| Financial Decision Making |

| | | | | |

| Evaluate the role of choice in decision making |

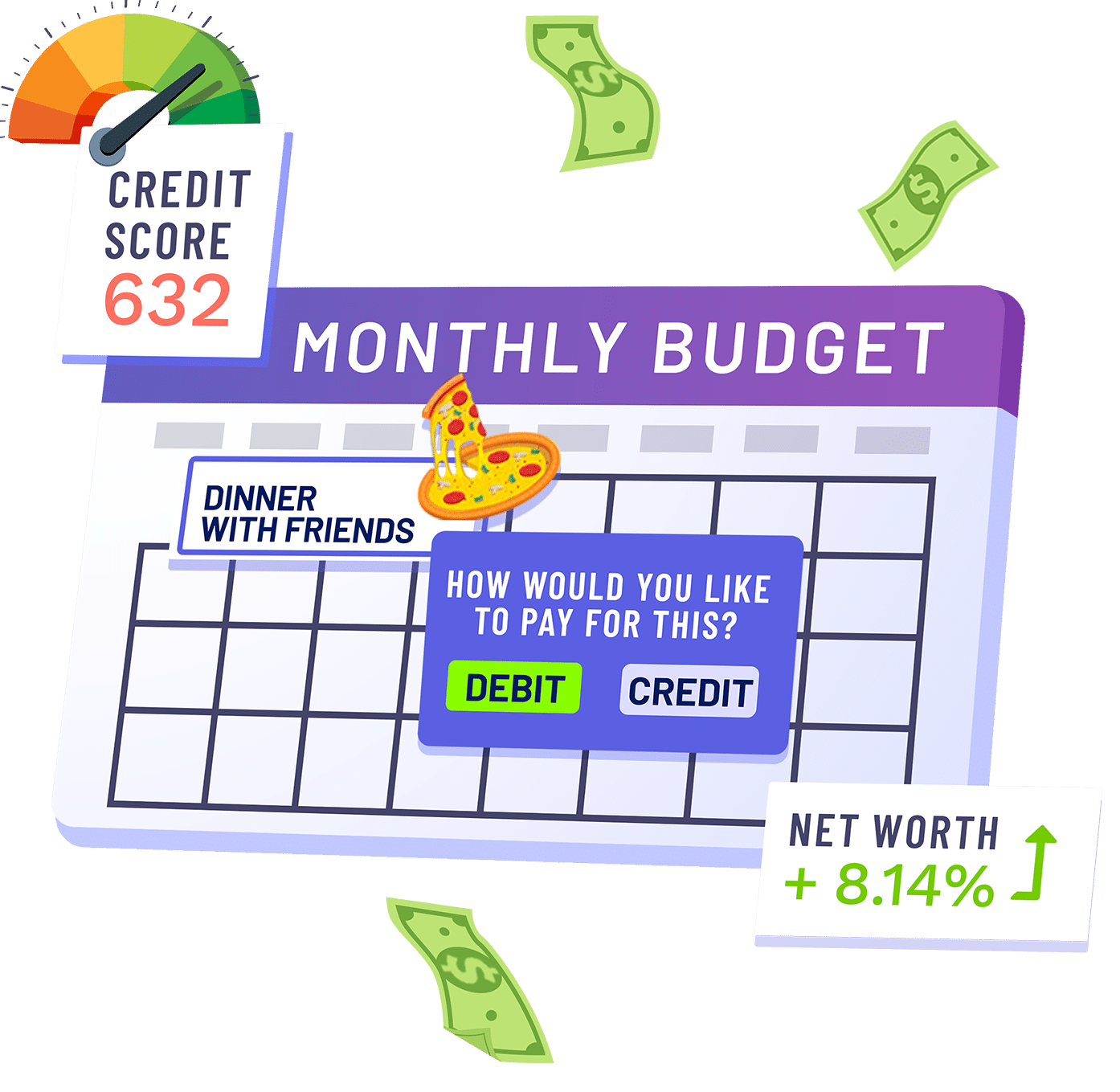

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Lesson – Opportunity Cost

| | | | | |

| Apply a rational decision making process to satisfy wants. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Lesson – Opportunity Cost

| | | | | |

| Explain how today’s choices have future consequences. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Activity – Use the Investment Return Calculator

Activity – Use the Compound Interest Calculator

Activity – Use the Saving to be a Millionaire Calculator

| | | | | |

| Explain the causal relationship between choice and opportunity cost. |

Budget Game – Core Component

Lesson – Opportunity Cost

| | | | | |

| Analyze how choices can result in unintended consequences. |

Budget Game – Core Component

Lesson – Good Debt, Bad Debt

Lesson – Bankruptcy

Lesson – Managing Debt

| | | | | |

| Income |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Evaluate how career choices impact income and quality of life. |

Lesson – Career Development

Lesson – Income and Compensation

| | | | | |

| Analyze the relationship between education, skill development and earning potential. |

Lesson – Career Development

Lesson – Income and Compensation

Lesson – Work or Study

Lesson – Labor and Productivity

| | | | | |

| Describe how wages and salaries are determined in labor markets. |

Lesson – Income and Compensation

Lesson – Supply and Demand Examples in the Stock Market

Lesson – Labor and Productivity

| | | | | |

| Analyze how changes in economic conditions and/or in labor markets can cause changes in a person’s income or employment status. |

Lesson – The Business Cycle

Lesson – Unemployment

Lesson – Labor and Productivity

Lesson – Importance of Interest Rates

Lesson – Inflation

| | | | | |

| Describe how entrepreneurs see problems as opportunities for creating new or innovative goods or services. |

Lesson – What is Entrepreneurship?

Lesson – Starting a Business

| | | | | |

| Examine how workers are paid through wages, salaries and commissions. |

Lesson – Income and Compensation

| | | | | |

| Analyze why benefits such as health insurance, paid vacation, retirement plan, family leave, tuition reimbursement and flexible scheduling are considered forms of compensation. |

Lesson – Income and Compensation

Lesson – Employer and Employee Rights and Responsibilities

| | | | | |

| Identify sources for earning income in addition to wages and salaries such as rent, interest, gifts, dividends, profits and capital gains. |

Lesson – Income and Compensation

Lesson – What is Money?

| | | | | |

| Compare gross and net income. |

Budget Game – Core Component

Lesson – Income Tax Filing and the Form 1040

| | | | | |

| Explain the purpose of standard deductions such as income taxes, social security (FICA), Medicare, deductions for health care and retirement savings plans. |

Lesson – Payroll Best Practices

| | | | | |

| Explain how taxes provide public goods and services. |

Lesson – Taxation Overview

| | | | | |

| Buying Goods and Services |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Differentiate between income and expenses. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

| | | | | |

| Analyze spending habits to recognize current spending and saving trends. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Lesson – Spending and Savings Plans

Lesson – Budgeting and Spending Strategies

| | | | | |

| Create a budget that includes savings goals, emergency funds, fixed expenses and variable expenses. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Lesson – Spending and Savings Plans

Lesson – Budgeting and Spending Strategies

| | | | | |

| Explain how budgeting for charitable giving may have tax benefits. |

Lesson – Charitable Giving

| | | | | |

| Prioritize expenses and payment due dates. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Spending and Savings Plans

| | | | | |

| Conduct research on product options to plan future purchases such as phone, car, home or vacation. |

Lesson – Researching Spending

Lesson – Buying a Car

Lesson – Mortgages

Lesson – Planning for Long Term Purchases

Activity – Use the Car Loans Calculator

Activity – Use the Buy vs Lease Calculator

Activity – Use the Home Budgeting Calculator

| | | | | |

| Evaluate product information for price, quality, service and features. |

Lesson – Researching Spending

| | | | | |

| Describe effective responses to deceptive or fraudulent sales practices. |

Lesson – Protecting Against Fraud

| | | | | |

| Identify payment methods. |

Lesson – Debit Cards

Lesson – Credit Cards

Lesson – Short-Term Financing

Lesson Mortgages

Lesson – Automatic Payments

| | | | | |

| Analyze the costs and benefits of different payment options. | Lesson – Debit Cards

Lesson – Credit Cards

Lesson – Short-Term Financing

Lesson Mortgages

Lesson – Automatic Payments

| | | | | |

| Evaluate substitutes when the price of goods or services exceeds your budget. |

Lesson – Researching Spending

Lesson – Budgeting and Spending Strategies

Lesson – Pay Yourself First

| | | | | |

| Compare the features, durability and maintenance costs of goods. |

Lesson – Researching Spending

| | | | | |

| Compare the services, service fees and requirements of various financial institutions such as banks, savings and loans, credit unions and virtual banks. |

Lesson – Banks, Credit Unions, and Savings and Loans

Lesson – Debit Cards

Lesson – Credit Cards

| | | | | |

| Calculate an account balance by recording deposits, withdrawals and debit transactions. |

Lesson – Reconciling Accounts

| | | | | |

| Analyze the costs and benefits of using or not using financial institutions and virtual exchanges. |

Investing101 Certification

Stock Game – Core Component

Lesson – Banks, Credit Unions, and Savings and Loans

Lesson – Debit Cards

Lesson – Credit Cards

| | | | | |

| Explain the importance of FDIC, NCUA and other security regulations to protect one’s wealth in financial institutions. |

Investing101 Certification

| | | | | |

| Saving |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Identify short, medium and long-term savings goals including saving for high value purchases, postsecondary education/training and retirement. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Lesson – Work or Study

Lesson – Building Wealth

Lesson – Preparing For Retirement

Lesson – Planning Long Term Purchases

Lesson – Family Planning

Lesson – Buying a Car

| | | | | |

| Develop a savings plan. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Lesson – Spending and Savings Plans

| | | | | |

| Explain the importance of a rainy day fund for unexpected expenses. |

Budget Game – Core Component

Lesson – Budgeting

Lesson – Pay Yourself First

Lesson – Spending and Savings Plans

| | | | | |

| Compare retirement savings options. |

Lesson – Income and Compensation

Lesson – Preparing for Retirement

Lesson – Building Wealth

| | | | | |

| Compare simple and compound interest. |

Lesson – Importance of Interest Rates

Activity – Use the Compound Interest Calculator

| | | | | |

| Explain how the time value of money, i.e. money in hand today, is worth more than money promised in the future, influences financial decision making. |

Lesson – Time Value of Money

Lesson – Inflation

Activity – Use the Net Present Value Calculator

| | | | | |

| Identify saving instruments such as certificates of deposit and savings accounts. |

Investing101 Certification

Lesson – Investing Strategies

Lesson – Building a Diversified Portfolio

Lesson – Building Wealth

| | | | | |

| Compare the liquidity, interest payment or penalty of various savings instruments. |

Investing101 Certification

Stock Game – Core Component

Lesson – Investing Strategies

Lesson – Building a Diversified Portfolio

Activity – Use the Investment Return Calculator

| | | | | |

| Using Credit |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Analyze the difference between a credit and a debit account |

Budget Game – Core Component

Lesson – Debit Cards

Lesson – Credit Cards

| | | | | |

| Compare sources of consumer credit such as credit cards, consumer loans, rent-to own, title and payday loans. |

Lesson – Short-Term Financing

Lesson – Good Debt, Bad debt

| | | | | |

| Evaluate the options for financing higher education. |

Lesson – Work or Study

Lesson – Student Loans

| | | | | |

| Analyze various terms and conditions of credit cards and consumer loans. |

Lesson – Credit Cards

Lesson – Short-Term Financing

Lesson – Using Credit

| | | | | |

| Explain the purpose, functions and costs of a mortgage. |

Lesson – Mortgages

| | | | | |

| Compare the cost of credit between financial institutions based on the Annual Percentage Rate (APR), initial fees charged and fees for late or missed payment. |

Lesson – Credit Cards

Lesson – Short-Term Financing

Lesson – Using Credit

| | | | | |

| Calculate the total purchase price of a good or service including interest paid. |

Activity – Use the Credit Card Payments Calculator

| | | | | |

| Explain the relationship between risk and interest including credit worthiness and down payment. |

Lesson – Credit Cards

Lesson – Using Credit

Lesson – Credit Reports

| | | | | |

| Differentiate between secured and unsecured loans. |

Lesson – Short-Term Financing

| | | | | |

| Evaluate factors that affect creditworthiness including paying on time and payment history. |

Budget Game – Core Component

Lesson – Credit Reports

| | | | | |

| Explain the purpose and components of credit records and credit history as provided by credit bureaus. |

Lesson – Credit Reports

| | | | | |

| Identify ways to avoid and/or correct credit problems. |

Lesson – Good Debt, Bad Debt

Lesson – Managing Debt

| | | | | |

| Analyze why credit scores may be used by entities such as employers, landlords and insurance companies. |

Lesson – Credit Reports

| | | | | |

| Evaluate a credit report to verify accuracy. |

Lesson – Credit Reports

| | | | | |

| Explain the importance of annually verifying one’s credit report. |

Lesson – Credit Reports

| | | | | |

| Explain the value of consumer credit protection laws. |

Lesson – Credit Reports

| | | | | |

| Explain responsibilities associated with the use of credit. |

Lesson – Using Credit

Lesson – Credit Cards

Lesson – Managing Debt

| | | | | |

| Protecting and Insuring |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Analyze the personal financial risks that can occur when unexpected events damage health, home, property, wealth or future opportunities. |

Lesson – Renter’s Insurance

Lesson – Home Owner’s Insurance

Lesson – Car Insurance

Lesson – Health Insurance

Lesson – Life Insurance

| | | | | |

| Explain how and why insurance companies create policies and determine premiums. |

Lesson – Renter’s Insurance

Lesson – Home Owner’s Insurance

Lesson – Car Insurance

Lesson – Health Insurance

Lesson – Life Insurance

| | | | | |

| Analyze factors people use to choose insurance coverage. |

Lesson – Renter’s Insurance

Lesson – Home Owner’s Insurance

Lesson – Car Insurance

Lesson – Health Insurance

Lesson – Life Insurance

| | | | | |

| Explain how personal behavior and risk impact insurance premiums. |

Lesson – Car Insurance

| | | | | |

| Analyze health insurance options to provide funds in the event of illness and/or to pay for the cost of preventive care. |

Lesson – Health Insurance

| | | | | |

| Analyze federal and state regulations which provide some remedies and assistance for identity theft. |

Lesson – Protecting Against Fraud

| | | | | |

| Analyze how individuals can protect themselves from others misusing personal information and from identity theft while online. |

Lesson – Protecting Against Fraud

| | | | | |

| Discuss current ways to counter cyber-attacks and protect personal information. |

Lesson – Protecting Against Fraud

| | | | | |

| Financial Investing |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Compare various financial assets for their risk and rewards such as stocks, bonds, mutual funds, real estate and commodities. |

Stock Game – Core Component

Investing101 Certification

Lesson – Building a Diversified Portfolio

Lesson – What is a Stock?

Lesson – Why invest in Stocks?

Lesson – What is an ETF?

Lesson – What is a Mutual Fund?

Lesson – What are Bonds

Activity – Use the Investment Return Calculator

| | | | | |

| Explain the impact of capital gains, dividends, risk and stock value on corporate stock ownership. |

Lesson – Dividends and Changes of Ownership

| | | | | |

| Explain how the price of a financial asset is determined by the interaction of buyers and sellers in a financial market. |

Lesson – Supply and Demand Examples in the Stock Market

Lesson – Understanding Price Movements

| | | | | |

| Explain how the rate of return earned from investments will vary according to the amount of risk. |

Stock Game – Core Component

Investing101 Certification

Lesson – Building a Diversified Portfolio

Activity – Use the Investment Return Calculator

| | | | | |

| Explain how the rates of return on financial assets are influenced by buyers and sellers in financial markets. |

Lesson – Supply and Demand Examples in the Stock Market

Lesson – Understanding Price Movements

| | | | | |

| Explain why an investment with greater risk, such as a penny stock, will commonly have a lower market price, but an uncertain rate of return. |

Stock Game – Core Component

Investing101 Certification

Lesson – Building a Diversified Portfolio

Activity – Use the Investment Return Calculator

| | | | | |

| Explain the risks and rewards of short term and long-term investments. |

Lesson – Preparing for Retirement

Lesson – Building Wealth

Lesson – Investing Strategies

Lesson – Building a Diversified Portfolio

| | | | | |

| Describe how diversification can lower investment risk. |

Lesson – Building a Diversified Portfolio

| | | | | |