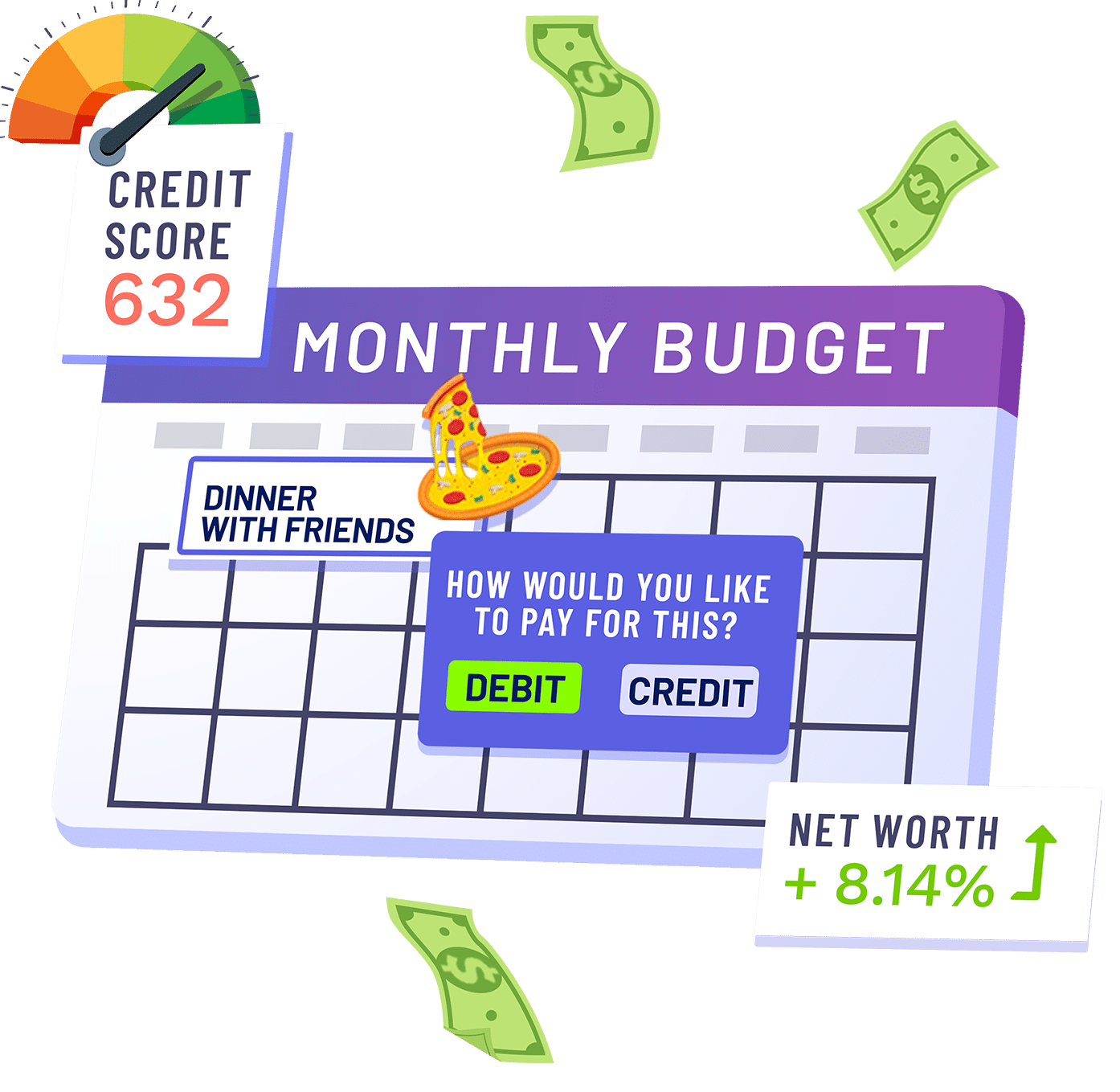

| Credit Card Debt |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Explain why some banks offer credit at low introductory rates that increase when a consumer makes a late payment or misses a payment. |

Lesson – Debit Cards

| | | | | |

| Explain what a credit bureau does, what a credit rating is and the factors from an individual’s credit history that may lead to denial of credit; explain the potential uses of credit reports and scores (e.g., in hiring or renting decisions or the setting of insurance premium rates). |

Lesson – Credit Reports

| | | | | |

| Research and report on the long-term consequences for borrowers of failure to repay loans, such as negative entries in a credit report, repossession of property, garnishment of wages, the inability to obtain loans in the future, and bankruptcy. |

Lesson – Managing Debt

Lesson – Short-Term Financing

Lesson – Bankruptcy

| | | | | |

| Explain a consumer’s rights for full disclosure of credit terms for a loan and for a free copy of his or her own credit report so that the consumer can verify it. |

Lesson – Credit Reports

| | | | | |

| Formulate a credit plan for purchasing a major item such as a car or home, comparing different interest rates. |

Activity – Use the Buy vs Lease Calculator

Activity – Use the Home Budgeting Calculator

Lesson – Mortgages

Lesson – Buying a car

| | | | | |

| Online Commerce |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Describe the impact of advertising and social media on purchasing decisions; use data to research the effects of media sources on purchases of durable goods (such as cars or appliances) or more temporary goods and services (such as shoes, clothes, cosmetics, or transportation). |

Lesson – Budgeting

| | | | | |

| Give examples of ways people can pay for goods, services, or charitable donations (e.g., cash, credit or debit card, check, mobile phone payment, layaway plan, rent-to-own) and analyze the costs and benefits of each method of payment. |

Lesson – What is Money?

Lesson – Automatic Payments

Lesson – Debit Cards

Lesson – Credit Cards

| | | | | |

| Explain the problems associated with identity theft and ways to protect sensitive personal information, particularly in online transactions, email scams, and telemarketing. |

Lesson – Protecting Against Fraud

| | | | | |

| Explain that a password helps protect the privacy of information. |

Lesson – Protecting Against Fraud

| | | | | |

| Identify and describe how people (e.g., students, parents, police officers) use many types of technologies in their daily work and personal lives. |

Lesson – Labor and Productivity

Lesson – Using Keywords In Your Resume

| | | | | |

| Explain the proper use and operation of security technologies (e.g., passwords, virus protection software, spam filters, popup blockers, cookies). |

Lesson – Protecting Against Fraud

| | | | | |

| Describe ways to employ safe practices and avoid the potential risks/dangers associated with various forms of online communications, downloads, linking, Internet purchases, advertisements, and inappropriate content within constrained environments. |

Lesson – Protecting Against Fraud

| | | | | |

| Explain the different forms of web advertising (e.g., search ads, pay-per-click ads, banner ads, targeted ads, in-game ads, e-mail ads). |

Lesson – Planning and Evaluating Business Advertising

| | | | | |

| Explain the concept of quality of service (e.g., security, availability, performance) for services providers (e.g., online storefronts that must supply secure transactions for buyer and seller). |

Lesson – Consumer rights and responsibilities

| | | | | |

| Rights and Responsibilities of Renting or Buying a Home |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Describe how clearly defined and enforced property rights are essential to a market economy. |

Lesson – Property Rights

| | | | | |

| Demonstrate how government wage and price controls, such as rent controls and minimum wage laws, create shortages and surpluses. |

Lesson – What are Price Controls?

| | | | | |

| Formulate a credit plan for purchasing a major item such as a car or home, comparing different interest rates. |

Lesson – Buying a Car

Lesson – Mortgages

Lesson – Planning Long Term Purchases

| | | | | |

| Explain what a financial asset is (e.g., bank deposit, stocks, bonds, mutual funds, real estate) is and explain why the worth of assets can go up or down over time. |

Stock Game – Core Component

Investing101 Certification – Chapter 01. Introduction to Investing

Lesson – Understanding Price Movements

Lesson – What is a Stock?

Lesson – What is an ETF?

Lesson – What is a Mutual Fund?

Lesson – What are Bonds

Lesson – Time Value of Money

| | | | | |

| Explain the purpose of various types of insurance (e.g., health, disability, life, property and casualty); research the costs and coverage of a particular type of insurance from several different companies and analyze which company provides the best option for a particular type of consumer (e.g., a young family, a retiree). |

Lesson – Renter’s Insurance

Lesson – Car Insurance

Lesson – Health Insurance

Lesson – Life Insurance

Lesson – Home Owner’s Insurance

| | | | | |

| Saving, Investing and Planning for Retirement |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Explain what it means to be employed and define the terms income, wages, and salary. |

Lesson – Income and Compensation

| | | | | |

| Give examples of choices people have to make about buying goods and services (e.g., food for the family or a video game; bus fare to get to work or a movie ticket for entertainment) and why they have to make choices (e.g., because they have only enough money for one purchase, not two). |

Budget Game – Core Component

Lesson – Spending and Savings Plans

Lesson – Pay Yourself First

| | | | | |

| Compare and contrast reasons why people save some of their money (e.g., deciding to put some of it aside for later for a future purchase, for a charitable donation or for an emergency). |

Budget Game – Core Component

Lesson – Spending and Savings Plans

Lesson – Pay Yourself First

Lesson – Planning Long Term Purchases

| | | | | |

| Predict how interest rates act as an incentive for savers and borrowers. |

Lesson – Importance of Interest Rates

Lesson – Inflation

Activity – Use the Compound Interest Calculator

| | | | | |

| Explain how financial markets, such as the stock market, channel funds from savers to investors. |

Investing101 Certification

Lesson – What is the New York Stock Exchange?

| | | | | |

| Explain the basic functions of money (e.g., medium of exchange, store of value, unit of account). |

Lesson – What is Money?

| | | | | |

| Explain the role of banks and other financial institutions in the economy of the United States. |

Lesson – Banks, Credit Unions, and Savings and Loans

| | | | | |

| Compare and contrast credit, savings, and investment services available to the consumer from financial institutions. |

Lesson – Banks, Credit Unions, and Savings and Loans

| | | | | |

| Research and monitor financial investments such as stocks, bonds, and mutual funds. |

Stock Game – Core Component

| | | | | |

| Explain that people choose jobs for which they are qualified based on a variety of factors, such as job satisfaction, independence, salary, opportunities to learn and grow, benefits such as health insurance coverage, retirement plans, and location. |

Lesson – Career Development

| | | | | |

| Research and report on government policies such as individual retirement accounts and educational savings plans, analyzing their effectiveness as incentives for saving. |

Lesson – Preparing for Retirement

Lesson – Income and Compensation

| | | | | |

| Formulate a savings or financial investment plan for a future goal (e.g., college or retirement). |

Lesson – Planning Long-Term Purchase

Lesson – Family Planning

Lesson – Work or Study

| | | | | |

| Explain how buyers and sellers in financial markets determine the prices of financial assets and therefore influence the rate of return on those assets. |

Stock Game – Core Component

Investing101 Certification

Lesson – What is a Stock?

Lesson – What is an ETF?

Lesson – What is a Mutual Fund?

Lesson – What are Bonds

Activity – Use the Investment Return Calculator

| | | | | |

| Analyze the role of diversification – having an investment portfolio with different kinds of assets – in lowering risk for the individual investor. |

Stock Game – Core Component

Investing101 Certification

Lesson – Building a Diversified Portfolio

| | | | | |

| The Role of Banking and Financial Services |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Identify the composition of the money supply of the United States. |

Lesson – How is Money Created?

Lesson – What is the Federal Reserve?

| | | | | |

| Describe the organization and functions of the Federal Reserve System. |

Lesson – What is the Federal Reserve?

| | | | | |

| Recognize that banks and other financial institutions are businesses that loan funds received from depositors to borrowers. |

Lesson – Banks, Credit Unions, and Savings and Loans

Lesson – Corporate Debt

| | | | | |

| Analyze the effectiveness of government agencies such as the Federal Reserve System, the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation and state banking departments in protecting the safety of the nation’s banking system and consumer interests. |

Lesson – What is the Federal Reserve?

Lesson – Consumer rights and responsibilities

Lesson – Government impact on the economy

| | | | | |

| Analyze the role of the Securities and Exchange Commission in regulating financial markets. |

Lesson – Government impact on the economy

| | | | | |