| EI.K.1 Compare different factors that impact wages, including employment type, career fields, education, race, gender, union membership and level of risk to personal safety and wellbeing. |

|

|

|

|

|

|

| Students will differentiate diverse employment types, including but not limited to, part-time, full-time, self-employment, apprenticeships, internships, seasonal, hourly, commission-based, contracted, remote and gig work. |

Lesson – Planning Your Career Path

Lesson – Are Internships Worth It?

Lesson – So, You Want to Be Your Own Boss?

Lesson – Starting a Business 101 |

|

|

|

|

|

| Students will distinguish how different career fields will include different wage ranges based on a variety of factors. |

Lesson – Planning Your Career Path

Lesson – Why Do Some Jobs Pay More Than Others?

Lesson – Go to College or Start Working?

Lesson – What’s in Your Compensation Package? |

|

|

|

|

|

| Students will examine how union membership may impact wages, including the impact of paying union dues and collective bargaining. |

Lesson – Why Do Some Jobs Pay More Than Others? |

|

|

|

|

|

| Students will analyze wage inequities based on individual characteristics, including but not limited to education level, race, gender and disability status. |

Lesson – Planning Your Career Path

Lesson – Why Do Some Jobs Pay More Than Others? |

|

|

|

|

|

| EI.K.2 Compare various compensation models for jobs or careers, such as wages, salaries, commissions, tips, bonuses, health insurance, retirement savings plans and education reimbursement programs. |

|

|

|

|

|

|

| Students will differentiate between income and employee benefit packages offered to new employees by various employers. |

Lesson – What’s in Your Compensation Package?

Lesson – What Benefits to Look for in a Job Offer |

|

|

|

|

|

| Students will examine the importance of evaluating employee benefits in addition to wages and salaries when choosing between job and career opportunities. |

Lesson – What’s in Your Compensation Package?

Lesson – What Benefits to Look for in a Job Offer |

|

|

|

|

|

| EI.K.3 Analyze the influence of non-cash factors, including working conditions, work hours, teleworking and career advancement potential, in addition to wages and paid benefits, on employee choices. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will compare examples of intangible job benefits. |

Lesson – What Benefits to Look for in a Job Offer |

|

|

|

|

|

| Students will analyze the tradeoffs between income and non-income factors when making career or job choices. |

Lesson – What’s in Your Compensation Package?

Lesson – What Benefits to Look for in a Job Offer |

|

|

|

|

|

| Students will examine how union membership may impact working conditions. |

Lesson – The Ultimate Employee Guide |

|

|

|

|

|

| EI.K.4 Analyze the differences between sources of retirement income, including Social Security, employer-sponsored retirement plans, personal investments and continued employment earnings. |

|

|

|

|

|

|

| Students will examine different potential sources of retirement income, including but not limited to Social Security, employer-sponsored accounts, 401(k) accounts, 403(b) accounts, 457(b) accounts, traditional and Roth IRA accounts, etc. |

Lesson – The Secret to a Comfortable Retirement

Lesson – What’s in Your Compensation Package? |

|

|

|

|

|

| Students will analyze the differences between having one or multiple sources of income in retirement. |

Lesson – The Secret to a Comfortable Retirement |

|

|

|

|

|

| Students will examine Social Security benefits. |

Lesson – The Secret to a Comfortable Retirement |

|

|

|

|

|

| EI.K.5 Evaluate the accessibility and costs of additional training and education and how it impacts future earning potential. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will examine the costs and benefits of investing in additional education or training in at least two different industries. |

Lesson – Planning Your Career Path

Lesson – Go to College or Start Working? |

|

|

|

|

|

| Students will compare the impact of different life circumstances on an individual’s opportunity and interest in pursuing higher education or training. |

Lesson – Planning Your Career Path

Lesson – Go to College or Start Working? |

|

|

|

|

|

| Students will describe average earning and unemployment rates in at least two different levels of education and training. |

Lesson – Planning Your Career Path

Lesson – Go to College or Start Working? |

|

|

|

|

|

| Students will identify how apprenticeships work to provide training for specific trades or careers. |

Lesson – Go to College or Start Working?

Lesson – Are Internships Worth it? |

|

|

|

|

|

| Students will compare at least two different opportunities to gain career skills (e.g., the Advanced Technical Center or the Advanced Internship Program). |

Lesson – Planning Your Career Path

Lesson – Go to College or Start Working? |

|

|

|

|

|

| EI.K.6 Evaluate the risks and benefits of starting and owning a business. |

|

|

|

|

|

|

| Students will evaluate the benefits and risks of small business ownership. |

Lesson – Starting a Business 101

Lesson – So, You Want to Be Your Own Boss? |

|

|

|

|

|

| Students will examine the benefits and risks of gig employment. |

Lesson – Starting a Business 101

Lesson – So, You Want to Be Your Own Boss?

Lesson – What’s in Your Compensation Package? |

|

|

|

|

|

| Students will evaluate the risks associated with owning a business in the informal economy (e.g., accepting payments via a mobile payment application or cash-only). |

Lesson – Starting a Business 101 |

|

|

|

|

|

| Students will examine sources of assistance and guidance available to individuals or groups starting an independent business. |

Lesson – Starting a Business 101 |

|

|

|

|

|

| EI.S.1 Assess information regarding income opportunities and identify signs and risks associated with predatory financial schemes (e.g., multi-level marketing schemes, pyramid schemes, tax fraud schemes). |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will critique predatory financial schemes and make informed decisions when interacting with those industries. |

Lesson – How to Avoid Identity Theft, Scams & Fraud |

|

|

|

|

|

| EI.S.2 Identify unique opportunities and programs available in Washington, DC, that provide financial support for higher education and career advancement, including scholarships, grants, apprenticeships, advanced research courses, dual enrollment and other avenues for educational and professional growth. |

|

|

|

|

|

|

| Students will research career opportunities and financial support programs within their local community. |

Lesson – Lesson – Financing Your Education

Lesson – Biggest Mistakes of Job Seekers

Lesson – How to Get Past Resume Software |

|

|

|

|

|

| EI.S.3 Analyze a variety of tools and services that are relevant to the preparation of personal and business taxes to understand how and when to complete taxes. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify key dates for submitting tax documents. |

Budget Game – Core Component

Lesson – Income Tax Filing Tips & Tricks |

|

|

|

|

|

| Students will navigate tools and services for completing taxes, including accessing Volunteer Income Tax Assistance (VITA) sites. |

Budget Game – Core Component

Activity – Get Practice Filing a Sample Tax Return

Lesson – Do You Need a Tax Professional? |

|

|

|

|

|

| Students will complete an IRS Form W-4. |

Budget Game – Core Component

Activity – Get Practice Filing a Sample Tax Return |

|

|

|

|

|

| Students will read and understand an IRS Form W-2. |

Budget Game – Core Component

Activity – Get Practice Filing a Sample Tax Return

Lesson – Income Tax Filing Tips & Tricks |

|

|

|

|

|

| Students will read and understand an IRS Form 1099. |

Budget Game – Core Component

Activity – Get Practice Filing a Sample Tax Return

Lesson – Income Tax Filing Tips & Tricks |

|

|

|

|

|

| Students select the appropriate tax forms (1040, Schedule A, Schedule B, Schedule C and Schedule D) needed to complete a tax return. |

Budget Game – Core Component

Activity – Get Practice Filing a Sample Tax Return

Lesson – Tax Basics You Need to Know

Lesson – Income Tax Filing Tips & Tricks |

|

|

|

|

|

| Students will prepare a sample tax form using a sample set of financial data. |

Budget Game – Core Component

Activity – Get Practice Filing a Sample Tax Return |

|

|

|

Interactive Calculator |

|

| Students will differentiate between a tax credit and a tax deduction. |

Lesson – Tax Credits & Deductions You Need to Know |

|

|

|

|

|

| EI.S.4 Identify the different forms and functions of taxation, and determine estimated payroll taxes, income taxes, property taxes and sales taxes. |

|

|

|

|

|

|

| Students will describe the different methods that the government taxes an individual. |

Lesson – Tax Basics You Need to Know

Lesson – Sales Tax: Who Pays, Collects, and Why?

Lesson – Why Is My Paycheck So Small? |

|

|

|

|

|

| Students will identify the benefits they receive, or may receive in the future, from government-collected tax revenue. |

Lesson – Tax Basics You Need to Know |

|

|

|

|

|

| Students will calculate payroll tax, income tax, property tax and sales tax using a set of financial data. |

Lesson – Why Is My Paycheck So Small?

Lesson – Sales Tax: Who Pays, Collects, and Why?

Lesson – Tax Basics You Need to Know |

|

|

|

|

|

| SI.K.1 Compare the functions, benefits and drawbacks of different types of checking and savings accounts, including but not limited to regular savings, high-yield savings, money market, certificates of deposit (CDs), college savings, health savings and retirement savings accounts. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will examine the average interest rate of various savings accounts. |

Lesson – Choosing the Best Banking Option for You |

|

|

|

|

|

| Students will analyze how different types of savings accounts differ in minimum deposits, rates and deposit insurance coverage. |

Lesson – Choosing the Best Banking Option for You |

|

|

|

|

|

| Students will justify using different types of checking and savings accounts based on a comparison of the benefits and drawbacks of each. |

Lesson – Choosing the Best Banking Option for You |

|

|

|

|

|

| SI.K.2 Identify the intricacies and risks of mobile payment accounts, stock trading applications and cryptocurrency accounts that are not federally insured. |

|

|

|

|

|

|

| Students will recognize the attributes of mobile payment accounts, stock trading apps and cryptocurrency accounts. |

Lesson – Choosing the Best Banking Option for You

Lesson – What are Cryptocurrencies? |

|

|

|

|

|

| Students will identify the impact of storing money in a mobile payment account on an individual’s ability to grow savings. |

Lesson – Choosing the Best Banking Option for You |

|

|

|

|

|

| Students will describe why mobile payment accounts and cryptocurrency accounts are not federally insured. |

Lesson – Choosing the Best Banking Option for You |

|

|

|

|

|

| SI.K.3 Analyze the influence of generational wealth and inherited assets on personal savings and investing. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will examine how generational wealth is generated through savings and investing and the advantages it provides. |

Lesson – What is Wealth? |

|

|

|

|

|

| Students will examine how the absence of generational wealth can contribute to cycles of inequity. |

Lesson – What is Wealth? |

|

|

|

|

|

| Students will analyze how financial education amongst family members contributes to wealth accumulation through savings and investing. |

Lesson – What is Wealth? |

|

|

|

|

|

| SI.K.4 Assess the impact of inflation and deflation on the value of savings. |

|

|

|

|

|

|

| Students will assess the impact of inflation and deflation on nominal interest rates. |

Lesson – The Impact of Inflation on Your Wallet

Activity – Model Your Financial Future |

|

|

|

|

|

| Students will assess how inflation can reduce the purchasing power of savings over time if the nominal interest rate is lower than the inflation rate. |

Lesson – The Impact of Inflation on Your Wallet

Activity – Model Your Financial Future |

|

|

|

|

|

| SI.K.5 Interpret the different types and purposes of various financial institutions available to an individual, including banks, credit unions and brokerage firms. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will compare the differences between various banking options such as banks, credit unions and brokerage firms. |

Lesson – Choosing the Best Banking Option for You

Lesson – How to Choose a Brokerage Account? |

|

|

|

|

|

| SI.K.6 Describe the role of government agencies such as the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), the Securities and Exchange Commission (SEC) and the National Credit Union Administration, along with their counterparts in state government in supervising and regulating financial institutions. |

|

|

|

|

|

|

| Students will identify areas of financial institution operations that are subject to state and/or federal regulation and supervision. |

Lesson – Unit Introduction – Stock Market Basics

Lesson – Choosing the Best Banking Option for You

Lesson – Why You Should Care About the Fed |

|

|

|

|

|

| Students will identify the state agency responsible for regulating financial institutions in Washington, DC. |

Lesson – Choosing the Best Banking Option for You

Lesson – Why You Should Care About the Fed. |

|

|

|

|

|

| SI.K.7 Assess how tax policies promote savings by allowing individuals to save pretax earnings or by providing tax advantages on interest earned. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will evaluate the tax savings advantages associated with traditional IRAs (individual retirement accounts), Roth IRAs and education savings accounts. |

Lesson – The Secret to a Comfortable Retirement |

|

|

|

|

|

| SI.K.8 Examine the incentives that drive companies to issue and sell stock and motivate individuals to invest. |

|

|

|

|

|

|

| Students will analyze the primary drivers compelling companies to issue and sell stocks to the public. |

Lesson – A Beginner’s Guide to Investing in Stocks

Lesson – Why Invest in Stocks vs. Just Saving?

Lesson – How Companies Raise Capital |

|

|

|

|

|

| Students will examine the diverse motivations prompting individuals to invest in stocks, evaluating factors such as potential returns and ownership benefits. |

Lesson – Why Invest in Stocks vs. Just Saving?

Lesson – What is Wealth?

Lesson – A Strategy to Build Wealth, Not Debt

Lesson – A Beginner’s Guide to Investing in Stocks |

|

|

|

|

|

| SI.K.9 Investigate the ethical dimensions of investment choices, considering the environmental, social and governance (ESG) principles related to specific industries or companies. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will describe frameworks for evaluating investment options that integrate ESG principles. |

Investing101 Course – Chapter 8: Current Hot Topics in Trading |

|

|

|

|

|

| Students will analyze the ethical trade-offs involved in investment decisions, considering the balance between financial returns and ESG-related ethical considerations. |

Investing101 Course – Chapter 8: Current Hot Topics in Trading |

|

|

|

|

|

| SI.K.10 Compare the trade-offs involved with investing in riskier assets with the potential for higher rates of return. |

|

|

|

|

|

|

| Students will compare the rates of return among higher- and lower-risk investments. |

Stock Game – Core Component

Activity – Model Your Financial Future

Lesson – Why You Should Diversify Your Portfolio

Lesson – How to Develop an Investing Strategy

Lesson – Lesson – Knowing Your Risks & Risk Tolerance |

|

|

|

|

|

| SI.K.11 Assess the extent to which federal regulation of financial markets helps ensure that investors have access to accurate information about potential investments and are protected from fraud. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will draw conclusions about how federal regulations help promote transparency in financial markets. |

Lesson – When the Government Uses Admin Privileges

Lesson – How to Choose a Brokerage Account? |

|

|

|

|

|

| Students will examine historical situations highlighting instances of regulatory successes and failures in ensuring investor access to accurate information and protection from fraud. |

Lesson – Could the 1929 Crash Happen Again? |

|

|

|

|

|

| SI.S.1 Identify practices for saving towards short- and long-term financial goals. |

|

|

|

|

|

|

| Students identify the processes for opening and managing various savings accounts to meet their financial goals. |

Lesson – Choosing the Best Banking Option for You |

|

|

|

|

|

| Students demonstrate financial goal-setting and decision-making skills for saving. |

Budget Game – Core Component

Activity – Get a Snapshot of Your Financial Health

Lesson – A Simple Yet Powerful Way to Build Wealth

Lesson – Achieve Financial Goals with a Spending Plan |

|

|

|

|

|

| SI.S.2 Compare nominal annual rates of return, including cash flows and price changes over time on different types of investments. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify different types of investments, including stocks, bonds, collectibles, real estate, index funds and mutual funds. |

Stock Game – Core Component

Investing101 Course – Chapter 1: Introduction To Investing

Lesson – A Beginner’s Guide to Investing in Stocks

Lesson – A Simple Explanation of ETFs

Lesson – The Pros and Cons of Mutual Funds

Lesson – Getting Started with Bond Investing

Lesson – How to Develop an Investing Strategy

Lesson – Why You Should Diversify Your Portfolio |

|

|

|

|

|

| Students will calculate nominal annual rates of return for various investment types. |

Activity – Model Your Financial Future

Activity – Net Present Value (NPV) Calculator |

|

|

|

|

|

| Students will simulate investment scenarios using historical data to calculate and compare hypothetical returns, emphasizing the impact of timing, diversification and asset allocation. |

Stock Game – Core Component

Activity – How to Research & Compare Stocks |

|

|

|

|

|

| SI.S.3 Analyze diversification and asset allocation decisions by considering an individual’s risk tolerance, goals and investing time horizon. |

|

|

|

|

|

|

| Students will determine portfolio allocation between major asset classes for a short- and long-term goal. |

Stock Game – Core Component

Investing101 Course – Chapter 5: Now That I Own It, What Should I Do?

Lesson – Why You Should Diversify Your Portfolio

Lesson – How to Develop an Investing Strategy

Lesson – Why Invest in Stocks vs. Just Saving? |

|

|

|

|

|

| Students will assess the level of risk of asset allocation for a very risk-averse person versus a very risk-tolerant person. |

Stock Game – Core Component

Lesson – Knowing Your Risks & Risk Tolerance

Lesson – How to Develop an Investing Strategy |

|

|

|

|

|

| Students will examine how target date retirement funds reallocate investments over time to meet their investment objective. |

Activity – Crack the Code to Becoming a Millionaire

Activity – Watch How Your Savings Could Grow

Lesson – `The Secret to a Comfortable Retirement` |

|

|

|

|

|

| SI.S.4 Examine how the expenses of buying, selling and holding financial assets, as well as different tax rules, impact the rate of return from different investments. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will examine how the expenses associated with buying and selling investments can impact rates of return and investment outcomes. |

Stock Game – Core Component

Activity – Model Your Financial Future

Lesson – How to Choose a Brokerage Account? |

|

|

|

|

|

| Students will compare the expense ratios for several mutual funds. |

Lesson – The Pros and Cons of Mutual Funds

Video – How to Trade Mutual Funds? |

|

|

|

|

|

| Students will examine why an actively managed mutual fund usually has a higher expense ratio than an index fund. |

Lesson – The Pros and Cons of Mutual Funds

Video – How to Trade Mutual Funds?

Lesson – A Simple Explanation of ETFs |

|

|

|

|

|

| SI.S.5 Analyze interest, dividends and capital appreciation (gains) and identify examples of passive income derived from financial investments. |

|

|

|

|

|

|

| Students will differentiate between earned and passive income. |

Lesson – What is Wealth? |

|

|

|

|

|

| Students will compare the tax rates assessed on earned income, interest income and capital gains income. |

Activity – Get Practice Filing a Sample Tax Return

Lesson – Uncovering Hidden Income Taxes You Owe

Lesson – Tax Basics You Need to Know |

|

|

|

|

|

| SI.S.6 Evaluate criteria for selecting financial professionals for investment advice include licensing, certifications, education, experience and cost. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will select a discount broker and research the minimum starting account balance, minimum monthly investment and trading costs. |

Investing101 Course – Chapter 2: How the Stock Market Works and Why It Moves

Lesson – How to Choose a Brokerage Account? |

|

|

|

|

|

| Students will evaluate how financial technology streamlines investing in financial markets for people of varied incomes and education levels. |

Lesson – What are Cryptocurrencies? |

|

|

|

|

|

| SP.K.1 Assess factors influencing individual and community values and attitudes towards spending, including the role of marketing, community, personal lived experiences and psychology. |

|

|

|

|

|

|

| Students will compare how different individuals have different attitudes towards spending. |

Budget Game – Core Component

Lesson – Achieve Financial Goals with a Spending Plan

Lesson – The Cost of Raising a Family

Lesson – Break Free From Money Stress with a Budget |

|

|

|

|

|

| Students will foster empathy and non-judgmental understanding around diverse perspectives of and priorities for spending. |

Budget Game – Core Component

Lesson – Achieve Financial Goals with a Spending Plan

Lesson – The Cost of Raising a Family

Lesson -Do You Know Why You Buy What You Do?

Lesson – Break Free From Money Stress with a Budget |

|

|

|

|

|

| SP.K.2 Analyze how management of financial resources changes at different income and wealth levels, considering budgeting, savings and expenditures. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will examine common examples of financial management tools and services at various income levels and ages. |

Budget Game – Core Component

Lesson – Break Free From Money Stress with a Budget

Lesson – A Strategy to Build Wealth, Not Debt |

|

|

|

|

|

| Students will analyze budgetary differences of two different income levels. |

Budget Game – Core Component |

|

|

|

|

|

| SP.K.3 Identify financial relief agencies and resources in the Washington, DC area and understand their value. |

|

|

|

|

|

|

| Students will identify existing financial resources in Washington, DC and describe the purpose of these resources (e.g., DC Open Doors and Home Purchase Assistance Program (HPAP)). |

Lesson – Public Financial Assistance Programs |

|

|

|

|

|

| SP.K.4 Interpret various factors that impact consumer decisions, including the availability of goods and services, marketing strategies and individual preferences. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify the various factors that may influence a consumer’s purchase decision (e.g., availability of goods and services). |

Budget Game – Core Component

Lesson – Why You Buy What You Buy

Lesson – How Do You Stop Impulse Purchases?

Lesson – Evaluating Big-Ticket Purchases

Lesson -Do You Know Why You Buy What You Do? |

|

|

|

|

|

| Students will examine different ways retailers advertise their products and how advertising impacts purchasing. |

Lesson – Make The Most of Your Marketing Dollars

Lesson – Do You Know Why You Buy What You Do?

Lesson – Achieve Financial Goals with a Spending Plan |

|

|

|

|

|

| Students will compare how different individual preferences impact consumer decision-making. |

Budget Game – Core Component

Lesson – Achieve Financial Goals with a Spending Plan

Lesson – Break Free From Money Stress with a Budget |

|

|

|

|

|

| SP.K.5 Analyze factors influencing housing decisions and accessibility, such as individual preferences, discriminatory practices, costs, tax credits, budgets and housing availability and evaluate the consequences of various choices on personal satisfaction and financial well-being. |

|

|

|

|

|

|

| Students will identify financial and personal reasons that individuals often choose to rent a home instead of buying. |

Activity – Rent or Buy: Which is Right for You?

Activity – Find Out Your Monthly Home Budget

Lesson – Mortgage Options for First-Time Homebuyers |

|

|

|

|

|

| Students will examine short-term and long-term costs and benefits of renting versus buying a home. |

Activity – Rent or Buy: Which is Right for You?

Activity – Find Out Your Monthly Home Budget

Lesson – Mortgage Options for First-Time Homebuyers |

|

|

|

|

|

| Students will examine discriminatory practices for housing ownership. |

Lesson – Mortgage Options for First-Time Homebuyers |

|

|

|

|

|

| SP.K.6 Identify the legal protections for homeowners and renters, including safeguards and sources of assistance specific to Washington, DC. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will describe local and federal protections for owning and renting. |

Lesson – Rules for Renters & Homeowners |

|

|

|

|

|

| Students will identify examples of resources to go to for assistance to safeguard their homeowner and renter rights. |

Lesson – Rules for Renters & Homeowners |

|

|

|

|

|

| SP.K.7 Explain the role of federal and state laws, regulations and consumer protection agencies designed to help individuals avoid unsafe products, unfair practices and marketplace fraud (e.g., the Federal Trade Commission, Consumer Affairs offices, including the DC Department of Licensing and Consumer Protection and the Consumer Financial Protection Bureau). |

|

|

|

|

|

|

| Students will identify the local and federal government agencies and consumer protection laws that help safeguard consumers from fraud. |

Lesson – Protect Yourself as a Consumer

Lesson – When the Government Uses Admin Privileges |

|

|

|

|

|

| Students will describe common types of consumer fraud and unfair or deceptive business practices, including online scams, phone solicitations and redlining and how to protect themselves. |

Lesson – How to Avoid Identity Theft, Scams & Fraud

Lesson – Protect Yourself as a Consumer |

|

|

|

|

|

| SP.S.1 Create a budget based on changing individual inputs, constraints and goals. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify their short-term and long-term financial goals. |

Budget Game – Core Component

Activity – Crack the Code to Becoming a Millionaire

Lesson – Break Free From Money Stress with a Budget

Lesson – Achieve Financial Goals with a Spending Plan |

|

|

|

|

|

| Students will develop a budget to allocate current income to necessary and desired spending, including estimates for both fixed and variable expenses. |

Budget Game – Core Component |

|

|

|

|

|

| Students adjust a budget for unexpected expenses or emergencies. |

Budget Game – Core Component |

|

|

|

|

|

| Students will investigate the limitations of a budget to plan out allocation of income. |

Budget Game – Core Component |

|

|

|

|

|

| Students will create a system to efficiently track their expenditures using different methods. |

Budget Game – Core Component

Lesson – Break Free From Money Stress with a Budget |

|

|

|

|

|

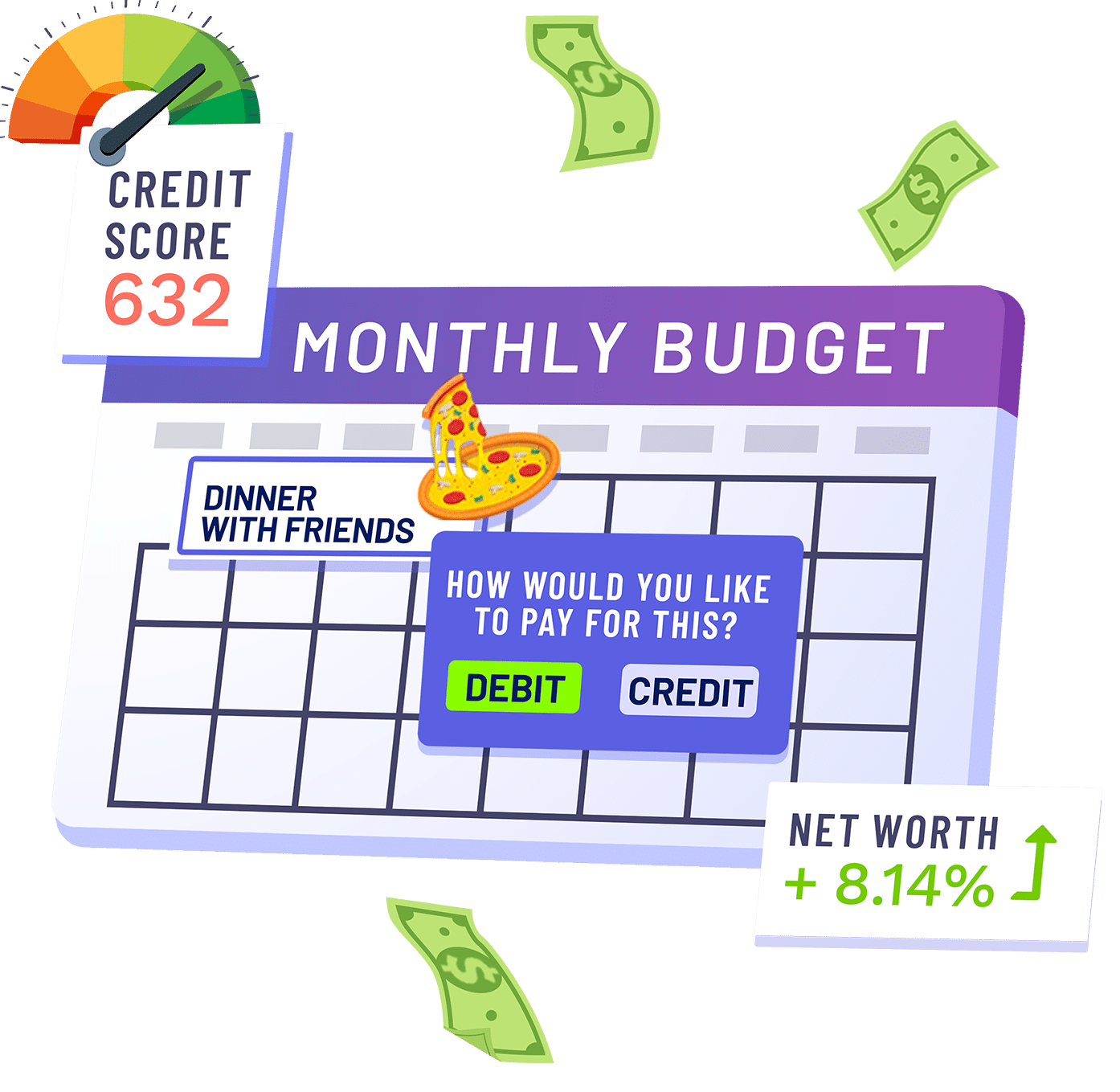

| SP.S.2 Analyze the various forms of payment an individual can utilize for expenditures. |

|

|

|

|

|

|

| Students will distinguish between different forms and functions of payment, including cash, check, cashier’s check, debit card, credit card, money orders and electronic payments. |

Budget Game – Core Component

Lesson – How Debit Cards Work

Lesson – What is Money?

Lesson – Automatic Payments: Convenience vs. Risk

Lesson – Credit Cards: Terms, Fees, and More |

|

|

|

|

|

| Students will accurately write a check and understand the potential risks of check writing. |

Lesson – What is Money? |

|

|

|

|

|

| SP.S.3 Assess the impact of unexpected expenses (e.g., medical emergencies, layoffs, car accidents), and develop effective strategies for managing these expenses. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will determine strategies to respond to unexpected expenses. |

Budget Game – Core Component

Lesson – How to Prepare for Unexpected Expenses |

|

|

|

|

|

| SP.S.4 Identify local and federal resources and programs that help individuals achieve their financial goals, beyond budgeting, such as public benefits, loans and other resources. |

|

|

|

|

|

|

| Students will identify and research local and federal resources for receiving money. |

Lesson – Public Financial Assistance Programs

Lesson – A Beginner’s Guide to Borrowing Wisely |

|

|

|

|

|

| SP.S.5 Interpret the cost of purchasing or leasing a new or used vehicle, including down payment, interest rate, loans and registration. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify required processes for registering a vehicle after purchase. |

Lesson – The Car Buying Checklist

Lesson – Find Your Best Car Loan Deal |

|

|

|

|

|

| Students will calculate the required down payment for a vehicle purchase or lease. |

Activity – Calculate Your Car Loan Payments

Lesson – Find Your Best Car Loan Deal |

|

|

|

|

|

| Students will determine total interest that will be paid over the lifetime of loan used to purchase a vehicle. |

Activity – Calculate Your Car Loan

Lesson – The Car Buying Checklist |

|

|

|

|

|

| Students will compare different vehicle options, including electric vehicles, hybrid vehicles and gas vehicles. |

Lesson – The Car Buying Checklist

Lesson – Find Your Best Car Loan Deal |

|

|

|

|

|

| CR.K.1 Understand the purpose, risks and benefits of credit. |

|

|

|

|

|

|

| Students will describe the concept of credit and how it is used in certain situations. |

Budget Game – Core Component

Lesson – A Beginner’s Guide to Borrowing Wisely

Lesson – How to Use Debt to Your Advantage |

|

|

|

|

|

| Students will identify the risks and benefits of leveraging credit, including, using a credit card, leveraging a payment plan and taking out a loan. |

Budget Game – Core Component

Lesson – A Beginner’s Guide to Borrowing Wisely

Lesson – How to Use Debt to Your Advantage

Lesson – Credit Cards: Terms, Fees, and More

Lesson – Getting Out of Debt: Debt Snowball and Debt Avalanche |

|

|

|

|

|

| CR.K.2 Assess different methods of debt management assistance. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify where to find sources of assistance with debt management. |

Lesson – Getting Help With Debt Repayment

Lesson – Debt Relief: Is Consolidation the Answer?

Lesson – How to Negotiate With Creditors |

|

|

|

|

|

| Students will evaluate the elements of a plan for a person who is having difficulty repaying debt. |

Lesson – Getting Help With Debt Repayment

Lesson – Debt Relief: Is Consolidation the Answer?

Lesson – How to Negotiate With Creditors

Lesson – Getting Out of Debt: Debt Snowball and Debt Avalanche |

|

|

|

|

|

| Students will evaluate the costs and benefits associated with for-profit versus non-profit credit counseling services. |

Lesson – Getting Help With Debt Repayment |

|

|

|

|

|

| CR.K.3 Identify the implications of declaring bankruptcy. |

|

|

|

|

|

|

| Students will describe the purpose of bankruptcy laws. |

Lesson – What Is Bankruptcy? |

|

|

|

|

|

| Students will explain the effects of bankruptcy on assets, employment and future access to credit. |

Lesson – What Is Bankruptcy? |

|

|

|

|

|

| CR.K.4 Analyze the reasons for and the risks of using financial services such as payday loans, check cashing services, pawnshops and instant tax refunds which provide access to credit at a relatively high cost. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify products and practices that are classified as alternative financial services. |

Lesson – What to Do When You Need Money Fast

Lesson – How to Use Debt to Your Advantage |

|

|

|

|

|

| Students will analyze the costs and benefits of using alternative financial services relative to traditional banking. |

Lesson – What to Do When You Need Money Fast

Lesson – How to Use Debt to Your Advantage |

|

|

|

|

|

| CR.S.1 Examine the cost of credit using the Annual Percentage Rate (APR), Effective Annual Rate (EAR) or the actual rate to be paid based on the period of compounding and other terms in the contract for a credit card or loan for purchases. |

|

|

|

|

|

|

| Students will analyze how credit card grace periods, methods of interest calculation and fees affect borrowing costs. |

Budget Game – Core Component

Activity – Calculate the True Cost of Credit Card Debt

Lesson – Credit Cards: Terms, Fees, and More |

|

|

|

|

|

| Students will compare the cost of borrowing $1,000 using consumer credit options that differ in rates and fees. |

Budget Game – Core Component

Activity – Calculate the True Cost of Credit Card Debt

Lesson – Credit Cards: Terms, Fees, and More |

|

|

|

|

|

| CR.S.2 Compare the risks and benefits of different mortgage payment plans depending on the amount borrowed, the repayment period and the interest rate, which can be fixed or adjustable. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify the type of collateral required for a mortgage loan. |

Lesson – Mortgage Options for First-Time Homebuyers |

|

|

|

|

|

| Students will differentiate between adjustable-rate and fixed-rate mortgages. |

Lesson – Mortgage Options for First-Time Homebuyers |

|

|

|

|

|

| Students will compare monthly mortgage payments for loans that differ in repayment period, amount borrowed and interest rate. |

Lesson – Mortgage Options for First-Time Homebuyers |

|

|

|

|

|

| CR.S.3 Assess the impact of down payments and interest rates on the amount needed to borrow and pay overtime for major financial transactions. |

|

|

|

|

|

|

| Students will identify examples of loans that may require down payments. |

Activity – Calculate Your Car Loan Payments

Activity – Rent or Buy: Which is Right for You?

Lesson – The Car Buying Checklist

Lesson – Mortgage Options for First-Time Homebuyers |

|

|

|

|

|

| Students will compare the monthly loan payment and potential additional fees with a 10% down payment versus a 20% down payment for a specific loan amount. |

Activity – Calculate Your Car Loan Payments

Activity – Rent or Buy: Which is Right for You? |

|

|

|

|

|

| Students will evaluate the benefits and risks of a large down payment. |

Activity – Calculate Your Car Loan Payments

Activity – Rent or Buy: Which is Right for You? |

|

|

|

|

|

| CR.S.4 Compare different methods of financing post-secondary education including federal loans, private loans, opportunities for loan forgiveness, grants, scholarships and savings. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify existing scholarships and grants for postsecondary education. |

Lesson – Financing Your Education |

|

|

|

|

|

| Students will compare the different sources of funding for postsecondary education. |

Lesson – Financing Your Education |

|

|

|

|

|

| CR.S.5 Identify factors that impact an individual’s credit score, and ways individuals can improve their credit. |

|

|

|

|

|

|

| Students will understand how to check their credit scores using at least one of the freely available credit reporting services (e.g., Experian, Equifax, TransUnion). |

Lesson – What Your Credit Report Says About You |

|

|

|

|

|

| Students will identify the primary factors that are included in credit score calculations. |

Lesson – What Your Credit Report Says About You |

|

|

|

|

|

| Students will identify ways that a person can increase their credit score. |

Budget Game – Core Component

Lesson – What Your Credit Report Says About You |

|

|

|

|

|

| MR.K.1 Explain why some types of insurance coverage are mandatory. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will describe why homeowners insurance is required when taking out a mortgage. |

Lesson – What Damage Does Home Insurance Cover? |

|

|

|

|

|

| Students will describe why most states mandate auto liability coverage. |

Lesson – Car Insurance: How to Lower Your Rates |

|

|

|

|

|

| Students will identify the minimum auto liability insurance required in Washington, DC and whether it is sufficient to cover typical auto accident financial losses. |

Lesson – Car Insurance: How to Lower Your Rates |

|

|

|

|

|

| MR.K.2 Compare the costs and benefits of disability insurance for replacing income lost when a person is unable to earn their regular income due to injury or illness. |

|

|

|

|

|

|

| Students will identify government-provided health care coverage including Medicaid. |

Lesson – Don’t Let Disability Derail Your Finances

Lesson – Public Financial Assistance Programs |

|

|

|

|

|

| Students will compare disability coverage offered by individual policies, employee benefit plans, Social Security, workers’ compensation and temporary disability programs. |

Lesson – Don’t Let Disability Derail Your Finances

Lesson – Public Financial Assistance Programs |

|

|

|

|

|

| Students will analyze the extent of financial risk and need for disability insurance using hypothetical disability scenarios. |

Lesson – Don’t Let Disability Derail Your Finances

Lesson – Public Financial Assistance Programs |

|

|

|

|

|

| MR.K.3 Explain different auto, homeowners and renters insurance reimbursements to policyholders for financial losses to their covered property and the costs of legal liability for their damages to other people or property. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will explain the primary types of losses covered by auto, homeowners and renters insurance policies. |

Lesson – What’s Not Covered in Renter’s Insurance?

Lesson – What Damage Does Home Insurance Cover?

Lesson – Car Insurance: How to Lower Your Rates |

|

|

|

|

|

| Students will explain situations where someone may be liable for injuries or damage to another person or their property. |

Lesson – What’s Not Covered in Renter’s Insurance?

Lesson – What Damage Does Home Insurance Cover?

Lesson – Car Insurance: How to Lower Your Rates |

|

|

|

|

|

| Students will explain factors that influence the cost of renters insurance and homeowners insurance. |

Lesson – What’s Not Covered in Renter’s Insurance?

Lesson – What Damage Does Home Insurance Cover?

Lesson – Rules for Renters & Homeowners |

|

|

|

|

|

| MR.K.4 Analyze the need for life insurance that provides funds for beneficiaries in the event of an insured individual’s death or disability. |

|

|

|

|

|

|

| Students will describe how an individual’s death can result in financial losses to others. |

Lesson – Life Insurance: The Ultimate Safety Net

Lesson – Who Gets Your Stuff When You’re Gone? |

|

|

|

|

|

| Students will analyze the benefits and costs of purchasing life insurance on the primary earners in a household. |

Lesson – Life Insurance: The Ultimate Safety Net |

|

|

|

|

|

| MR.K.5 Assess ways to secure online transactions and safeguard personal documents from privacy infringement, identity theft and fraud. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will identify examples of how online behavior, email and text-message scams, telemarketers and other methods make consumers vulnerable to privacy infringement, identity theft and fraud. |

Lesson – How to Avoid Identity Theft, Scams & Fraud |

|

|

|

|

|

| Students will describe the steps an identity theft victim should take to limit losses and restore personal security. |

Lesson – How to Avoid Identity Theft, Scams & Fraud |

|

|

|

|

|

| Students will examine strategies to reduce the risk of identity theft and financial fraud. |

Lesson – Lesson – How to Avoid Identity Theft, Scams & Fraud

Lesson – Tame Your Financial Paperwork |

|

|

|

|

|

| MR.K.6 Evaluate the utility of extended warranties and service contracts on different kinds of purchases. |

|

|

|

|

|

|

| Students will compare extended warranties or service contracts and insurance. |

Lesson – Receipts: What to Keep and Why |

|

|

|

|

|

| Students will evaluate the costs and benefits of buying an extended warranty on a specific item (e.g., cellphone, laptop, or vehicle) considering the likelihood of product failure, cost of replacing the item and price of the warranty. |

Lesson – Receipts: What to Keep and Why |

|

|

|

|

|

| MR.S.1 Analyze the factors that influence insurance premiums including copayments and deductibles and determine the costs and benefits of plans with different costs. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will research factors that result in lower insurance premiums. |

Lesson – Why Health Insurance is So Expensive

Lesson – Car Insurance: How to Lower Your Rates |

|

|

|

|

|

| Students will calculate the costs of different plans based on a case study scenario. |

Lesson – Car Insurance: How to Lower Your Rates |

|

|

|

|

|

| Students compare the pros and cons of buying an insurance policy with a higher deductible. |

Lesson – Why Health Insurance is So Expensive

Lesson – Car Insurance: How to Lower Your Rates |

|

|

|

|

|

| MR.S.2 Compare the costs, benefits and risks of different health insurance plans, including the extent to which health insurance covers preventative care. |

|

|

|

|

|

|

| Students will estimate the impact of different health insurance deductibles and coinsurance rates on out-of-pocket medical costs. |

Lesson – Why Health Insurance is So Expensive |

|

|

|

|

|

| Students will examine the advantages of obtaining health insurance coverage through an employer plan versus buying private insurance or being uninsured. |

Lesson – Why Health Insurance is So Expensive

Lesson – What’s in Your Compensation Package?

Lesson – What Benefits to Look for in a Job Offer |

|

|

|

|

|

| Students will compare the cost of health insurance to the potential financial consequences of not having health insurance. |

Lesson – Why Health Insurance is So Expensive |

|

|

|

|

|

| MR.S.3 Analyze the financial risks and consequences of gambling activities. |

Activity |

Long-Term Game |

Comprehensive Chapter |

Short Lesson |

Interactive Calculator |

Graded Assessment |

| Students will analyze the financial risks and consequences associated with gambling activities, including sports betting and playing the lottery. |

Lesson – What is Wealth?

Lesson – Knowing Your Risks & Risk Tolerance |

|

|

|

|

|