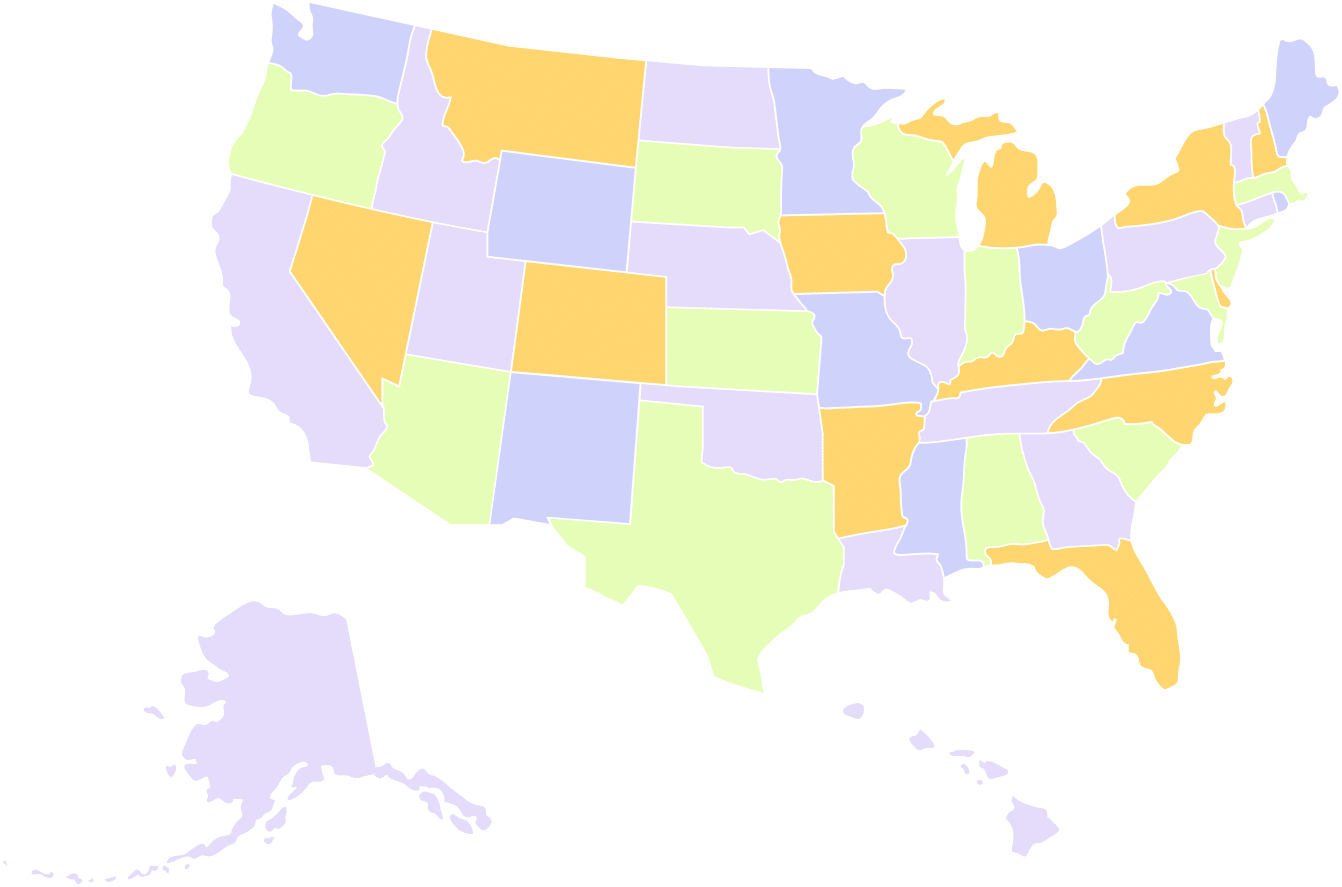

Financial Literacy

Resources

Our financial literacy educational platform makes learning fun

with our engaging games, activities and integrated lessons.

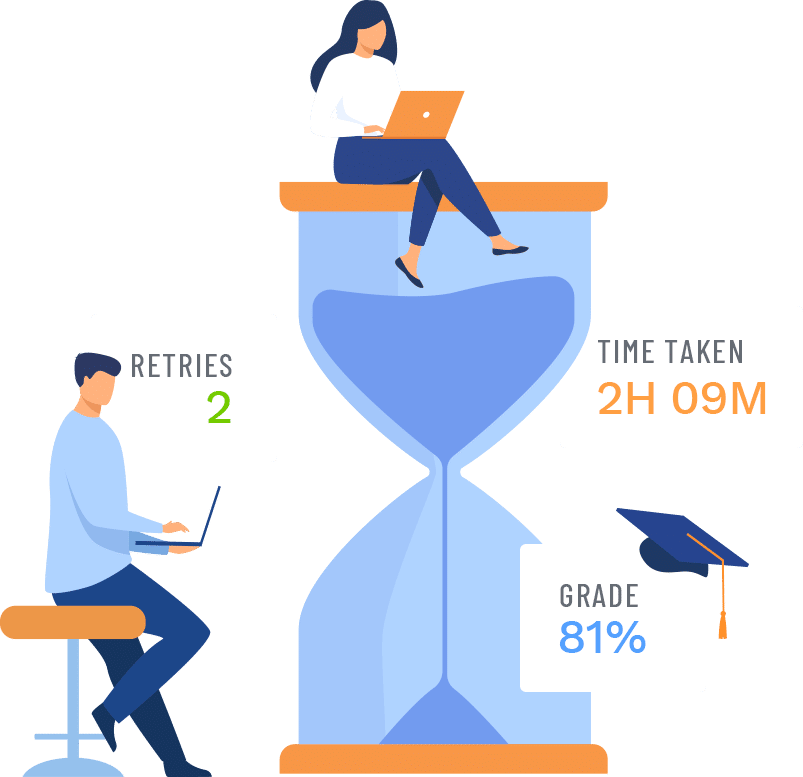

- Our learning library includes 300+ standards aligned Lessons

- Use as a self-paced learning tool or as a supplement to other classroom materials

- Self-Grading Lessons cover Personal Finance, Investing, Economics, Business, Accounting, Career Prep and Entrepreneurship topics

- Customizable by instructors for the grade level and class subject